The Commodities Feed: No change from OPEC+

Your daily roundup of commodity news and ING views

Energy

Oil markets remained fairly dull yesterday, despite the OPEC+ Joint Ministerial Monitoring Committee (JMMC) meeting and EIA weekly US inventory numbers.

As for the OPEC+ JMMC meeting, it was a fairly boring affair, with the group keeping the level of cuts unchanged at 7.7MMbbls/d, as largely expected. There was however plenty of focus on compliance, and for those who continue to produce above their quota, to reduce output not just to their quota level, but also to compensate for their overproduction between May and July. Those who have fallen short will need to submit their plans to the JMMC by 28th August on how they will implement their compensatory cuts. The group also acknowledged the uncertainties over the demand outlook, and that the pace of recovery had been slower than anticipated. The next JMMC meeting is scheduled for 17 September.

Moving onto the EIA, and the inventory numbers were quite different from what the API reported the previous day. EIA numbers show that US crude oil inventories declined by 1.63MMbbls over the last week, compared to the 4.26MMbbls drawdown the API reported. The gasoline inventory numbers were much more constructive than API numbers suggested. The EIA reported that gasoline inventories fell by 3.32MMbbls over the week, compared to the almost 5MMbbls build the API numbers showed. However, despite the gasoline draw, implied demand was still lower over the week, falling by 253MMbbls/d. In fact, total refined products demand in the US was down 2.21MMbbls/d WoW.

Metals

Base metals finished the day higher yesterday, with LME copper settling almost 1.8% higher on the day, and at more than a 2-year high. Rio Tinto reduced its 2020 production guidance for refined copper once again, after an unexpected maintenance related issue delayed the restart of its Kennecott smelter in the US. The company’s 2020 production guidance now stands at 135-175kt, down from their guidance of 165-205kt from April.

The latest data from the National Bureau of Statistics shows that China’s refined copper output fell 5.3% MoM to 814kt (lowest since March) in July, as domestic smelters enter their summer maintenance period, while constrained concentrate supply due to Covid-19 would have not helped. However, refined output in the first seven months of the year was still up 3.9% YoY, to total 5.63mt. In the secondary market, China’s Solid Waste and Chemicals Management Bureau issued the 11th batch of scrap import quotas for 2020; a total of 14.53kt of copper scrap will be allowed to enter China as per the latest quota released yesterday. YTD total scrap import quota allowances now stand at 743kt.

Finally in Aluminium, Norsk Hydro announced yesterday that it will reduce the operating capacity at its Alunorte alumina refinery due to extended maintenance on a pipeline transporting bauxite from the Paragominas mine. Pipeline operations are expected to resume in the next two months. However, until then Alunorte is expected to operate at 35%-45% of its full production capacity.

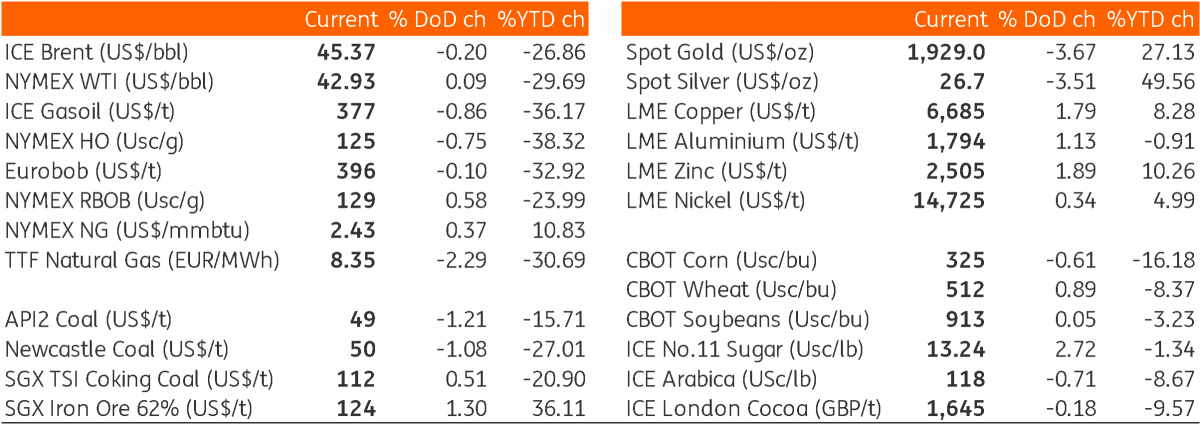

Daily price update