Iron ore takes a tumble, looking more in line now

The long awaited mill re-stocking cycle that kept iron ore prices inflated through 1Q is now failing to meet expectations as steel demand looks tepid. Weaker iron ore prices were always inevitable as oversupply beckons, but high mill margins will provide a floor.

ING Forecasts vs Forward Curve

Can’t fight the oversupply

Iron ore prices have fallen 15% since peaking at the end of February. High port stocks and high seaborne supplies had been largely discounted on the understanding that higher mill margins and capacity controls saw aggressive bids for higher grade ores. The 62-58% spread has since fallen to US$24/mt compared with highs of US$29/mt in early January as Chinese mill capacity begins to re-open post winter cuts. Whilst we do expect continued capacity controls to keep mill margins stable and iron ore grade premiums a theme for some time the iron ore market cannot escape oversupply. Chinese demand for iron ore imports is slowing and will be outpaced by seaborne supply.

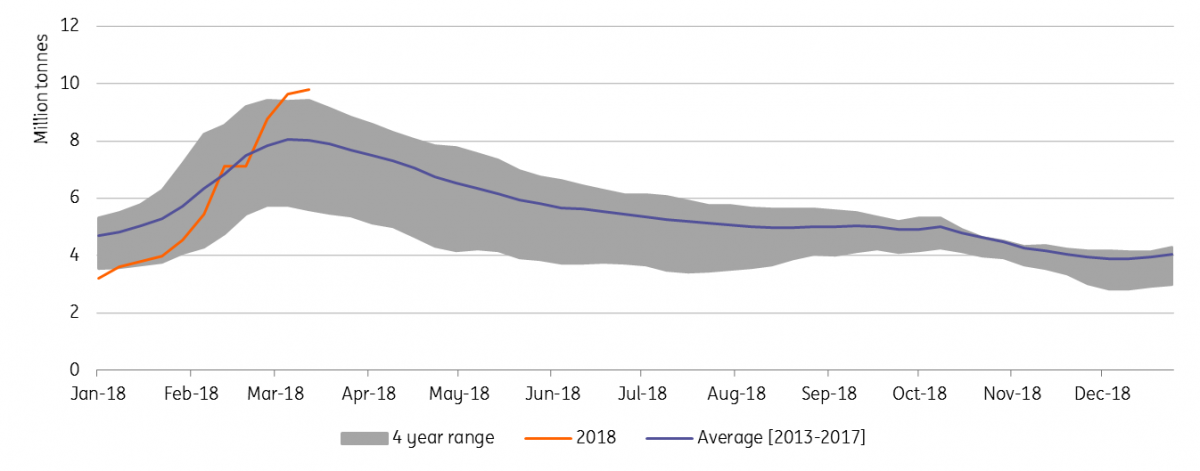

The World Steel Association expects steel demand in China will be flat this year, largely on the back of construction demand as property speculation is curbed. Following news of extended capacity cuts we have also downgraded our 0.6% expected growth in steel production outlook to flat for blast furnaces. Surging rebar stocks now 20% above the last 5 years seasonal average, in addition to weaker property sales data this week was a stark reminder that the slowdown is indeed coming. With SHFE Rebar open interest up 50% since CNY, the speculators were clearly of the same mind as they built up short positions en masse.

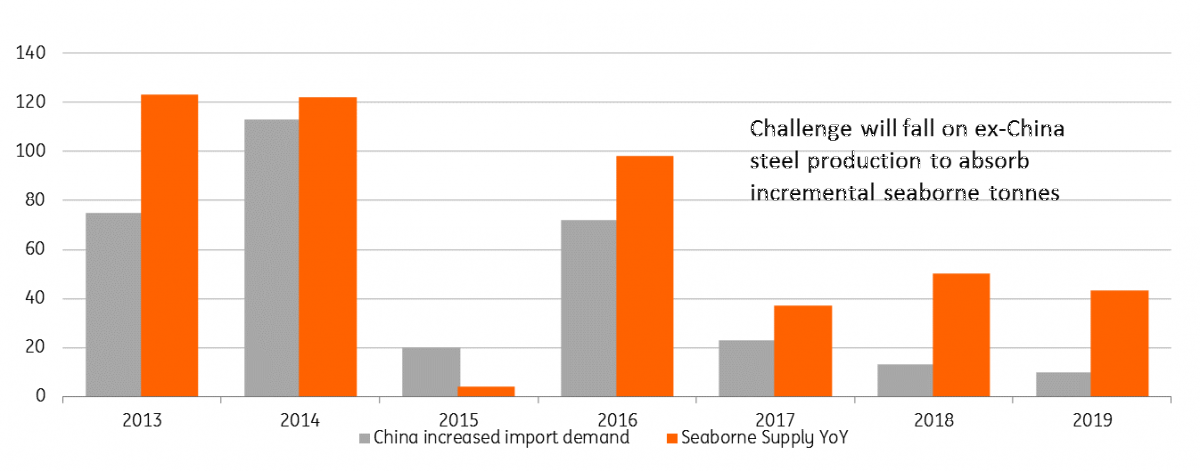

Given our mild expectations for Chinese steel production the next few years iron ore imports are expected to plateau, even as domestic mining continues to slide. It will be increasingly up to rest-of-world steel production to absorb incremental seaborne tonnages, starting with a 50MT increase from Australia and Brazil this year.

Global synchronised growth and lower Chinese exports saw RoW steel output grow 5% last year with bright spots from India and the US. This year ex-China demand is expected to grow 3%, translating to 22MT of incremental iron ore demand after discounting for higher scrap mix and EAF’s. Restrictions on Indian domestic mining could make some difference, but on our base case for those low grade exports to fall by 10MT, the seaborne market still looks oversupplied by at least 15MT this year and again in 2019 (likely larger if China runs down its high port inventory). Whilst moderate against a 1 Billion+ tonne seaborne market the surplus environment has proven unable to sustain higher prices.

Chinese Rebar stocks well above seasonal average (Mt)

Its now up to ex-China Steel to absorb growing seaborne supply (Mt)

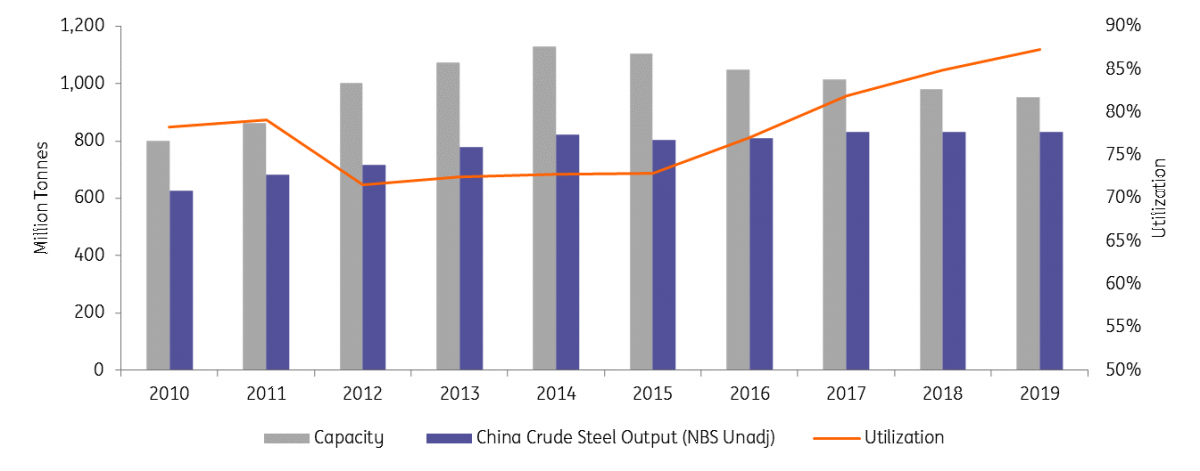

Higher margins=higher for longer

ING had pushed back its sub US$60 forecast to late 2019 on the expectation that mill profitability and hence purchasing power would stay high. Even as steel prices have fallen with some aggressive shorting behaviour on SHFE those margins remain stable and we re-affirm our view this will now hold support for the market. China continues to act aggressively on overcapacity in the steel sector and has this year bought forward its 150Mt reduction target as well as extending capacity curbs in the non-winter months in Tangshan (15% of Chinese steel capacity). Overall we expect steel mill utilization to therefore average firmly above 80% this year, which will keep the incentive for higher yielding ores and keeping a floor for 62% prices.

Capacity Cuts to Drive Chines Steel Utilization Higher (Mt, %)

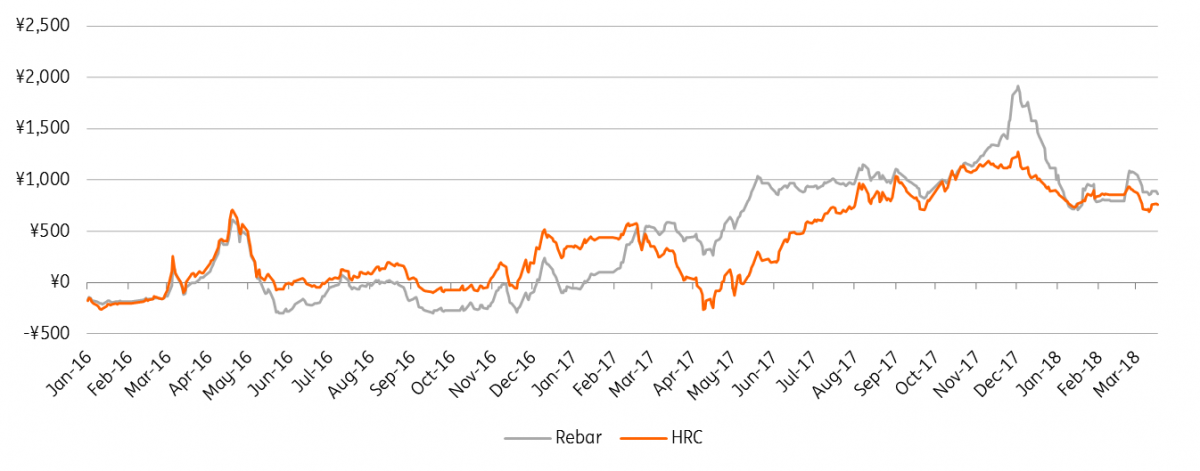

China mill margins stabalise at high levels (CNY/mt)