Hungary: Inflation in focus for a possibly less dovish NBH

With inflation being higher than expected we see Hungary's central bank focusing more on price levels rather than supporting a vulnerable economy at the upcoming rate-setting meeting. A hawkish tone would prove to the market that the NBH really does care about inflation

The National Bank of Hungary (NBH) is facing a tough challenge after a stronger-than-expected drop in GDP and an upside surprise in inflation. With EUR/HUF moving above 360 and the forint being the underperformer in the region yet again, the market could well be expecting the NBH to focus on growth and to be dovish.

We disagree with this market perception. NBH Vice President Barnabás Virág and other officials have made it apparent that the recent rise in inflation is an issue. In our view, the central bank does care about price stability, especially if that stability were to be further jeopardised by forint depreciation. Against this backdrop, we expect this time to be different – the NBH needs to choose between GDP and CPI and we believe it will focus on the latter.

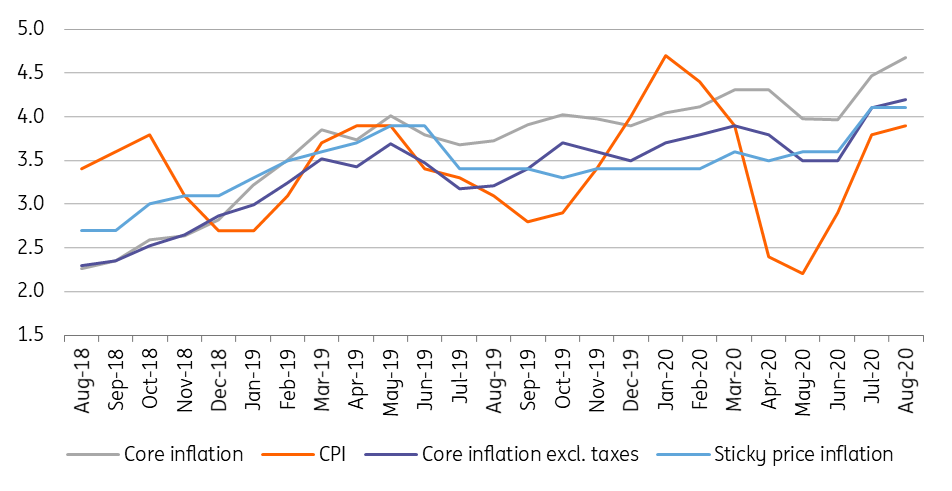

Headline and core inflation measures (% YoY)

We expect the rate-setting meeting to be strong in words rather than full of action. One or two strong references to the inflation situation, complemented by a message that the NBH doesn’t have the appetite to ease further, could be enough. A powerful verbal intervention should prove to the market that its assessment of the situation before the meeting was wrong. With that, the central bank can buy precious time until inflation (both headline and underlying) drops back closer to the middle of its 2–4% target range by year-end.

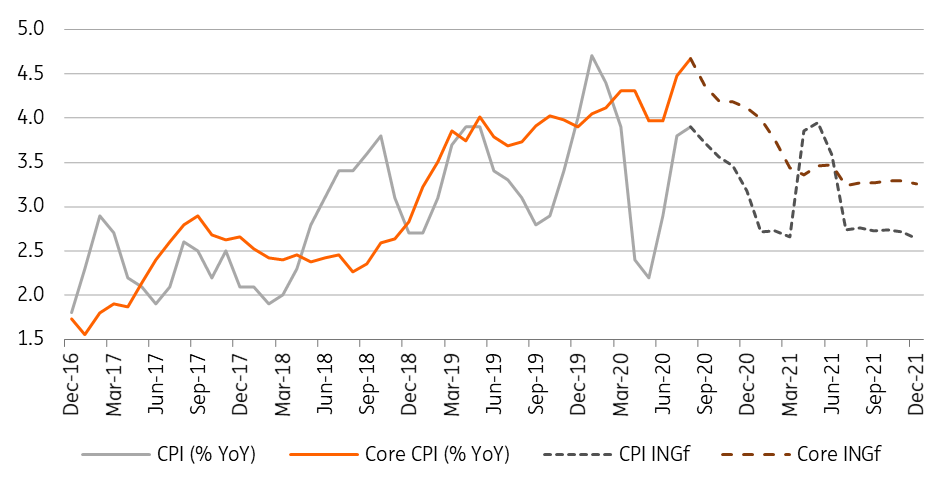

ING Inflation forecast (% YoY)

The NBH will also reveal the key figures of its new Inflation Report on Tuesday before it releases the full report on Thursday. We expect a strongly revised-down GDP forecast, from growth of 0.3-2.0% to a 5.0-7.0% recession. The inflation forecast should remain broadly unchanged, but a small revision on the upside is possible.

| 2020 | 2021 | 2022 | |

|---|---|---|---|

| Change in real GDP (ING prediction) % | 0.3-2.0 | 3.8-5.1 | 3.5-3.7 |

| Previous NBH projection (June) % | (-5.0)-(-7.0) | 4.5-6.5 | 3.5-3.7 |

| Headline inflation (ING prediction) % | 3.2-3.3 | 3.2-3.3 | 3.0 |

| Previous NBH projection (June) % | 3.3-3.5 | 3.1-3.2 | 3.0 |

We expect HUF to rebound after the NBH meeting as the central bank is likely to surprise with a less dovish tone vs market expectations (ie no hint at further easing, justifiable by the downward revision to the GDP forecast). Increasing FX pass-through this year in response to Covid-linked cost side pressures and lost revenues also points to a more cautious central bank stance next week in order not to trigger further pro-inflationary FX weakness. A less dovish than expected NBH should therefore trigger a correction in the HUF.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap