The Commodities Feed: Chinese teapot refiners boost run rates

Your daily roundup of commodity news and ING views

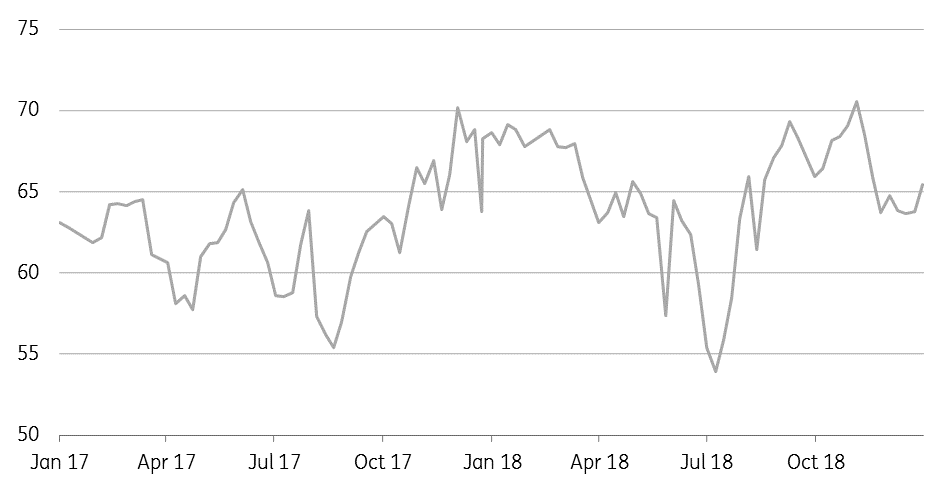

Chinese independent refinery run rates edge higher (%)

Energy

ARA product inventories: Latest data from PJK International shows that refined product inventories in the Amsterdam, Rotterdam, and Antwerp (ARA) region increased by 235kt over the last week to total 5.7mt. The bulk of the increase was due to fuel oil stocks, which increased by 286kt, whilst gasoil saw a marginal increase of 5kt. Gasoline, naphtha and jet fuel all saw drawdowns over the week. Gasoil inventories in the region remain well below the five-year average, which should prove fairly supportive for the gasoil crack. As for gasoline, cracks in Europe are likely to remain under pressure, with ARA inventories at their highest levels in at least five years for this stage of the year.

Chinese independent refinery run rates: According to data from Sublime China Information, run rates at independent refiners in Shandong increased by 1.64 percentage points to 65.44%, taking run rates to their highest levels since late November. Last week, the Chinese government issued its first batch of import quotas for 2019 to independent refiners (known as teapots). According to Reuters, the government released quotas for 89.84mt, down from the 121.32mt issued in the first batch in 2018.

Metals

Zinc cash/3m spread: The LME zinc cash/3M spread has come under pressure this week, falling from US$77/t earlier in the week to a three-month low of US$15/t yesterday. The zinc supply picture is slowly improving, whilst stronger treatment charges in China should see smelters in the country increase utilisation rates. Treatment charges have increased from US$20/t in September to US$165/t currently. Chinese zinc production recovered to a year-to-date high of 17.3kt/day in November, compared to 13.9kt/day in August.

Potential iron ore disruption: Iron ore miner Rio Tinto has had to shut part of its export terminal at Cape Lambert in Australia after a fire broke out. The terminal has an annual export capacity of 205mt. Operations have partly restarted, and it is unknown yet what the full impact, if any, will be on export volumes.

Agriculture

Brazilian soybeans: Brazilian soybean cash values remain under pressure. After having peaked at almost US$2.75/bu in mid-October, values have fallen to US$0.60/bu. As trade tensions between China and the US continue to thaw, with China returning as a buyer of US soybeans, it is uncertain whether Chinese demand for Brazilian soybeans will fall moving forward. Meanwhile, CONAB released its latest estimates for the 2018/19 Brazilian soybean crop yesterday, and they revised crop prospects down from 120.1mt to 118.8mt due to unfavourable weather conditions.

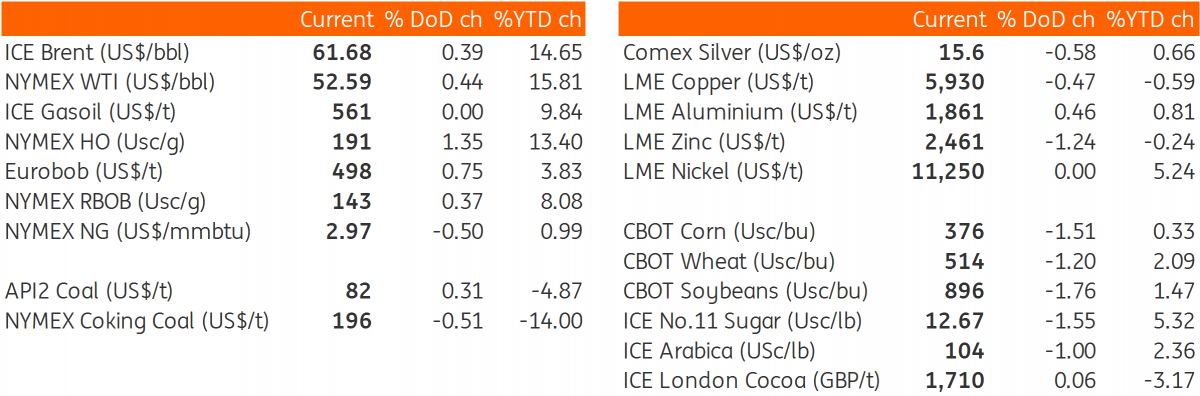

Daily price update