Briefing Romania

All eyes on today's National Bank of Romania Board meeting

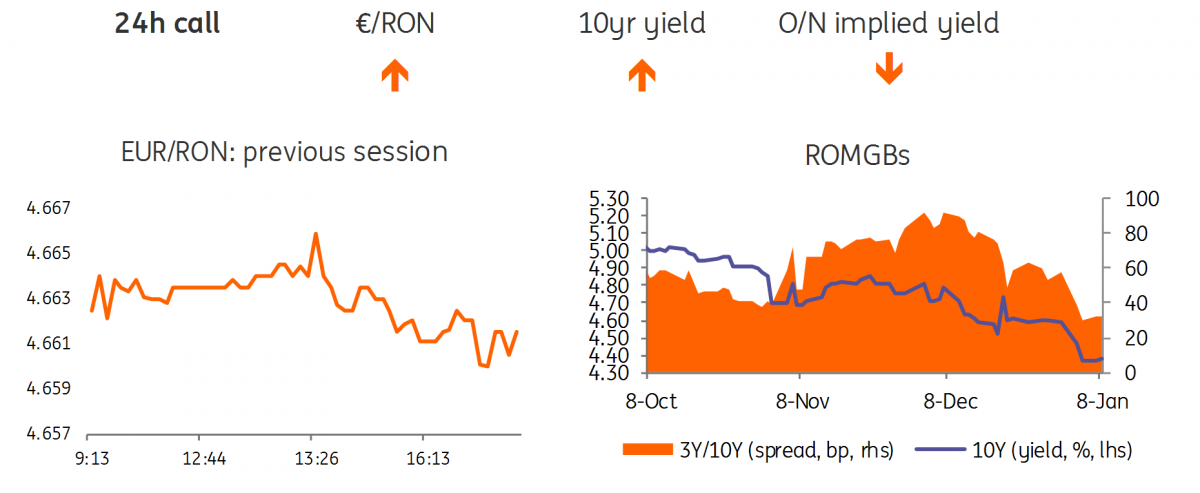

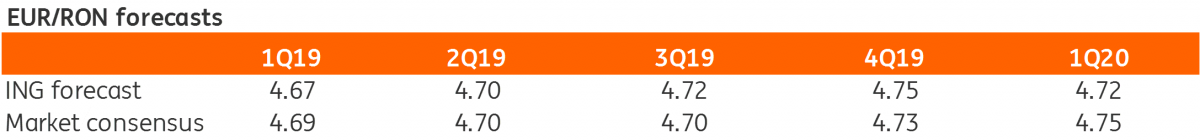

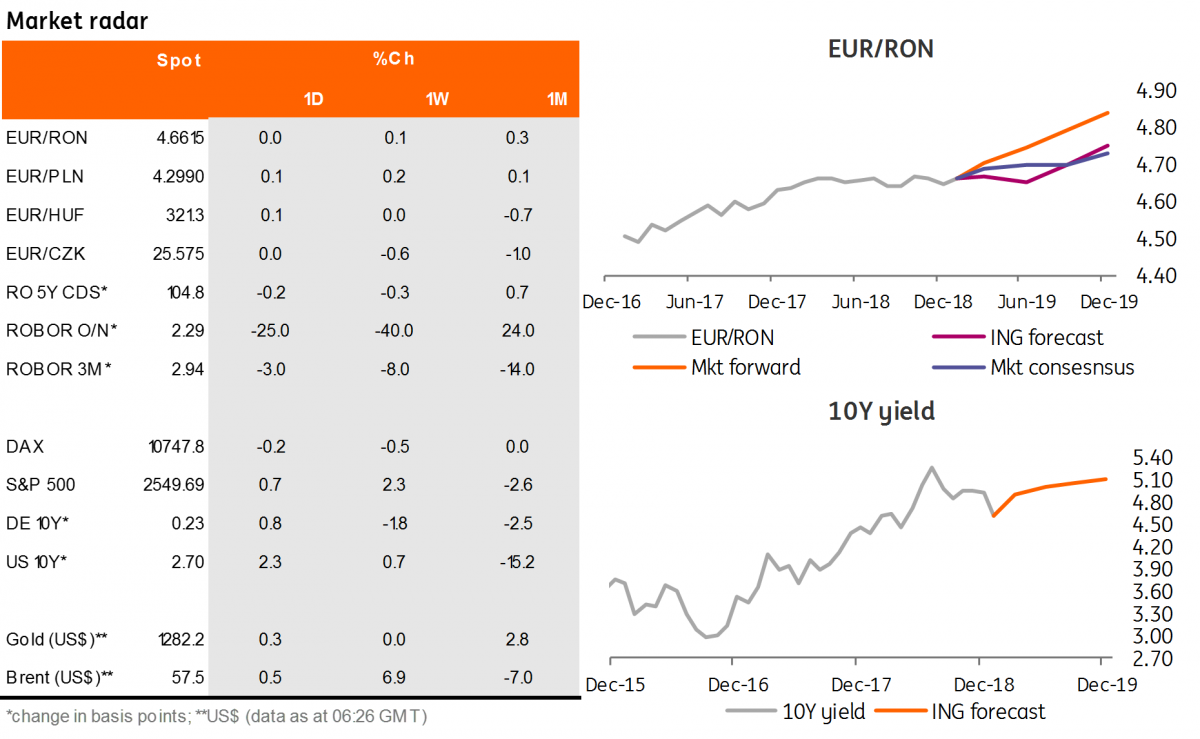

EUR/RON

Low turnover and limited volatility for the EUR/RON yesterday as the market awaits today’s NBR Board meeting. We don’t expect any key rate change but will be watching for remarks about a shift in the comfort range for the EUR/RON.

Government bonds

The accommodative liquidity conditions still allowed for a drop in yields in the front end of the curve which inched 5-6 basis points lower, while the rest of the curve re-priced slightly higher. The October 2021 auction came out well at a 1.34x bid-to-cover ratio. The Ministry of Finance sold the RON400 million planned at 4.04% average and 4.06% maximum. Today the bond market will likely be in wait-and-see mode, hence we expect little trading ahead of the NBR meeting.

Money market

Cash rates continue to trade below the key rate on ample liquidity conditions and we could soon hit the deposit facility of 1.50%. At the last press briefing following the November Board meeting, the NBR Governor Mugur Isarescu suggested that the time for a cut in minimum reserve requirements for RON liabilities is likely approaching as the current liquidity deficit is “quasi-permanent”. Comments along these lines will be carefully scrutinised by the market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap