Thailand: An upside trade surprise

Re-pricing for narrowing external surplus and lingering political uncertainty will likely weigh on THB performance going forward

| $808m |

Trade surplus in February |

| Better than expected | |

Positive swing in trade balance

Consistent with our forecast, Thailand’s external trade balance bounced to $808m surplus in February from $119m deficit the previous month (consensus: $636m, ING forecast: $831m surplus). Export growth slowed to 10.3% year-on-year from 17.6% in January while imports also slowed, to 16.0% from 24.3%.

Weak domestic spending

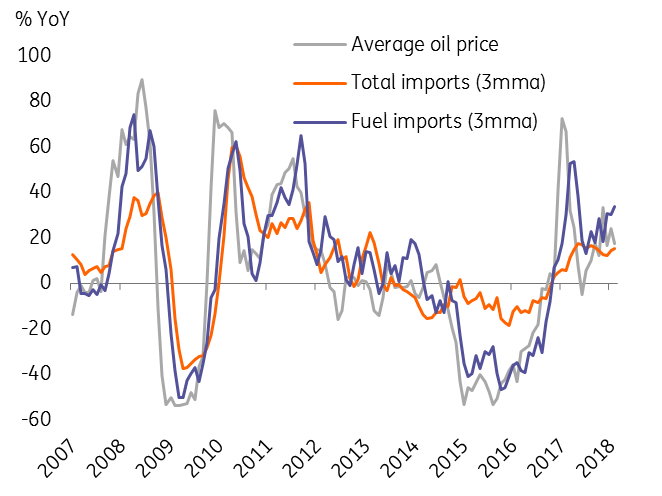

Import growth outpaced export growth in most of 2017 and this trend continues to hold into 2018. We view this more as a function of rising global oil prices boosting the fuel import bill (see chart), rather than an underlying recovery in domestic demand. A side effect of weak domestic demand is a wide trade surplus, albeit with a modest narrowing of the surplus underway since last year. At $13.9bn, the trade surplus in 2017 was $7.3bn narrower than the previous year. It narrowed further, by $1.7bn YoY, in the first two months of 2018. If sustained this should drive the current account surplus below 10% of GDP in 2018, from 10.8% in 2017 and a record 11.9% in 2016.

Oil drives imports

THB re-pricing

The large trade and current account surpluses support positive sentiment toward the currency. The Thai Baht (THB) remains Asia’s top-performing FX with 4.4% year-to-date appreciation against the US dollar. We believe re-pricing for narrowing external surplus and lingering political uncertainty surrounding timing of general elections will weigh on THB performance going forward. We forecast a tight range trading of USD/THB around the 31 level through the end of the year (spot 31.2, ING and consensus forecast for end-2018: 31.0).

Download

Download snap

21 March 2018

Good MornING Asia - 22 March 2018 This bundle contains 5 Articles