The Commodities Feed: Canadian oil strengthens

Your daily roundup of commodity news and ING views

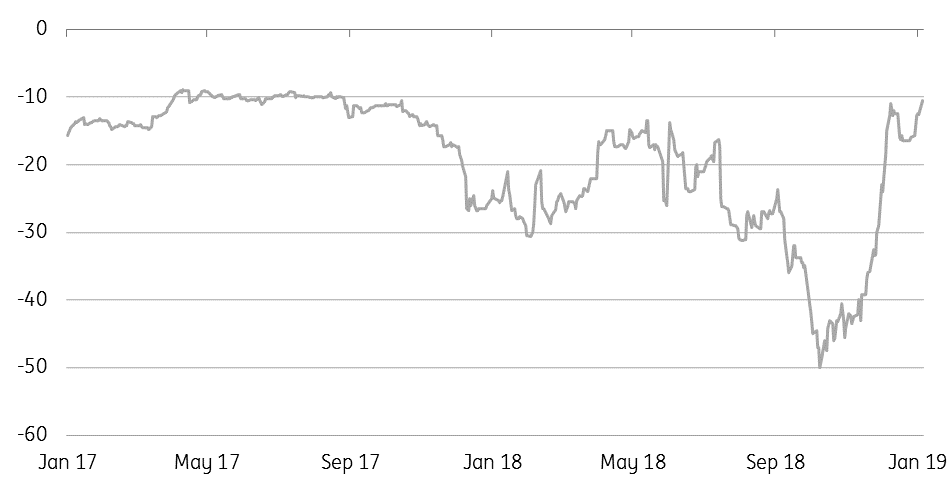

WCS/ WTI differential narrows (US$/bbl)

Energy

West Canada Select differential narrows: WCS continues to strengthen, with its discount to WTI narrowing to just US$10.50- levels not seen since August 2017. This strength follows the Alberta government implementing mandatory production cuts of 325Mbbls/d. The Canadian oil industry was under significant pressure last year, with producers struggling to move oil to the US, as a result of capacity constraints. This saw the WCS/WTI discount reach US$50/bbl in October 2018. Production cuts are set to remain in place until domestic inventories are back towards more normal levels, after which the cut will be reduced to 95Mbbls/d.

US crude oil inventories: The API is scheduled to release its weekly inventory report later today, and the market will be expecting a crude oil drawdown of around 1.75MMbbls over the last week. Market expectations are for a gasoline build of around 3.4MMbbls and a distillate fuel oil build of around 1MMbbls.

Metals

China adds to gold reserves: China has restarted gold purchases after a break of more than two years, with 0.32mOz of gold being added to its reserves in December 2018. People's Bank of China data shows that the country’s gold reserves stood at 59.56mOz at the end of December. Recent appreciation in the Chinese yuan suggests little need for the PBoC to sell foreign reserves. Elsewhere, Bloomberg reports that gold imports into India totalled 762 tonnes over 2018, a 20% decline from the previous year. A weakening Indian rupee over much of 2018 appears to have been the factor that weighed on imports.

Zinc backwardation: The premium for LME zinc cash over 3M forwards has increased from US$50/t at the start of the year to US$77/t yesterday, with the prompt market remaining tight. LME zinc inventories have fallen from a recent peak of 133kt in late December to 128kt currently with nearly 19kt of inventory earmarked for withdrawal.

Agriculture

USDA export inspections: Latest data from the USDA shows that 673kt of soybeans were inspected for export over the last week, down from 1.2mt over the same period last year. The last week also saw 74kt of soybeans inspected for export to China. There are media reports that China bought at least 20 cargoes of US soybeans on Monday. However, at the moment, the Chinese tariff of 25% on US soybeans remains in place. Turning to corn, and 502kt was inspected for export over the last week, compared to 953kt in the previous week.

Sugar rallies: The No.11 Mar’19 sugar contract rallied by more than 6% yesterday, with the broader move higher in the commodities complex, and in particular oil proving supportive for the sugar market. Weather in parts of CS Brazil has not been the greatest, with rainfall in some regions during the off crop below average. The sugar market is set to see a significantly smaller surplus in the current season than initially expected, whilst the 2019/20 season appears as though it will return to deficit.

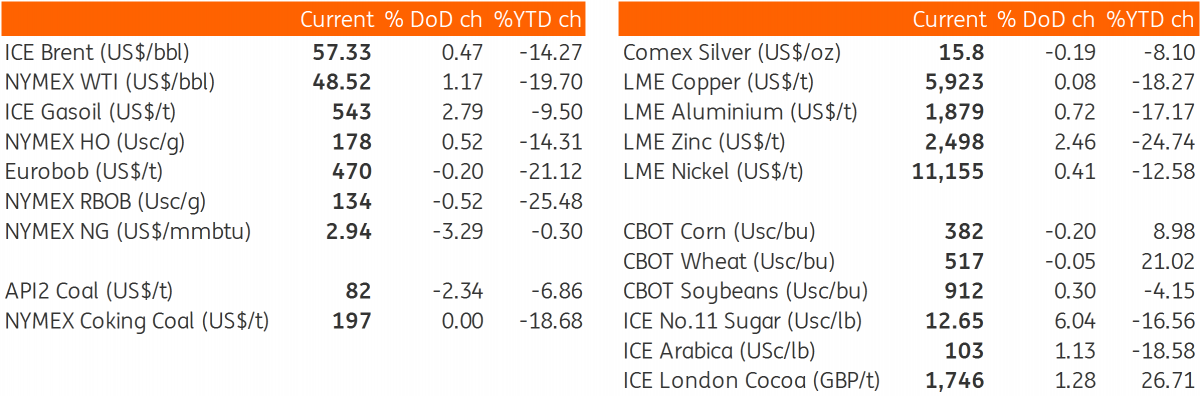

Daily price update

Download

Download snap