US: auto rebound brings manufacturing cheer

Industrial production has rebounded strongly in November, primarily due to the ending of the GM auto workers strike. Utility output also jumped on colder weather, but the underlying story remains one of a sector that is struggling due to weak global demand, a strong dollar and trade uncertainty

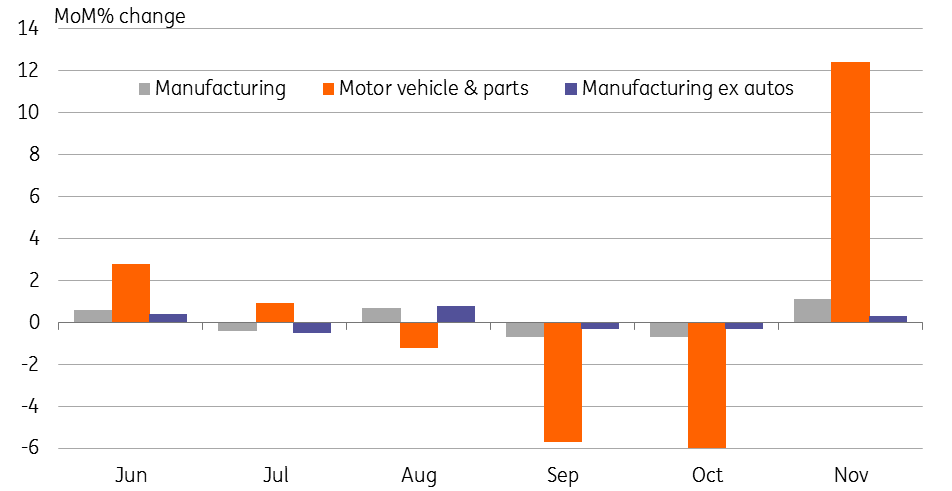

Industrial output jumped 1.1% month-on-month in November versus the consensus forecast of a 0.9% rise, but October’s growth rate was revised down a tenth of a percentage point to -0.9% from -0.8%. Of course these big swings are overwhelmingly auto related following the conclusion of the auto workers strike at General Motors, which had effectively shuttered production for the second half of September and most of October. Auto output plunged 5.7% in September and 6% in October only to rebound 12.4% in November. Given aggregate hours worked in the auto sector had risen little more than 5% in November, today’s output number suggests employees were pretty productive.

Autos responsible for manufacturing swings

This isn’t the whole story. There were better numbers ex auto too with output up 0.3% after a poor run - computers & electronics performed well. We also saw utilities rise 2.9% thanks to a cold snap, but mining fell 0.2%, the third consecutive monthly contraction.

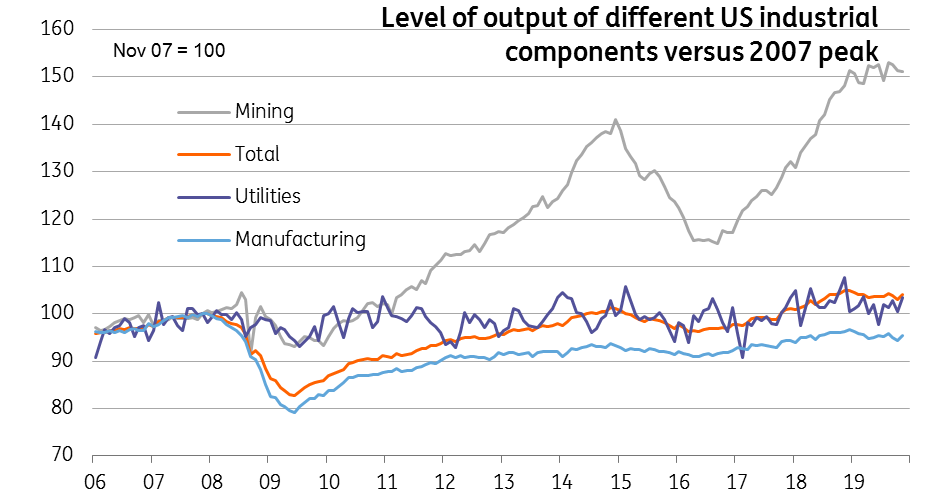

While today’s numbers are good, we have to remember that looking at levels, manufacturing output in total remains 1.4% below the levels of year-end 2018 and 4.7% below the peak level of manufacturing output seen in December 2007. Even when taking into account the surge in oil and gas output over the past decade, industrial production in total is only 4% up on pre-Global Financial Crisis levels.

Levels of industrial activity

There has been some optimism that the phase 1 trade agreement with China will bring some positive news for the sector. We see it as more a situation of stabilization of relations rather than a major improvement in the trade environment though. After all, there is only a partial roll back in the September 1 set of tariffs from 15% on around US$120bn of good imports from China to 7.5%. Also, as other countries have recently experienced, President Trump can swiftly change his mind when it comes to trade.

Moreover, the conditions of weak global demand and the strong dollar remain in play. In this regard the ISM manufacturing series suggests that the tough times for the sector will continue, at least in the near term. The production index suggests output will continue to contract at a -2% year-on-year rate while the employment index points to manufacturing payrolls falling 10,000-15,000 per month - note the recent massive swings relating to the GM strike.

ISM series point to tough times continuing

With manufacturing continuing to struggle and the recent retail sales numbers suggesting a more subdued environment for consumer spending we continue to see 2020 growth more likely coming in closer to 1.5% rather than 2%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap