Russia: CPI higher than consensus in August, supporting unchanged key rate in September

The lack of monthly deflation in August confirms our take that the pick-up in CPI – to 3.6% YoY currently – is caused not only by the low base effect, but also by RUB depreciation, higher agriculture prices and a lack of demand constraints. Higher CPI combined with increased market volatility are strengthening the case for an unchanged key rate this month

| 3.6% |

August CPI, YoYup from 3.4% in July |

| Higher than expected | |

No monthly deflation in August, YoY CPI higher than consensus

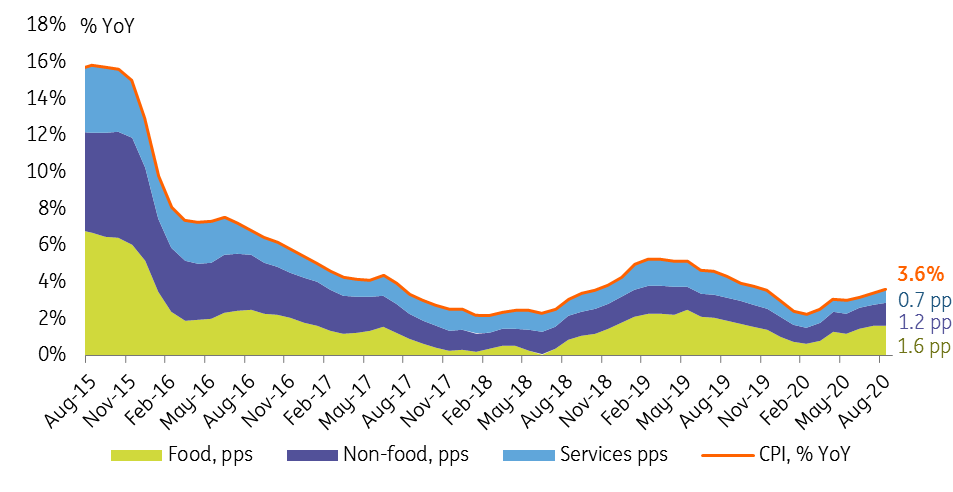

Russian CPI showed no monthly deflation in August despite seasonality, and the annual CPI rate picked up by another 0.2 percentage points (pp) to 3.6% year on year (Figure 1). This result is in line with our expectations, however we were on the hawkish side of the consensus range, with most of the market participants expecting 3.4-3.5% YoY. We take the numbers as supportive of our initial take, that the reasons for the acceleration in the CPI, which is likely to take place in 2H20 and in the beginning of 2021, go beyond the statistical base effect. We have the following list of suspects:

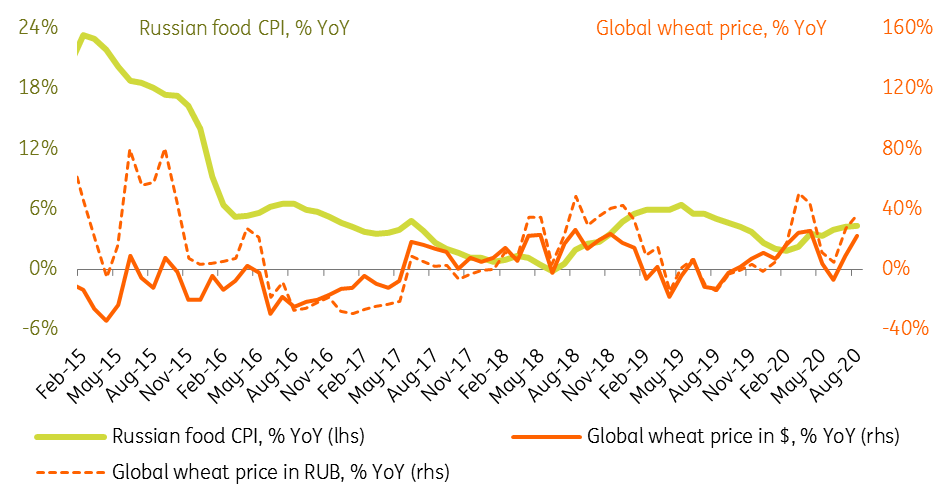

- Pick-up in global agriculture price growth on solid demand and damaged crops is likely putting upward pressure on the local food CPI in Russia, as it was historically (Figure 2). We remind, that around 10 pp of global wheat price growth translates into around 1 pp of local food CPI growth and 0.4 pp of overall inflation.

