Briefing Romania

Another successful bond auction

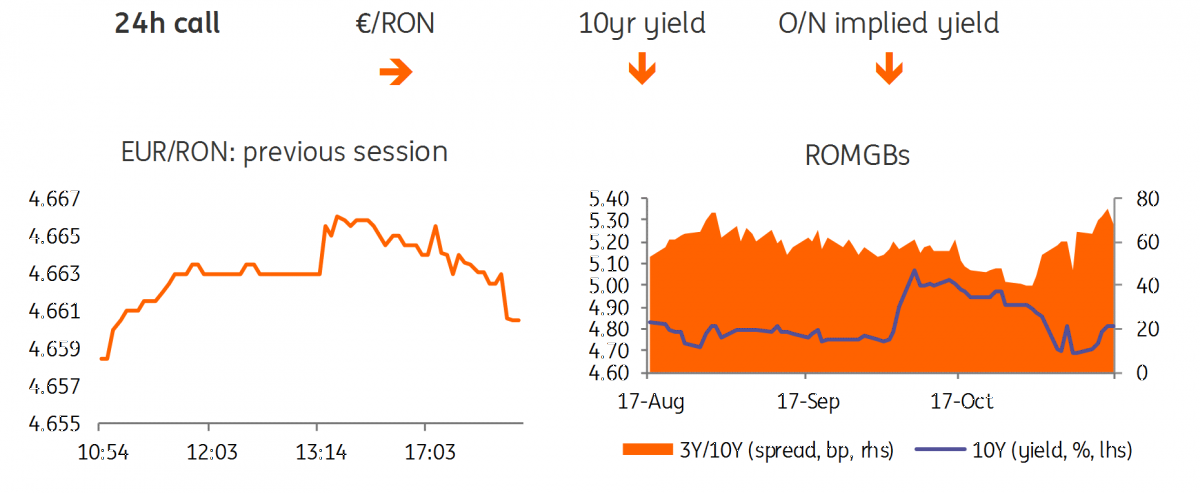

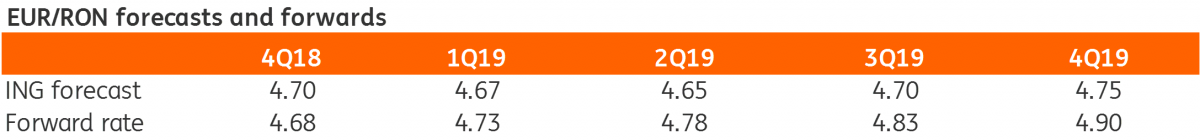

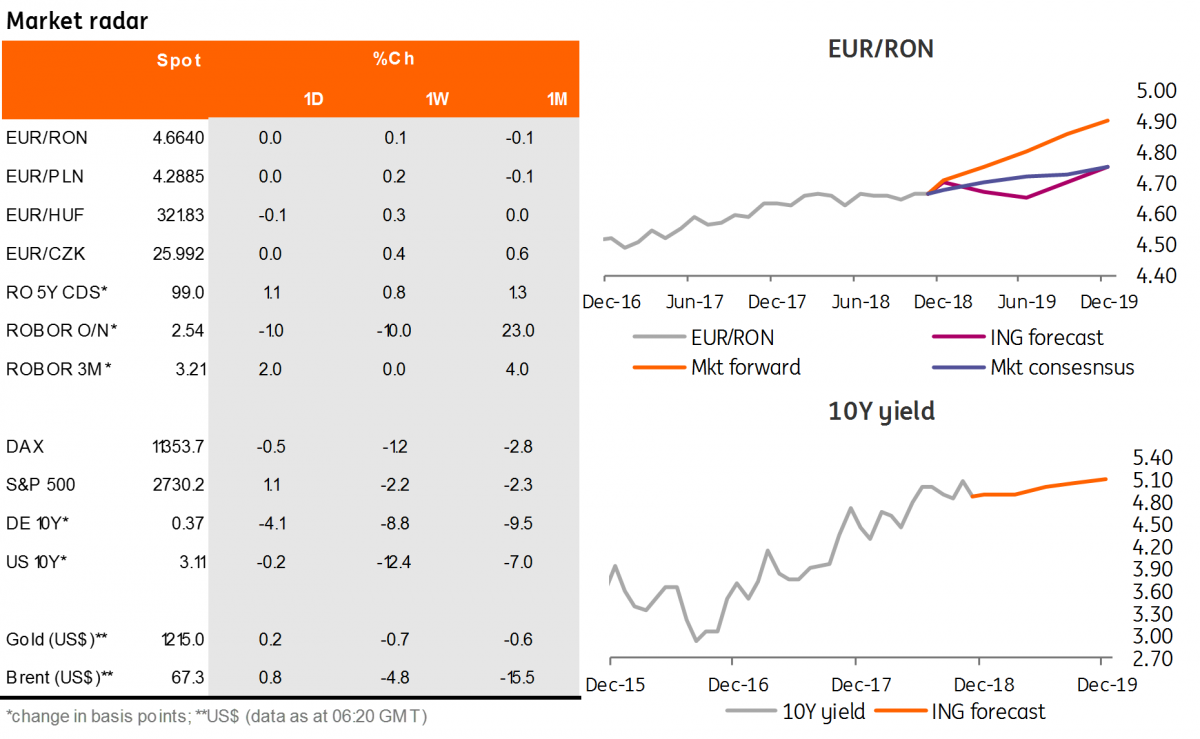

EUR/RON

The Romanian leu weakened throughout yesterday’s trading session, closing the day above 4.6600 and thus returning to its previous 4.6600-4.6700 comfort range. We see the pair stable around these levels though upside pressure could intensify as liquidity is returning to the market via government spending and the upcoming bond redemption.

Government bonds

ROMGBs recovered some of the previous day's losses, with the mid-part of the curve gaining the most and inching some 6 to 8 basis points lower. The June 2023 auction went out broadly in line with expectations. The demand was strong at a 2.25x bid-to-cover and the Ministry of Finance allocated RON644 million, slightly above the initial target, at a 4.52% average and 4.54% maximum yield.

Money Market

Cash rates continue to trade just above the key rate and it looks as though a repo auction will not be needed on Monday. The 1W to 1M curve shifted 15-20 basis points higher as some players likely want to have some protection against the potential volatility caused by the tricky timing of cash flows on the next reserve period. The year-end effect could also start to kick in as banks begin to steer their balance sheet. This could determine further volatility for tenors covering the turn of the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Romania bondsDownload

Download snap