The Commodities Feed: Saudi doubts

Your daily roundup of commodity news and ING views

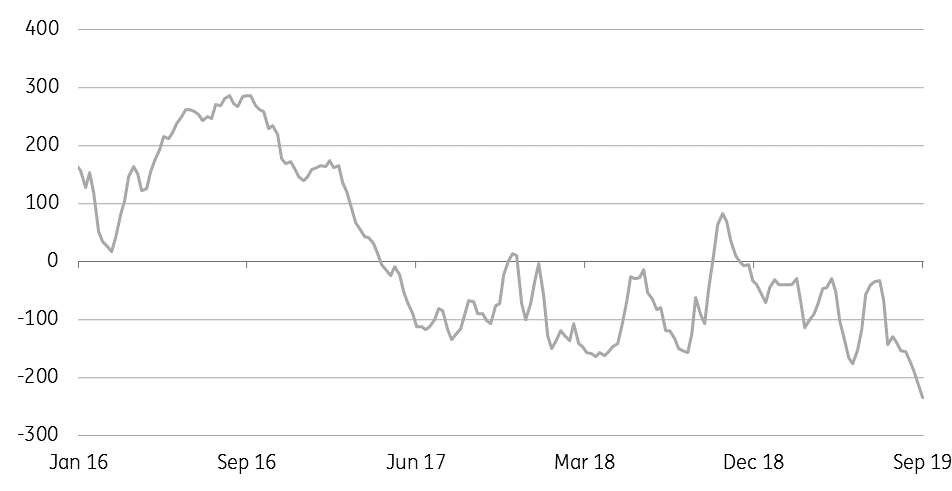

Sugar No.11 managed money net position (000 lots)

Energy

Saudi attack aftermath: The Saudis continue to try to convince the market that they will restore oil production to pre-attack levels before the end of this month. However, the Wall Street Journal reports that repair work at the Abqaiq oil processing plant and the Khurais oilfield could in fact take months, according to contractors and insiders. These doubts, along with the elevated geopolitical risk in the region continue to offer support to the oil market, with ICE Brent up a little over 1% this morning, trading around US$65/bbl.

While the US$5/bbl risk premium that the market is pricing in seems fair (assuming we do see a return to pre-attack levels before the end of this month), the global oil balance continues to tighten, which should offer further support to prices in the coming months. However any strength will likely be short-lived, with the supply outlook over 2020 continuing to look bearish.

Speculative positioning: Latest exchange data shows a muted response from speculators following the Saudi attack. In fact, speculators reduced their net long in ICE Brent by 9,225 lots over the last reporting week, leaving them with a net long of 284,653 lots as of 17 September. CFTC data shows that speculators increased their net long in NYMEX WTI by 12,242 lots over the week, leaving them with a net long of 213,410 lots.

Metals

China iron ore: Weekly data from SteelHome shows that China’s iron ore inventory at ports fell by 0.8mt last week, the second consecutive drawdown, which sees stocks falling to 124.1mt as of 19 September. Softer iron ore prices over the past few weeks have improved the profitability of steel mills in China, supporting demand. However, the outlook for the remainder of the year remains cloudy, with slower economic activity and winter capacity cuts. At the same time, supplies from Brazil continue to recover.

CFTC data: Weekly data from the CFTC shows that managed money net longs in COMEX gold increased by 14,150 lots over the last week, with them holding a net long position of 261,878 lots as of 17 September. Managed money gross longs increased by 7,963 lots over the week, while gross shorts dropped by 6,187 lots. Weaker economic data from China and monetary easing continue to see speculators moving towards precious metals. Meanwhile, the speculative net short in COMEX copper fell by 2,997 lots over the week, leaving speculators with a net short of 48,467 lots as of 17 September. Speculators have covered some shorts over the past two weeks on expectations of policy support from the US and China amid softer economic activity – last week, the Fed delivered another 25 basis point rate cut, while the People's Bank of China lowered the one-year loan prime rate and Reserve Requirement Ratio for banks.

Agriculture

Sugar shorts: Latest CFTC data shows that speculators increased their net short position in ICE No. 11 sugar to a record high of 234,839 lots as of 17 September, rising by 21,345 lots on a weekly basis. The change was largely driven by fresh shorts, with the gross short position increasing by 16,442 lots, while the gross long position declined by 4,903 lots. Despite the fact that the global sugar market is set to return to deficit in the 2019/20 season, sentiment is clearly still very bearish, with high stock levels globally, and the threat of significant Indian exports to the world market.

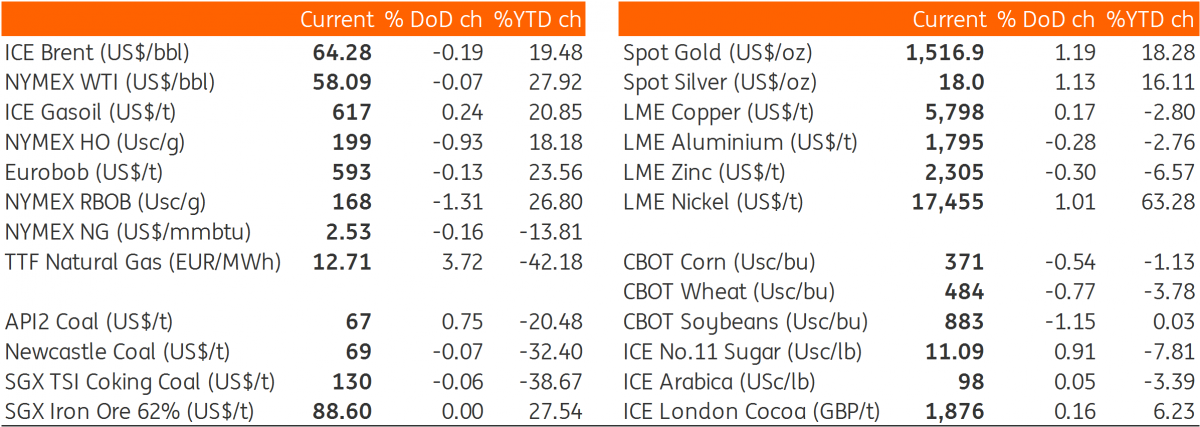

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap