The Commodities Feed: US crude inventory decline below expectations

Your daily roundup of commodity news and ING views

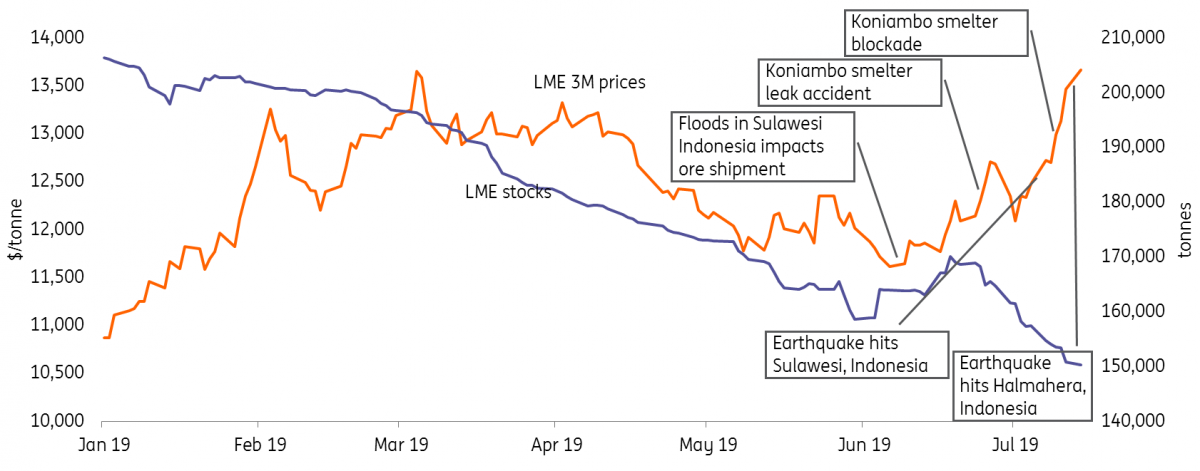

LME nickel prices and inventory

Energy

US inventories: The American petroleum institute (API) yesterday reported that US crude oil inventory dropped by 1.4MMbbls over the last week, less than the 2.5MMbbls drawdown that the market was expecting, according to a Bloomberg survey. The API also reported a fall of 1.2MMbbls of oil inventory at Cushing, Oklahoma. On products, API reported that gasoline inventory dropped by 0.5MMbbls while distillate inventory increased by 6.2MMbbls. Widely followed EIA data is scheduled to be released later today. Meanwhile, BSEE says that 58% of oil production (around 1.1MMbbls/d) remains shut in the Gulf of Mexico region as of Tuesday, improving from 69% closure on Monday.

Russian oil output: Interfax reports that Russia’s crude oil output has dropped to 10.955MMbbls/d over the first two weeks of July, compared to 11.155MMbbls/d of production in June 2019 due to production cuts by Rosneft at its main west Siberian unit. The contaminated oil incident earlier this year and ensuing tension between Rosneft and pipeline operator Transneft have been the primary factor for the reduced oil output in the country. Under the OPEC+ deal, Russia was to keep output at around 11.2MMbbls/d and the current disruption will keep the country fully compliant to the deal.

Metals

Nickel stocks: LME nickel stocks have dropped by around 16kt in the month so far taking the year-to-date withdrawal to 58kt. At current levels of 149kt, LME nickel stocks are at the lowest levels in nearly six years and highlight a tighter physical market. The output disruptions over the recent few weeks including leakages at Glencore’s Koniambo smelter and floods in Indonesia have further accentuated the inventory drawdown. However, the time spread on the LME remains somewhat comfortably in the range of US$40-70 of Contango giving mixed signals on metals availability. On the other hand, SHFE nickel stocks surged to a 17-month high of 25.8kt; though it remains only a fraction of LME stocks.

Iron ore speculation: To rein in the speculative activity in iron ore futures contract; Dalian Commodity Exchange announced increasing trading fees on September contract (most active contract currently) to 0.025% from earlier 0.01%. It also increased trading fees on other contracts as well making it costlier to trade in iron ore futures. The measure was implemented as the iron ore active contract made a fresh high of CNY910/t yesterday. Earlier in the month, China Iron & Steel Association urged the government to keep the iron ore prices under check as higher prices were seen impacting profitability and sustainability of the steel industry.

China metals output: Data released by China’s National Bureau of Statistics shows that the country’s refined copper output increased 11.8% YoY to 804kt in June 2019 with YTD output up 5.8% to 4.52mt. Alumina output in the country increased 5.4% YoY to 6.4mt in June 2019 with YTD output up 11.1% YoY to 37.2mt. China’s zinc output also surged 10.3% YoY to 513kt with YTD output largely flat at 2.8mt. Higher availability of raw materials and increased utilization rates at smelting and refining plants helped the base metals production to increase in the country.

Agriculture

Cocoa processing: European cocoa association reported that cocoa processing in the region dropped 3.2% YoY to a two-year low of 344.9kt in 2Q19 due to higher prices and low margins. Adding to the pressure was low demand from chocolate makers as sales have been slower. Meanwhile, two of the biggest cocoa producers, Ivory Coast and Ghana have implemented a US$400/t of surcharge for the 2020/21 harvest, aiming to boost farmer’s income. However, higher prices could potentially lead to a bigger crop for the year which may make it difficult for prices to sustain; especially when demand may not be very robust due to increased cost and a slowing economy.

Daily price update