The Commodities Feed: US oil imports fall

Your daily roundup of commodity news and ING views

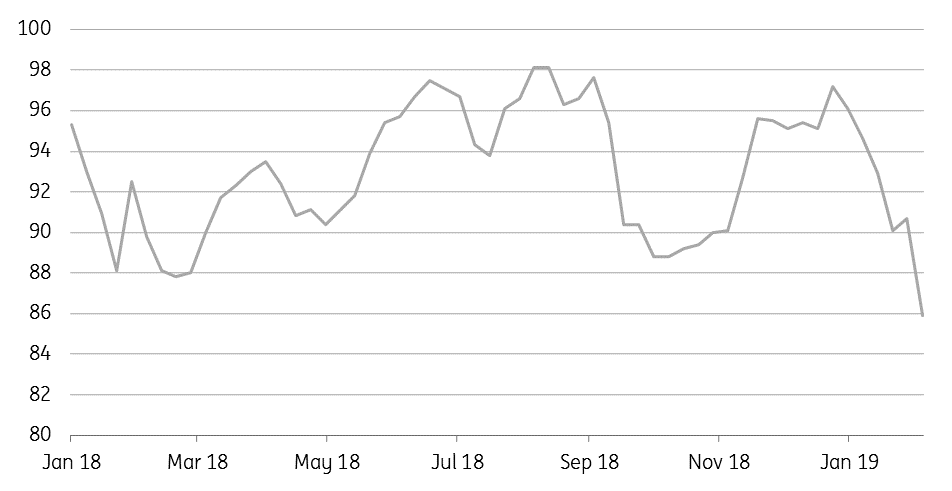

US refinery utilisation rates fall (%)

Energy

US crude oil inventories: The EIA reported yesterday that US crude oil inventories increased by 3.63MMbbls over the last week, which was larger than the 2.4MMbbls build the market was expecting, and at odds with the 998Mbbls draw the API reported the previous day. This larger than expected crude oil build occurred despite the fact that oil imports into the country fell by 936Mbbls/d over the week. Imports from Venezuela fell by 228Mbbls/d to 117Mbbls/d, as sanctions take a toll, while imports from Saudi fell by 195Mbbls/d to 415Mbbls/d. The fall in imports was offset by refinery utilisation rates declining from 90.7% in the prior week to 85.9% in the latest week. We believe yesterday’s numbers were fairly bearish, given the fact that inventories grew more than expected, despite a significant fall in crude oil imports over the week.

China oil imports: The latest customs data out of China shows that crude oil imports over the month of January totalled 10.07MMbbls/d. While this was up 5% year-on-year, it was still off from the record levels seen towards the end of last year when imports averaged 10.48MMbbls/d and 10.35MMbbls/d in November and December, respectively. Still, the very strong imports seen towards the end of last year seem to reflect refiners using their import quota licences before the end of the year.

Metals

Chinese metals trade: Chinese exports of aluminium semis hit record levels over January, with flows totaling 552kt over the month, up 25% YoY, and 4% higher MoM. These stronger flows have come despite the fact that the export arb has narrowed since 4Q18. These stronger exports are certainly not helping sentiment in the aluminium market, with the spot market fairly well supplied. Chinese refined copper imports increased 9% YoY (+14% month-on-month) to 479kt, likely reflecting the tougher restrictions on copper scrap inflows.

Meanwhile, President Trump has suggested that he would be willing to extend trade talks with China by 60 days. These comments have provided some support to metal markets this morning, with the threat of higher tariffs on Chinese goods possibly being pushed further forward.

Agriculture

China soybean imports: The latest trade data from China shows that soybean imports increased 29% MoM to total 7.38mt over the month of January, although imports are down 13% YoY. China has increasingly turned back towards US soybeans since the first trade talks took place at the G20 summit in late November. Just over the last week, almost 480kt of US soybeans inspected for export were destined for China.

Indian minimum sugar price: There are media reports that the Indian government is considering raising the minimum sales price of sugar sold into the domestic market from ING29/kg to as much as INR32/kg. Mills have been pushing for higher prices, with these levels still below their production costs. This action could mean reduced exports to the world market, with an unattractive export arb. However, this does not solve the issue of growing stock in the domestic market.

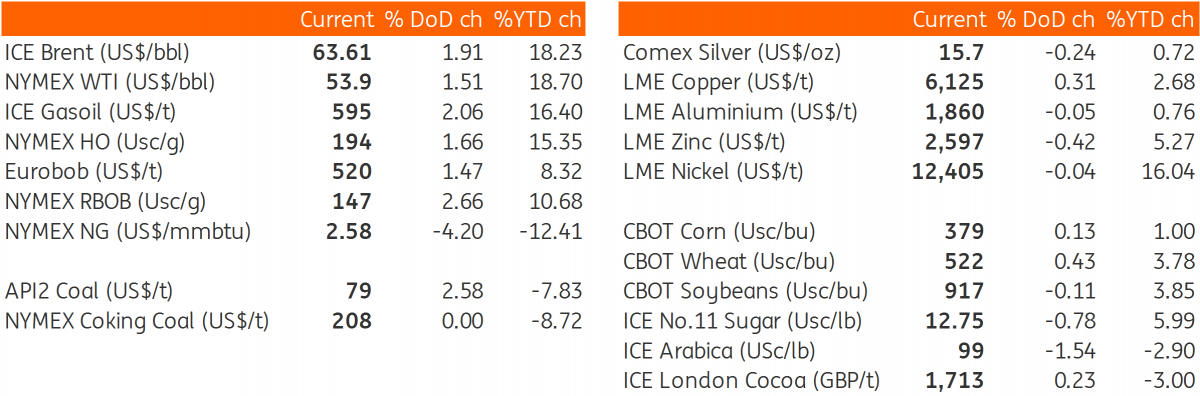

Daily price update

Download

Download snap