The Commodities Feed: China copper output grows

Your daily roundup of commodity news and ING views

Energy

The rally in crude oil markets yesterday came to an abrupt end following the API report that US crude oil inventories saw a surprise build of 4.7MMbbls over the last week. This compares to market expectations for a 1.75MMbbls drawdown, according to a Bloomberg survey. Builds were also reported on the product side, adding to the bearishness of the release. API numbers showed 5.6MMbbls and 3.7MMbbls increases in gasoline and distillate fuel oil inventories respectively. Later today the EIA will release its more widely followed report, and numbers similar to the API would likely be seen as bearish in the immediate term. Refinery margins remain under pressure, and may weigh on run rates moving ahead. The previous report showed a week on week decline in utilisation rates. A continuation in this trend would be at odds with the seasonal pattern we usually see at this time of the year, and could lead to further crude oil stock builds in the weeks ahead.

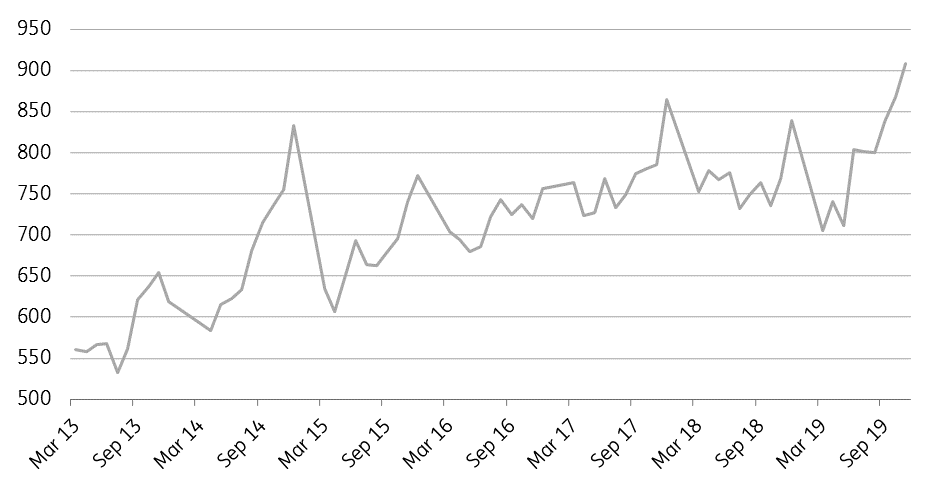

China refined copper output reaches record levels (k tonnes)

Metals

It was a fairly quiet day for LME markets, with little in the way of fresh developments on the trade front. LME aluminium finished the day almost 0.8% lower, with exchange inventories increasing by 41.2kt yesterday and taking total stocks to 1.44mt. Stocks have increased by around 500kt over the last month, to levels last seen in June 2017. Meanwhile, LME copper has come under some pressure in early trading today, with latest numbers out of China showing that refined copper output over November hit a record 909kt, surpassing the previous record of 868kt in October. This stronger output comes despite the fact that we have seen smelter margins in China shrink, as treatment charges have come under pressure. Cumulative refined copper output over the first 11 months of the year totals 8.88mt, up around 11% YoY. Meanwhile LME zinc has largely ignored production data out of China, with the statistics bureau reporting that refined zinc output increased by around 13% YoY to total 594kt in November- levels last seen in late 2017. Cumulative output over the first 11 months of the year totals 5.69mt, up 9% YoY.

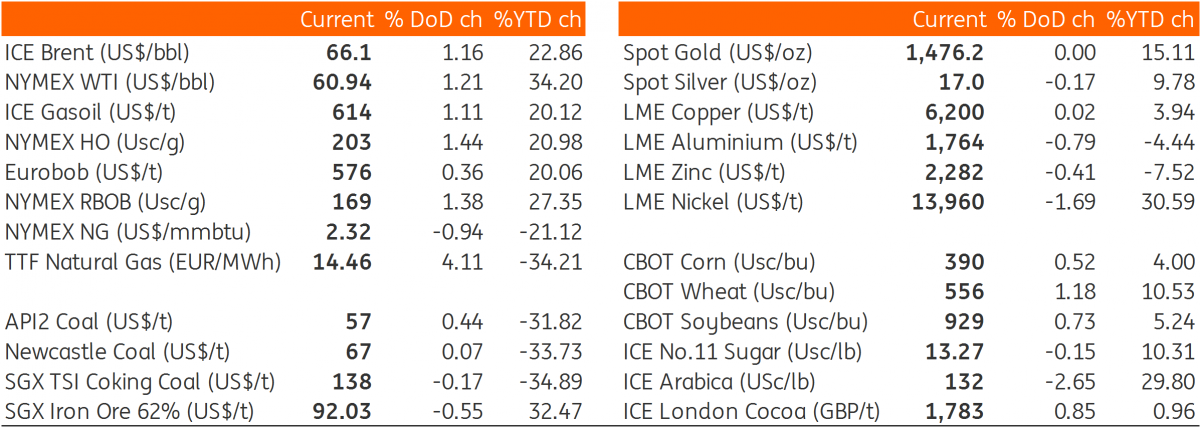

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap