The Commodities Feed: Covid-19 worries grow

Your daily roundup of commodity news and ING views

Energy

The sell-off in oil continued yesterday, with worries over Covid-19 growing. The World Health Organization (WHO) reported that the number of new cases outside China exceeded those within China for the first time. The pressure yesterday means that ICE Brent is almost 10% lower over the past week. This should send a clear signal to OPEC+ ahead of their meeting in Vienna late next week. Clearly, it is Russia that needs convincing, with little indication that they back the recommendation from the Joint Technical Committee from a few weeks ago. However the CEO of Gazprom has said that given the level of uncertainty around demand, that OPEC+ should make a decision around quotas at a later stage.

Yesterday, the EIA released its weekly report, which was more constructive than expected. It showed that US crude oil inventories increased by just 452Mbbls, much less than the 2.6MMbbls build the market was expecting, and lower than the 1.3MMbbls build the API reported the previous day. Meanwhile sizeable draws of 2.69MMbbls and 2.12MMbbls were seen in gasoline and distillate fuel oil respectively. The outage at the Baton Rouge refinery was also reflected in the numbers, with refinery run rates in the Gulf Coast down 3.1% over the week.

Metals

Ex-China Covid-19 developments offered renewed support to gold and this strength has continued in early morning trading today. Uncertainty over the virus continues to see investors flocking towards the yellow metal, with gold ETF holdings increasing for 26 consecutive days, with inflows over that time growing by 2.72moz to total 84.43moz currently. Given this uncertainty is likely to linger, along with the prospect for lower rates, it suggests that gold prices are the to remain well supported.

Turning to base metals, LME data showed that copper exchange inventories saw inflows of 61.2kt yesterday (the highest since 2004), taking total stocks to 221kt. Meanwhile turning to aluminium, there are reports that negotiations for 2Q20 Japanese aluminium premia started this week, with one buyer offered a premium of US$90/t, for the upcoming quarter. This would be up from US$83/t in the current quarter.

Agriculture

There are media reports that the Argentinian government is set to increase the export tax on soybeans from the current 30% to 33% after it temporarily suspended its export registry system. If this is the case, it follows an increase late last year following the arrival of the new president, Alberto Fernandez. The hope is that this will help reduce the country’s fiscal deficit. As of yet, there has been no official confirmation of the tax hike. However, the news did see a brief spike higher in CBOT soybeans.

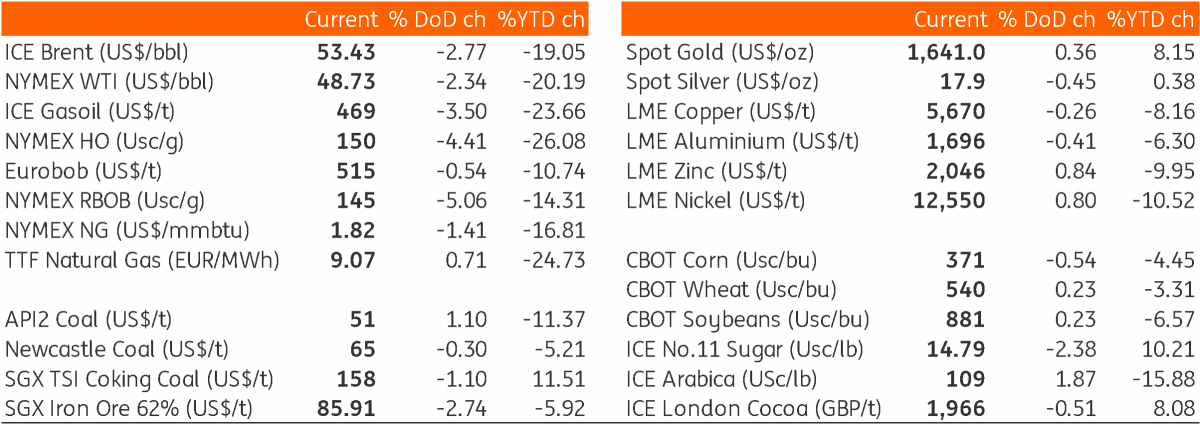

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap