Why Chile needs the Fed to start cutting pronto

Chile has been off to the races, with big cuts delivered to date. They're far from finished, but should they cut next week, as expected, they will move into the “dodgy zone”. This is one where Fed cuts are really needed to justify further easing. Why? Key rate differentials will have flipped to below medium-term averages. No panic, but caution is warranted

Banco de Chile has already cut by 400bp, from 11.25% to 7.25%. Progress on inflation falling has stalled somewhat, but yet we are leaning into a likely cut at the next policy meeting based off behaviour to date and some extrapolation thereof.

However, if such a cut is delivered, our calculations show that a weighted average of key interest spreads moves to below the historical average. While not necessarilly outright prohibitive, it does move us to a point where cuts from the Federal Reserve will be required to justify further moves, else vulnerabilities abound while in this "dodgy zone".

As an aside, we have done the same analysis for Banxico here, BCB here, BanRep here in the past number of weeks. The respective outcomes show a material rates gap for Mexico and Colombia (ample room to cut), but none for Brazil (not suggesting Brazil can't cut. Just saying they have entered the "dodgy zone" too).

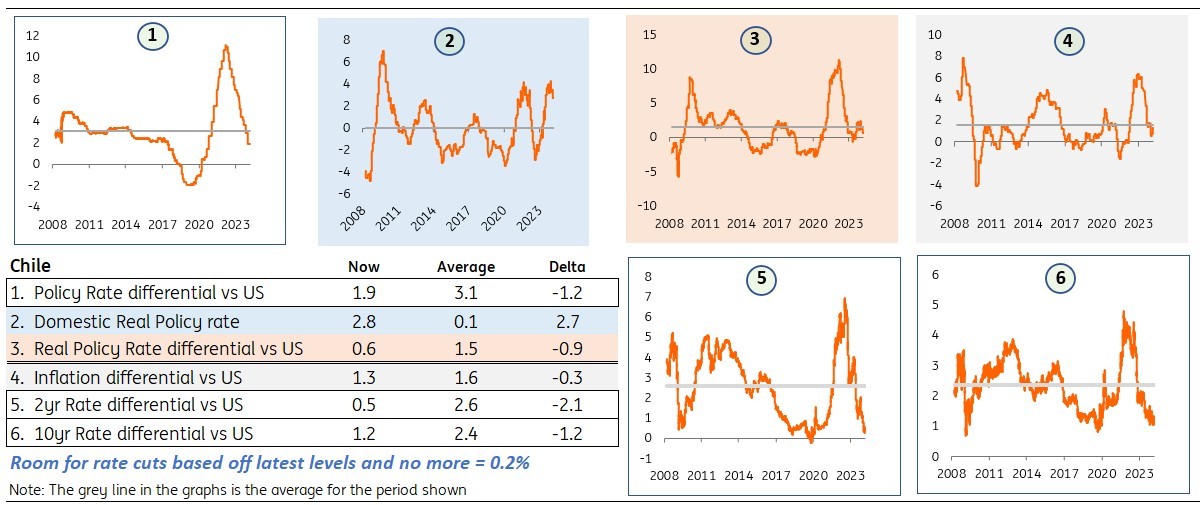

We use the same three ingredients to help identify room for policy rate manoeuvre:

- The nominal policy rate differential (to the Fed)

- The domestic real rate (Chilean policy rate less inflation)

- The real policy rate differential (to the US)

Inputs to the calculation process for the official rate and market rates

For Chile:

- The nominal policy rate differential is 1.9%, versus a 3.1% average. The delta is -1.2%.

- The domestic real rate is 2.8%, versus a 0.1% average. The delta is +2.7%.

- The real policy rate differential to the US is 0.6%, vs a 1.5% average. The delta is -0.9%.

There is a cushion in the official rates differential in the sense that it’s above average. However, both the policy rate differential and real policy rate differential are through their respective historical averages.

Applying an equal weighting gives us 0.2%. This means that Banco de Chile has room to cut by a cumulative 20bp before hitting the weighted average of the aforementioned spreads. The calculations are illustrated below.

Here’s how we calculate rate cut potential for Banco de Chile based off a steady state

The market is discounting another cut at the upcoming meeting. If delivered, it would push the policy rate through it’s neutral valuation based off where inflation currently is in Chile and the US, and where the Fed funds rate is.

But, let’s take things one step forward. Hypothesise the following,

- Chilean inflation falls by about 1% (to c.3%),

- The Fed cuts by 2.25%, and

- US inflation also falls by 1%.

Then we’d have the following:

Adding some future dynamics – lower inflation and Fed cuts. What then?

Now we’d have,

- The nominal policy rate differential at 0.3% above average,

- The domestic real policy rate at 1.2% above average, and

- The real policy rate differential to the US at 0.4% above average.

Now, an interest rate gap has re-opened for Banco de Chile. Applying equal weighting gives us 1.8% for that gap.

So, Banco de Chile can ultimately chop its official rate to as low as 5.25% – that is assuming falls in inflation and, crucially, 225bp of cuts from the Fed. In fact, most of the manoeuvre from here on out is coming from Fed rate cuts. If these don’t come, then Banco de Chile really shouldn't deliver. Or if it does, it runs a (calculated) risk.

Markets are already pricing a lot – FX weak and market rates 'low'

And what does all this mean for market rates? Currently, the 10yr spread to the US is 1.2%, and the 2yr spread is 0.5%. These are well through the historical average (back to 2008). Both spreads are some 70bp above historical lows, so technically, there is room to the downside for Chilean market rates. But that downside potential is premised on heading back towards historical extremes that were briefly touched; extremes that were also significantly below average. Vulnerabilities are likely to emerge as we journey along this route, and any frustration on delivery of Fed cuts would frustrate the ability of Banco de Chile to get towards 5%.

And what about the FX angle? USD/CLP is now in the 965 area, and the forwards see it at 970 on an 18-month view, which is a very moderate implied depreciation in the CLP. Our FX strategists note that the CLP stands out as the worst performer in the Latin space, driven by the aggressive Banco de Chile easing cycle. From here, it could be at a tipping point into a rout. Or it could be viewed as being at a concessional level from which it really should not get much weaker. For choice, we’re in the latter camp. See more here.

However, Banco de Chile likely need to pay more heed to room for policy rate chopping ahead. We’ve identified the next cut as taking them through weighted historical averages, and for that to occur without harm, it needs to be backed up with Fed cuts. The problem is, the Fed is not set to cut for at least another number of months. Implied market vulnerabilities can elevate on further cuts.

Banco de Chile can get to 5.25%, but they really need big Fed cuts for validation

A weighted average of key interest spreads moves to below the historical average on the next cut from Banco de Chile. We enter the "dodgy zone". For this to be a sustainable outcome, the Federal Reserve needs to start cutting rates. The problem is the likelihood for a Fed cut has slipped into mid-summer, and realistically to July (on the market discount). That’s quite a waiting game, one that means exposure to vulnerability.

The CLP has already built up a concession, which can act as a buffer against outsized harm. But there is no such concession in market rates, which trade well below historical averages to the US. Spread to the US have been tighter, so technically there is a route for Chilean market rates to fall. But that’s still running the gauntlet until the Fed actually delivers a first cut.

Download

Download opinion

Padhraic Garvey, CFA

Padhraic Garvey is the Regional Head of Research, Americas. He's based in New York. His brief spans both developed and emerging markets and he specialises in global rates and macro relative value. He worked for Cambridge Econometrics and ABN Amro before joining ING. He holds a Masters degree in Economics from University College Dublin and is a CFA charterholder.

Padhraic Garvey, CFA

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more