The Commodities Feed: OPEC output declines

|

Your daily roundup of commodity news and ING views |

Energy

Oil remains well supported, with ICE Brent continuing to edge higher yesterday, whilst WTI settled largely flat. This is despite it becoming apparent that OPEC failed to cut output to its production quota in the first month of the deal. According to a Bloomberg survey, OPEC output came in at 24.6MMbbls/d in May, down 5.84MMbbls/d from April, leaving compliance at only around 77%. Under the broader deal, where the OPEC+ alliance agreed to cut output by 9.7MMbbls/d over May and June, OPEC’s share is a little over 6MMbbls/d. Unsurprisingly Iraq and Nigeria fell short of their quotas, with compliance in the first month of around 42% and 33% respectively. Even the largest OPEC producer, Saudi Arabia was unable to reach its target production of 8.5MMbbls/d, with output in the Kingdom coming in at 8.7MMbbls/d. For June, we would expect the group’s compliance to improve, thanks to Saudi Arabia, UAE and Kuwait agreeing to cut their output by an additional 1.18MMbbs/d over the month.

Meanwhile, there is still no confirmation that OPEC+ will bring forward their meeting from 9-10 June to the 4 June, despite the newly proposed date being just 2 days away. The big question is whether OPEC+ will continue with the current deal, and so reduce cuts from 9.7MMbbls/d to 7.7MMbbls/d from July, or extend current cuts for several more months. Russia will be the key obstacle in any extension, and they are unlikely to agree on any extension which goes beyond a couple of months.

Metals

Gold prices along with other precious metals traded higher on Monday supported by ongoing US/China tensions and a softer dollar. The spot gold price is edging closer towards the US$1,750/oz mark, after having traded briefly below US$1,700/oz last week. Meanwhile, gold ETF holdings have passed the 100moz mark for the first time, with inflows of 774koz over the last week. The move in silver has been even more impressive recently, with the gold/silver ratio falling from a peak of almost 125 in March to around 95 currently. Investment demand along with expectations of a recovery in industrial demand has boosted sentiment for the metal, which has rallied more than 50% from its lows in March.

Moving to base metals, and the market continues to focus on more positive developments, including US manufacturing activity bouncing from its 11-year low. Given the reopening we are seeing in major economies, and positive demand from China, the market seems to be of the view that the worst for demand is now behind us. Copper led gains yesterday, with mining risks yet to subside, following media reports of rising Covid-19 infections among workers at Codelco's Chuquicamata mine. Since the Antamina mine in Peru announced the restart of operations, spot treatment charges (TCs) have already begun to rise, although so far the increase has been fairly moderate, up around US$2/t from last week. Meanwhile, according to SMM, steel producers in China’s Tangshan’s city will have to reduce steel production for a month starting from 1st June as per the new air pollution control plan. Steel mills are advised to curb their capacity starting from 20%, 30% and up to 50% depending upon mill location.

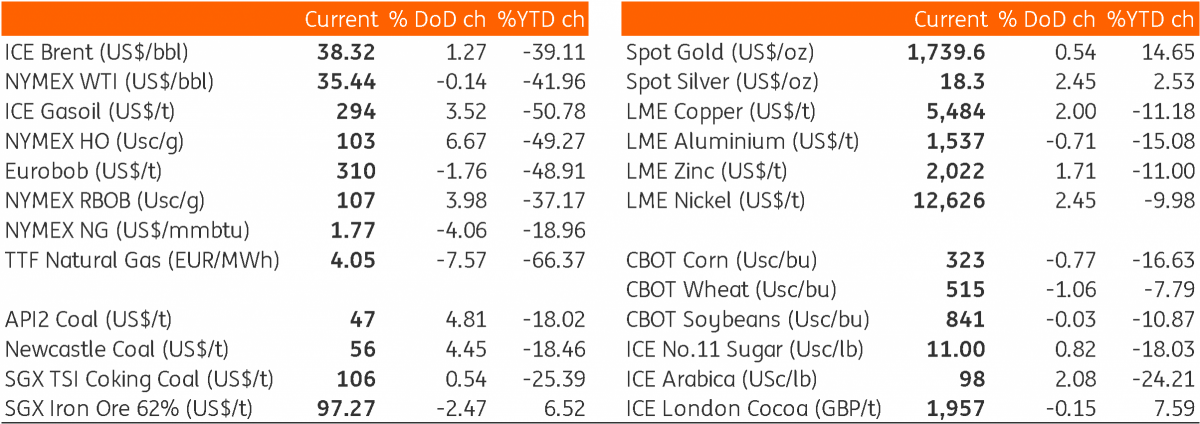

Daily price update