UK rate cut unlikely despite benign inflation backdrop

While the UK consumer price inflation backdrop appears relatively benign, the fact that wage growth is holding up suggests it's too early to be thinking about rate cuts. But the increasing uncertainty surrounding Brexit suggests policy tightening is equally unlikely this year

The fact that UK inflation has hit the Bank of England’s 2% target for the second month in a row at face value offers little reason for policymakers to move interest rates any time soon.

As is often the case, energy was more of a drag following a modest fall in petrol prices during June, compared to a 2.2% increase at the same time last year. Once this is stripped out, core inflation inched slightly closer to target (1.8%) following a less pronounced fall in clothing/footwear costs compared to June 2018.

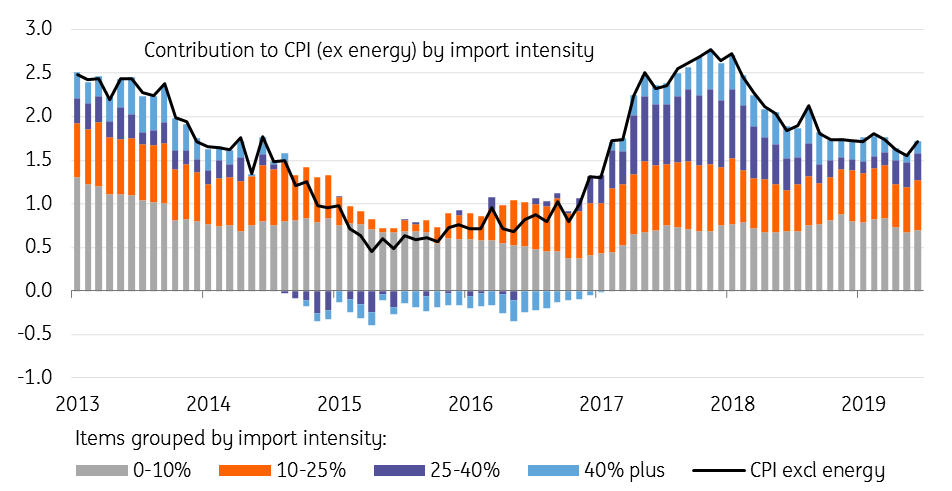

Scratching beneath the surface though, we think the Bank of England will remain relatively relaxed about the inflation backdrop. While core inflation has now sat below target for 10 consecutive months, this is predominantly down to the waning impact of the pound’s post-Brexit slide. Stripping the CPI basket down by import intensity – the proportion of a goods/services that are deemed to have been produced abroad – shows that the contribution from items with a 25%-or-greater import share has fallen from around 1.2% at the start of 2018 to 0.5% in the latest figures.

Even accounting for this currency effect, the underlying inflation story as measured by the core services index has stayed fairly lacklustre. However, this can be mainly attributed to weakness in rents – which make up almost 8.5% of the total inflation basket. According to the Bank of England, this has been driven by a decline in local authority/social landlord rent charges.

Policymakers are also keeping a close eye on wage growth, which has continued to perform well as skill shortages in certain sectors put upward pressure on pay. As we noted in our review of the latest jobs report, this has as much to do with structural factors as it does cyclical, and for now, we expect the positive wage growth story to persist.

This latter point is one of the few remaining hawkish factors for the Bank of England and is one reason why we think it is too early to be thinking about rate cuts. Markets are now pricing almost a 50% chance of easing in 2019.

However, with the growth outlook continuing to be dominated by Brexit uncertainty, we think it is equally unlikely that policymakers will look to increase rates this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

UKDownload

Download snap