Russia’s current account stabilises despite higher oil prices

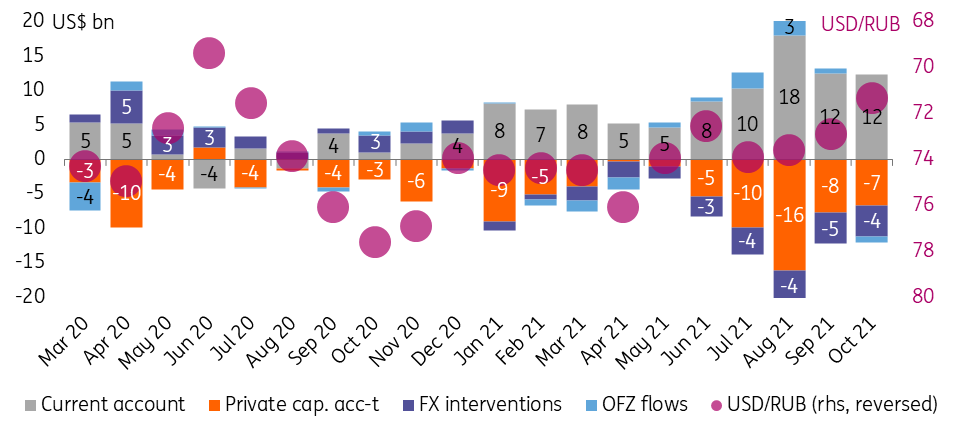

The $12.3b current account in October was big, but no bigger than the 3Q21 average, despite tighter energy markets. Exports are likely to catch up with it in November-December, but so will imports and FX purchases. The local fundamentals are therefore in stalemate, putting portfolio flows back into the spotlight, and these are quite volatile

Russia's preliminary balance of payments estimate for the first 10 months of 2021 suggests little change in the current account surplus in October compared to the 3Q21 monthly average. That, however, did not prevent the ruble from showing a noticeable 2.2% appreciation against the US dollar and 3.8% against the euro.

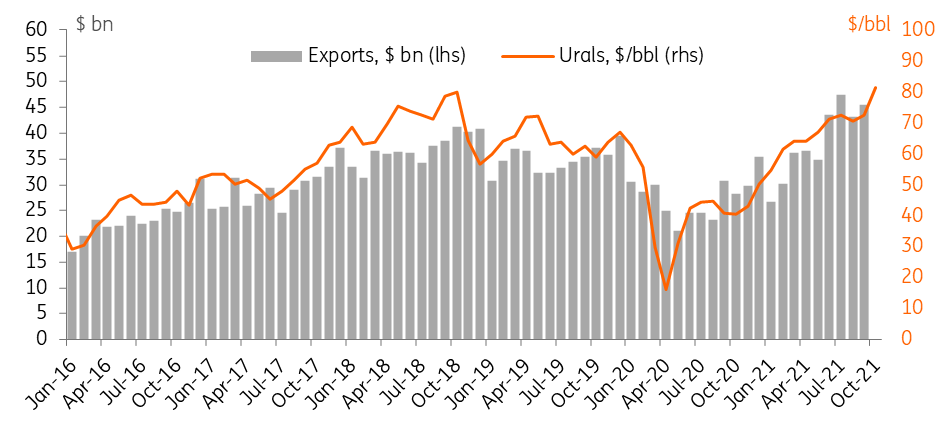

Based on the monthly central bank estimates (subject to subsequent revisions), the current account surplus totalled US$12.3b in October (US$94.4b year-to-date), which is close to the US$13.6b monthly average seen in 3Q21. We expected October numbers to stay in the US$10-15b range, so we take the actual result as strong but largely neutral. Nevertheless, we note that the current account surplus is stable despite a noticeable increase in the average monthly Urals price from US$70-73/bbl in 3Q21 to US$81/bbl in October. Moreover, the preliminary non-CIS imports data (covers 90% of the total merchandise imports) suggests no material uptick in October. Several conclusions could be made here, both positive and negative.

- The positive takeaway is that exports may have yet to catch up with the spot prices, as delivery contract prices tend to lag behind (Figure 2). Also, as fuel accounts for only 48% of Russia's merchandise exports (based on the Central Bank of Russia's 9M21 data), overall exports should also benefit from price growth in other commodities, such as metals (19% of exports, based on Federal Customs' data).

- The negative takeaway is that imports of goods and services are going to catch up, too, due to the reopening of foreign travel destinations and the recent ruble strengthening against the US dollar and euro (EU accounts for 33% of Russia's imports of goods). As a result, the monthly current account surplus is unlikely to show any further expansion from the current levels, at least in the near term.

Looking at the broader balance of payments composition, it appears that the ruble may have been supported last month by restrained FX purchases of US$4.4b and a deceleration in the net private capital outflow, to US$6.8b in October from the US$11.3b average seen in 3Q21 (year-to-date net private capital outflow is US$65.7b).

- On FX intervention, as a reminder, these are also playing catch up, with US$7.2bn announced for November, sterilising the excess fuel revenues of the budget.

- The improvement in the private capital account should be taken as the key positive takeaway from the October statistics, but the reiterated statement by the central bank that the structure of 10M21 outflows is heavy on foreign asset accumulation suggests little improvement in the structure and visibility of future flows.

Figure 1: Ruble rally in October was supported by smaller than expected FX purchases and smaller private capital outflow

Figure 2: Export volumes should catch up with oil prices in a month or two

We remain constructive on the ruble for 4Q21 thanks to strong commodity markets and signs of deceleration in net private capital outflows. That said, the pick up in FX intervention and recent resurgence of portfolio outflows from the local bond market could make further ruble performance more dependent on inflationary expectations globally and locally.

Download

Download snap