Russian key rate: a tactical hold

Bank of Russia held on to 4.25% today, in line with expectations. The door for further cuts remains open, though uncertainties with budget and foreign policy may extend the pause till December. With Russian real rates becoming elevated among peers, our call for the nominal 3.5-4.0% rate floor is still valid, though risks are tilted to the upper bound

| 4.25% |

Russian key rateunchanged |

| As expected | |

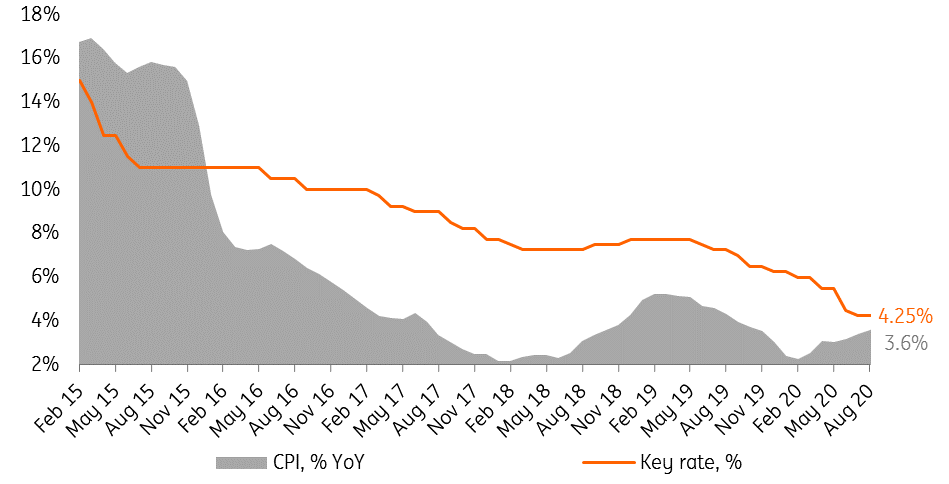

Bank of Russia kept the key rate unchanged at 4.25%, in line with market and our expectations. The overall tone of the commentary also didn't surprise, as the moderately dovish mid-term signal remained in place.

CBR rhetoric confirms our take that the reasons for the tactical hold include more a more active recovery in local economic activity, higher foreign policy risks and market volatility, slightly higher-than-expected CPI trajectory for reasons beyond the base effect, and elevated CPI expectations among households and businesses.

The mid-term signal remains moderately dovish, as CBR pointed that

- the economy is growing below potential, and Governor Nabiullina stressed the need to maintain loose monetary policy (real rate below 1%) in 2021

- market expectations for CPI for 2021 are below 4%

- the upcoming budget consolidation may slow down the recovery in demand

This suggests that the scope for further cuts is not exhausted.

Meanwhile, we note that the CBR commentary also contains signs of lower certainty in its dovish base case

- There is higher attention to foreign politics: according to CBR, the global foreign policy tensions (including on trade) can lower the potential growth, which could lead to higher risk of overheating; it also can lead to higher volatility of the financial markets, also being potentially pro-inflationary in Russia's case

- CBR highlighted that its base case in no small part relies on the Finance Ministry's ability to defend its tight fiscal policy approach. The 2021-23 budget draft is current under discussion, and is likely to be finalised in December

Based on the tone of the communique and press-conference by the governor, we believe that another 25bp key rate cut this year is possible, though not necessarily in October. The finalisation of the Russian budget drafting process is expected only in December, and the US political cycle renews in November. We would not exclude that CBR would like to clear those uncertainties before proceeding with further cuts.

In a longer run, we continue to believe in further scope for the key rate cut, as the Russian real key rate (1.0% based on expected CPI in 12 months) has reached CBR's threshold between loose and neutral monetary policy, and is now leaning again towards the upper border of the peer spectrum (which spans from -2.6% to +2.8%), however we share CBR's pro-inflationary concerns (we see upward risks to our CPI forecast of 3.3% for 2021) and see that the key rate floor should be in the middle or at the upper border of our 3.5-4.0% forecast range.

A return to the neutral monetary policy, which in CBR's definition is 1-2% in real terms and 5-6% in nominal terms, at this point appears as a prospect for periods beyond 2021.

Figure 1: CBR keeps the key rate unchanged amid accelerating CPI

Figure 2: Russia's EM/commodity peers have also slowed down the easing cycle

Figure 3: Russian real rates are becoming elevated again

Figure 4: Elevated real rates may be justified by increased country-specific risk perception

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap