The Commodities Feed

Your daily roundup of commodities news and ING views

Palladium ETF holdings decline with tight market (k oz)

Energy

US crude oil inventories: The EIA yesterday reported that US crude oil inventories increased by 3.58MMbbls over the last week, broadly in line with the 3.45MMbbls build reported by the API the previous day, but still higher than the 1MMbbls build the market was expecting. This is despite refinery run rates increasing further over the week from 92.7% to 95.6%. Higher refinery run rates also meant that distillate fuel oil inventories increased by 2.61MMbbls over the week, although gasoline saw a small draw of 764Mbbls. Overall the report was fairly bearish for the market, marking a tenth consecutive week of inventory builds, despite refinery run rates above the five-year high for this stage in the year.

Russia on output cuts and refinery activity: Comments from President Putin yesterday only add to the uncertainty over the potential for OPEC+ production cuts in 2019. The President has said that Russia is fine with oil at US$60/bbl, as this is still at levels which ensure the government’s budget remains in surplus. Despite this comment, we are still of the view that OPEC+ will agree to cuts at its meeting in December. And sticking with Russia, Bloomberg reports that just over 400Mbbls/d of Russian refining capacity is offline as of today, a factor which is likely to add further support to an already buoyant fuel oil market.

Metals

Copper disruptions: PT Smelting has declared force majeure at its Gresik smelter in Indonesia and has started diverting concentrate supply to the spot market. The 300kt pa smelter was undergoing maintenance which was scheduled to be completed by the end of November, but has now been delayed by a month. The smelter outage should free up concentrate supply, which should push spot treatment charges higher. Meanwhile, Spence mine in Chile witnessed a few hours of chaos yesterday as BHP announced 57 job cuts. This resulted in workers walking out in protest, although disruptions were short-lived. Finally, a more dovish tone from the US Fed yesterday provided further support to LME Copper, with the market settling 1.3% higher for the day.

Palladium strength: Palladium continues to outperform the precious metals complex, gaining 2.7% yesterday, with spot palladium trading to a record high of US$1,188/oz. Supply deficit fears continue to support palladium. The deficit market has led to increases in lease rates, which has meant significant draws in ETF holdings in order to meet industrial demand. Nearly 515kOz of palladium has been withdrawn from ETF holdings in 2018 year-to-date with total ETF holdings now down to 738kOz.

Agriculture

Egypt delays wheat shipments: Bloomberg reports that Egypt’s General Authority for Supply Commodities (GASC) has asked suppliers to delay wheat shipments, as they are unable to open letters of credit before January. This potentially will have an impact on eight cargoes over December, although it seems suppliers may still be willing to ship without a letter of credit being in place.

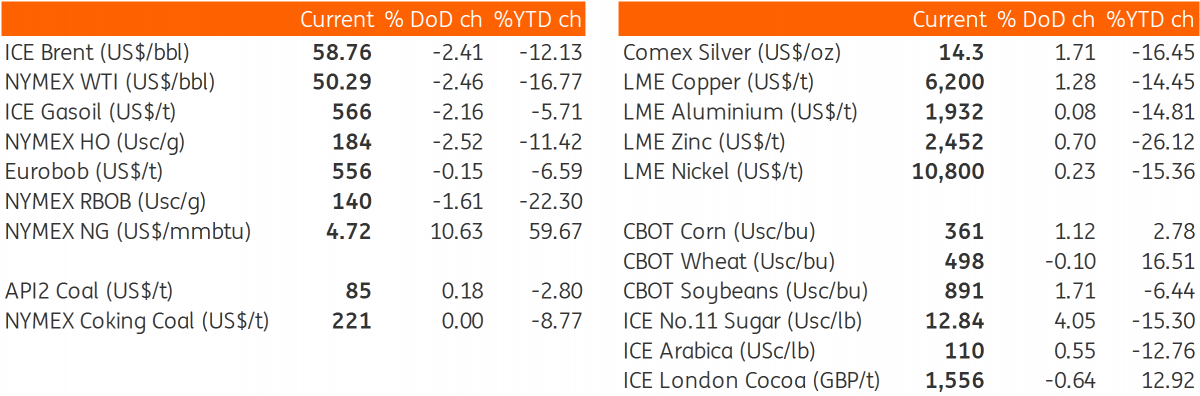

Daily price update