Briefing Romania

Busier day ahead for Romanian government bonds

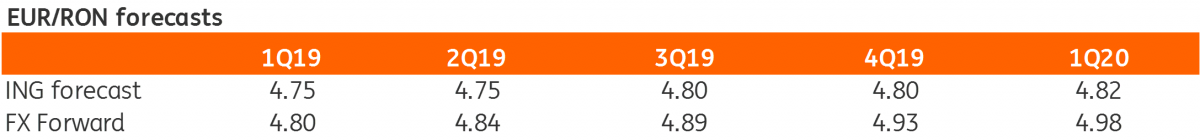

EUR/RON

It’s expensive to short the Romanian leu these days! With carry rates back above 5.00%, the EUR/RON tested lower and closed just above 4.7420. We see the 4.7400 area as a good support zone but if cash rates continue to trade at current levels the only way is down for the EUR/RON.

Government bonds

There's a deafening silence these days in the Romanian government bond market. Luckily, we have the primary auctions to stir things up a bit. The Ministry of Finance today auctions RON 200 million of June-2024 bonds (the new 5Y benchmark). Given the small amount, we believe it shouldn’t be a major problem for MinFin to sell as planned and look for an average yield possibly below 4.30%. But that’s not all, as we also have an 11-month Tbill auction for RON 400 million. We are slightly less optimistic here due to the persistent high funding environment and expect maybe a partial allocation somewhere in the 3.45% area.

Money Market

There are ups and downs in any market and then there is the Romanian funding market. Short dated implied yields (up to 1W) were back above 5.00% yesterday, reaching almost 5.50% at times overnight. As the end of the reserve maintenance period nears, some players are becoming more anxious and are paying up to secure funding needs. However, we still believe that the liquidity squeeze is more circumstantial than structural, most likely related to the MinFin’s spending and possibly affected by the still-unapproved budget bill for 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap