UK wage growth surprise could spell repeat 50bp rate hike

A few months ago it looked like UK wage growth had peaked. Now it is running at its fastest pace yet, and, depending on next week's inflation figures, it could push the Bank of England into another 50bp rate hike in August

The latest UK wage data is a blow for the Bank of England in its battle against high inflation. Private sector regular pay is now growing at more than 9% on a three-month annualised basis, which as the chart below suggests, is the highest it has been since the depths of the Covid-19 pandemic (when the figures were highly skewed due to the furlough scheme). Some of this can be explained by backward revisions, but it nevertheless bolsters the chances of a repeat 50 basis point rate hike in August – although this will depend heavily on whether next week’s services inflation comes in higher than expected too.

UK wage growth has picked up again

If there’s a sliver of good news for policymakers, it’s that there are further signs that the UK’s worker shortage crisis is becoming less acute. The number of people inactive (neither employed nor actively seeking a job) has continued to fall. Where at one point there were more than half a million extra people inactive compared to pre-pandemic, that figure now sits at 173,000. That’s overwhelmingly because of a net influx of students to the jobs market, helping to offset elevated long-term sickness levels which haven’t improved at all.

That, and a marked increase in economic migration this year, has helped lower the proportion of companies reporting that it is “much harder” to recruit in recent Bank of England surveys of Chief Financial Officers (CFOs). The latest jobs figures also contain further signs that the labour market is cooling, though it’s a gradual story. The unemployment rate ticked up to 4% in May, albeit the redundancy rate has barely budged over recent months.

The reality though, as the Bank of England’s rate June decision made clear, is that these trends have been on display for several months now, and policymakers are losing confidence that they will translate into lower inflation. The BoE is focused squarely on the official pay and CPI data as it emerges.

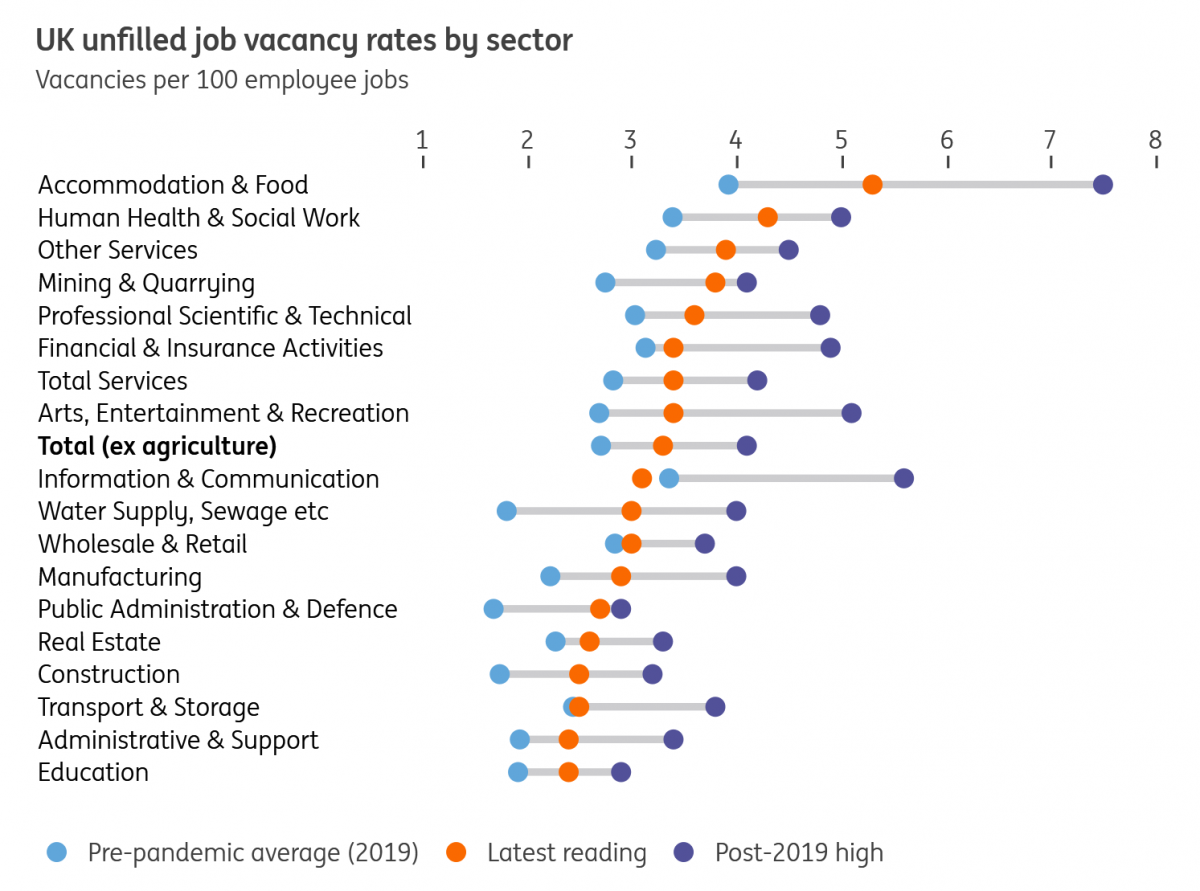

Worker shortages have eased, but it varies by sector

The downside to that strategy of course is that wage growth is one of the most backward-looking indicators out there. And we think we should see pay pressure start to ease later this year – how quickly is up for debate.

Bank of England modelling indicates that higher inflation expectations among consumers/businesses explain most of the previous rise in wage growth, and by that logic you’d expect pay pressures to abate a fair bit from here on. Consumers, and to a lesser extent businesses, are no longer expecting such aggressive price rises over the coming months.

But as we discussed in more detail last month, we think that modelling underplays the role of worker shortages. In the UK jobs market – where only a minority of roles are linked to collective bargaining agreements/formal pay negotiations – it’s ultimately the ability (or threat) of workers quitting that keeps pay growth elevated. Higher inflation may incentivise workers to switch jobs more readily than they might otherwise, but the process relies on a strong underlying jobs market. Our tweaked version of that BoE modelling finds that post-pandemic shortages were a big driver of the wage pressure we’re seeing now.

While those worker shortages are easing, the story varies considerably across sectors and at least some of these hiring challenges can be explained by structural rather than cyclical forces. Persistent staff shortages suggest the downtrend in wage growth, when it comes, is likely to be pretty gradual.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Bank of EnglandDownload

Download snap