The Commodities Feed: Chinese gold reserves grow

Your daily roundup of commodity news and ING views

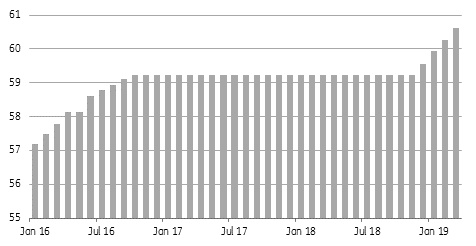

China gold reserves (mOz)

Energy

Libyan tensions build: Conflict in Libya has escalated once again, with Khalifa Haftar in the east of the country ordering his troops to move towards Tripoli, which is home to the internationally-recognised government. As of yet, the fighting does not appear to have led to a disruption in oil output. However, current events certainly increase the risk of possible disruptions, and are thus supportive for oil prices.

That said, Bloomberg reports that oil production at the Sharara oil field has risen to 293Mbbls/d, after restarting operations in early March. The country’s largest oil field was taken over by local tribesmen in early December.

Speculative positioning: The oil market saw another week of speculators continuing to add to their net long positions. The managed money position in ICE Brent increased by 26,625 lots to leave specs with a net long of 348,660 lots- the largest position since the end of October. Spec positioning in NYMEX WTI also increased, though not to the same extent, with the net long increasing by 6,602 lots, leaving specs with a net long of 244,807 lots.

Looking ahead to this week, speculators will likely focus on the EIA's Short Term Energy Outlook on Tuesday, followed by the OPEC monthly report on Wednesday, and finally the IEA monthly oil market report on Thursday.

Metals

Chinese gold reserves: China added 360kOz of gold to its foreign reserves last month, taking total gold holdings to 60.62mOz as of the end of March 2019. It was the fourth consecutive month of gold purchases by the country, having added 1.38mOz since the end of November 2018. This increased buying comes at a time when trade tensions between the US and China continue to drag on. Globally, central bank gold purchases were strong over 2018, predominantly driven by Russia, and 2019 looks as though it will be another year of strong buying from central banks, with China returning to the market.

Mine operations to return to normal: Miner MMG expects operations at its Las Bambas copper mine in Peru to return to normal, after having come to a deal with locals, which will see a blockade lifted. The 400ktpa mine has seen operations disrupted for the last two months, which forced MMG to declare force majeure on supply from the mine.

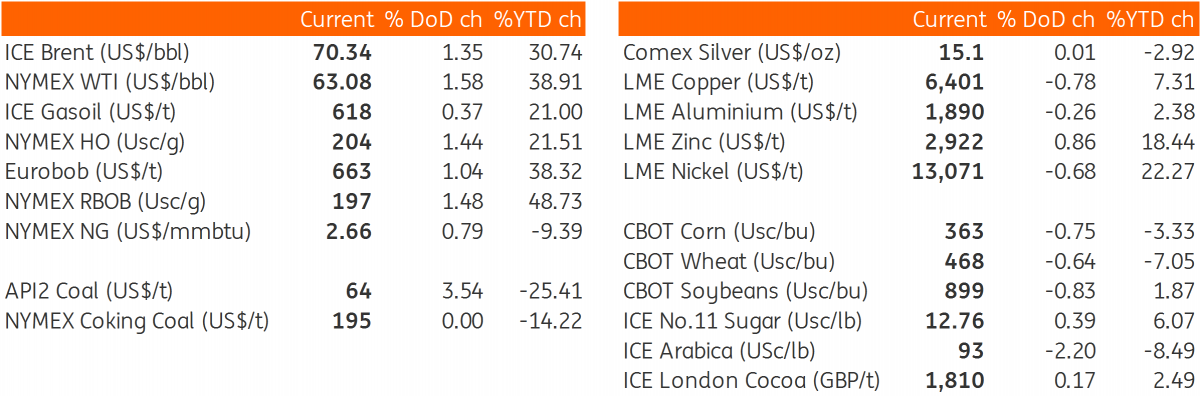

Daily price update

Download

Download snap