Briefing Romania

New 3Y maturity auctioned

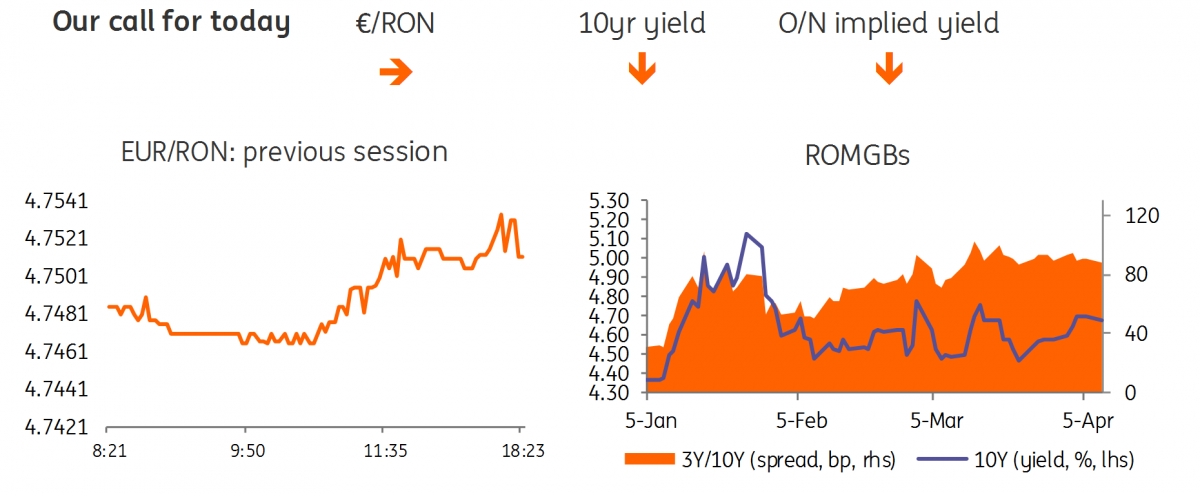

EUR/RON

The EUR/RON has stabilised around 4.7500 on lower carry rates and below average turnover. We expect the pair to remain broadly stable around current levels.

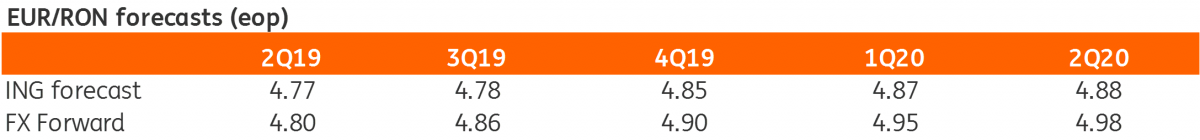

Government bonds

The Romanian government bond market has remained mostly quiet, with yields inching marginally lower by one to two basis points. Today, the Ministry of Finance auctions RON500 million in Aug-2022, a new ISIN which should see good demand as the tenor appeals to a broad range of investors. Unless we see a meaningful allocation upsize, the average yield should print below 4.00%.

Money Market

Cash rates returned to around-Lombard levels of 3.50% after trading above 4.00% towards the end of last week. We don’t expect the National Bank of Romania to organise any market operations today.

The week ahead

In the US, we look for headline CPI to rise 0.3% month-on-month and for the core to increase by 0.2%. This would leave the annual rate of core inflation at 2.1%, which is broadly in line with the Federal Reserve’s medium-term target of 2.0%. We will also get the minutes to the March FOMC meeting, which saw officials remove from their forecasts the two rate hikes they had previously pencilled in for 2019. In the eurozone, the focus will be on the ECB meeting on Wednesday. After all the action in March, the meeting is likely to be relatively calm. We don't expect the ECB to announce further details of the built-in incentives for the next Targeted Longer-Term Refinancing Operations (TLTROs) or of any tiering system. The ECB will continue its balancing act between demonstrating that it is not running out of ammunition while still keeping its cards close to its chest.

In Romania, we expect March CPI to inch 0.1 percentage point higher to 3.9% year-on-year, driven by higher oil prices and a weaker Romanian leu. This is likely to be the peak for inflation this year, assuming no meaningful supply shocks (including from regulated prices) ahead. The NBR minutes are likely to be hawkish.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap