The Commodities Feed

Your daily roundup of commodities news and ING views

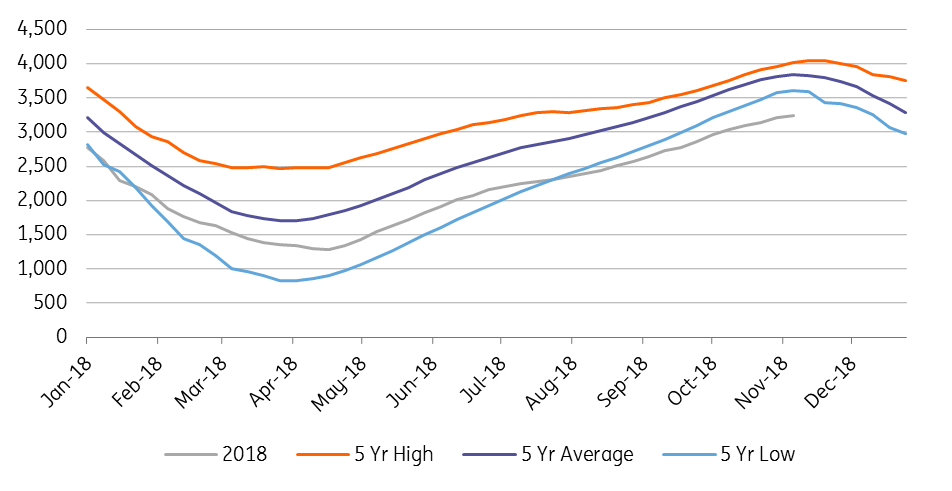

US natural gas inventories remain well below 5 year low (Bcf)

Energy

US crude oil inventories: The EIA yesterday reported that US crude oil inventories increased by 10.27MMbbls over the last week, higher than the 8.78MMbbls reported by the API in the previous day, and significantly higher than the 3.2MMbbls expected by the market. Weekly crude oil production estimates increased by 100Mbbls/d to 11.7MMbbls/d. From a crude oil perspective the report was fairly bearish, however the refined product numbers were more constructive. Gasoline inventories fell by 1.41MMbbls over the week, whilst distillate fuel oil inventories fell by 3.56MMbbls. Product demand, in fact, hit a record high of 22.38MMbbls/d, up 2MMbbls/d WoW. Meanwhile, refinery run rates are yet to show their seasonal pick up following refinery maintenance.

Natural gas volatility: Henry Hub natural gas has had an amazing week, with the market rallying as much as 20% on Wednesday, only to give back all these gains yesterday. A combination of US natural gas inventories being well below the 5-year low as we enter the winter season, and the current cold weather seen over parts of the US has been bullish for sentiment. However, the EIA did release its latest storage data yesterday, which showed a 39Bcf inventory build over the last week, compared to market expectations of a 36Bcf build.

Metals

Copper TCs edge lower: According to media reports, miner Antofagasta and Chinese smelter Jiangxi have agreed on lower treatment and refining charges for 2019. Treatment charges will fall from $82.25/t in 2018 to $80.80/t, whilst refining charges will fall from USc8.225/lb to USc8.08/lb. While a marginal decline in charges, it does highlight both tightening concentrate supply along with growing smelting capacity in China.

Refined zinc deficit: The latest data from the International Lead and Zinc Study Group (ILZSG) shows that the refined zinc market saw a deficit of 305kt over the first nine months of 2018, less than the 398kt deficit reported over the same period last year. This narrowing in the deficit has been driven partly by a ramp-up in mine supply, and with this trend expected to continue into 2019, we expect that deficits moving forward will continue to narrow.

Agriculture

US soybean processing: The latest data from the National Oilseed Processors Association shows that the US processed 172.35m bushels of soybeans over the month of October, up from 164.24m bu for the same month last year, and above market expectations for a 169.63m bu crush. Meanwhile, Bloomberg reports that President Trump will push for a commitment from China to continue buying US soybeans in any trade deal.

Global sugar surplus narrows: The International Sugar Organization (ISO) has lowered its surplus estimate for the current 2018/19 season from 6.7mt to just 2.2mt. The smaller surplus is unsurprisingly driven by weather concerns, with the ISO downgrading their crop estimates for Brazil, the EU and India. Looking further ahead, and to the 2019/20 season, we would expect the global market to return to deficit, with EU farmers likely to reduce 2019 plantings.

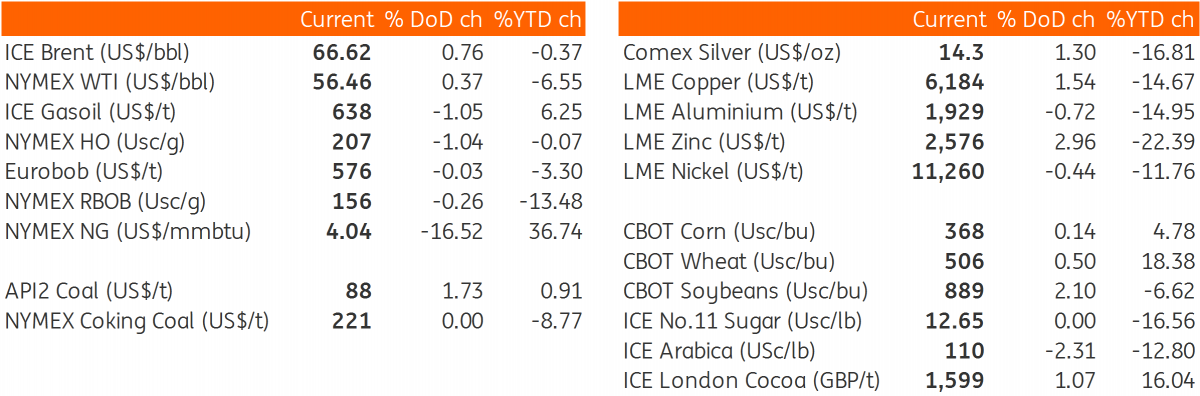

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap