Wheat: Rains bring some relief

CBOT wheat was having a good run. Prices had rallied as much as 30% from the lows seen in mid-December, with concerns over the condition of the US winter wheat crop. However, the return of rains in the US plains this week saw the market aggressively sell off. Could there be more downward pressure to come?

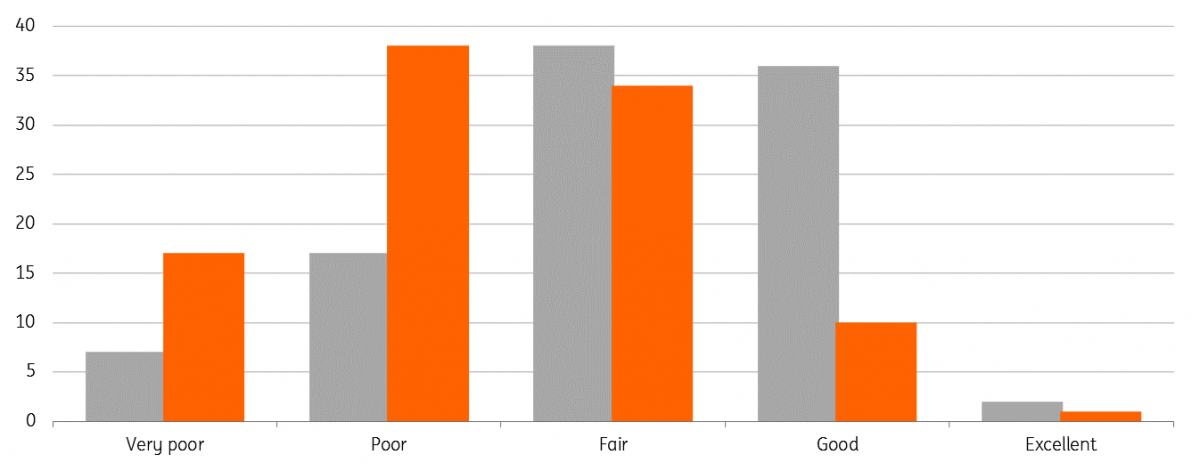

Poor winter wheat conditions

Drier than usual weather across the US plains over the winter months has seen a number of states downgrade the condition of the winter wheat crop. Crop conditions in Kansas have been edging lower, with 55% of the crop rated poor to very poor as of 18 March. This compares to just 24% at the same stage last season. Kansas plantings make up around 24% of total US winter wheat plantings. Then in Texas, which makes up around 15% of total winter wheat area, 60% of the crop in the state is rated poor to very poor as of 18 March. This compares to just 21% at the same stage last year.

The USDA estimate that winter wheat planted area for the 2018/19 season will fall by less than 1% YoY to 32.61m acres. However, due to drought conditions in some regions, the harvested-to-planted ratio could fall, with farmers potentially not harvesting some acreage in the worst affected areas.

While there is risk around the winter wheat crop, the USDA are still expecting that total US wheat production for the season will increase by 98m bushels, on the back of increased spring wheat area and marginally higher yields for spring wheat. However, we will need to keep an eye on how the winter crop develops, and whether recent rains do in fact prove beneficial.

Given that both US and global wheat inventories are expected to remain above the five-year average, we expect prices to remain under pressure. We currently estimate that CBOT wheat will average US4.60/bu over 2018, however this is assuming no further deterioration to the US winter wheat crop.

Kansas winter wheat crop condition YoY comparison (%)

Speculative influences

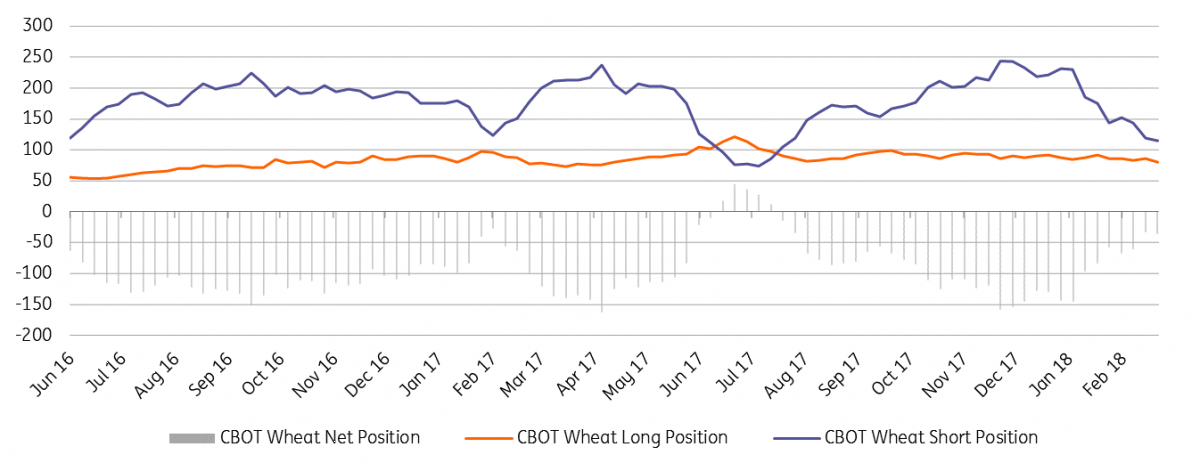

Speculators entered 2018 with a sizeable net short of close to 150k lots in CBOT wheat, which meant that the move higher in the market was going to be over exaggerated with speculators running to cover their shorts, and as of 13 March speculators had reduced their net short to just 35.6k lots.

The CFTC data confirms that it has largely been a short covering rally, with the gross short position in CBOT wheat falling from around 244k lots in December to just 115k lots currently. Over the same period the gross long position strangely fell from around 86k lots to 79.6k lots currently, so even with a relatively more constructive outlook, speculators have been reluctant to go long the market. We would likely need to see a further drawdown in global inventories, before speculators consider entering the market from the long side.

CBOT wheat managed money position (000 lots)