- It remains unclear if the protests and strikes at Belarus' companies since August have any material impact on Russian CPI. According to our estimates, Belarus accounts for around 1.6% of the Russian consumer basket, with elevated importance for dairy, textiles, fertilizers, and furniture. So far, those items of the Russian CPI have shown no noticeable uptick in prices.

- Ruble's depreciation to major currencies since June, especially by 9% to EUR in July-August (as the EU accounts for around 36% of Russia's imports), could have contributed to the upward pressure in import-heavy non-food items, such as consumer electronics and household chemicals, which are already showing signs of acceleration of CPI in July-August.

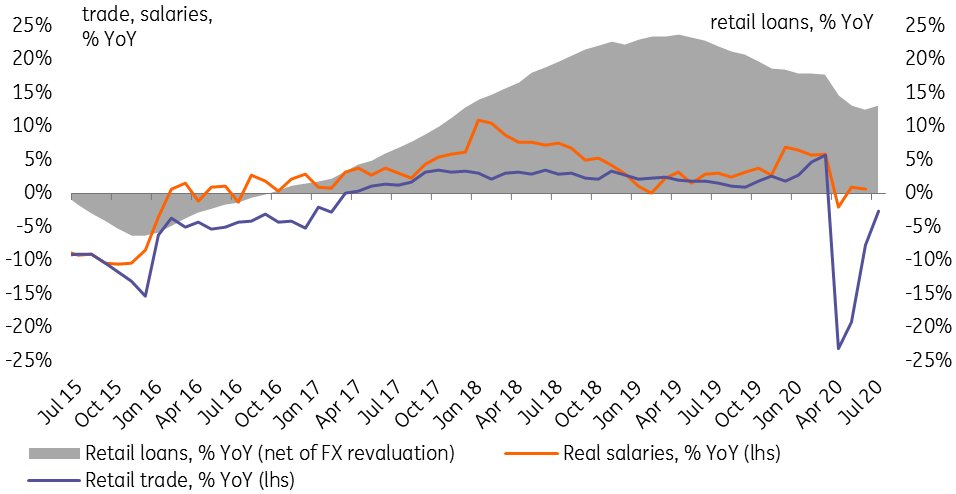

- Lack of obvious signs of disinflationary effects of demand that seems to be recovering faster than expected, as the consumer trend is actively rebounding (Figure 3) amid resumed retail lending, active fiscal support, persistent real salary growth and restrained foreign travel.

Figure 1: CPI creeping up on both base effect and other factors

Figure 2: Global grain prices are contributing to the upward pressure in the local food CPI

Figure 3: Active recovery in consumption is challenging the narrative of disinflationary demand drivers

Higher CPI combined with increased market volatility are strengthening the case for unchanged key rate this month

Higher-than-expected CPI in August is not a threat to the Central Bank of Russia's wide year-end guidance range of 3.7-4.2% for the year-end, and therefore is obviously not an argument against the generally dovish monetary policy framework for the medium term. However, it does suggest that our and the market expectations of 3.7%, the lower border of the CBR range, might be challenged. This in our view strengthens the case against an immediate key rate cut from the current 4.25% level at the upcoming 18 September monetary policy decision.

Other arguments against the immediate cut include the increased local market volatility observed since July as a result of dividend payments, acceleration of local capital outflow and the renewed foreign policy challenges.