The Commodities Feed

Your daily roundup of commodities news and ING views

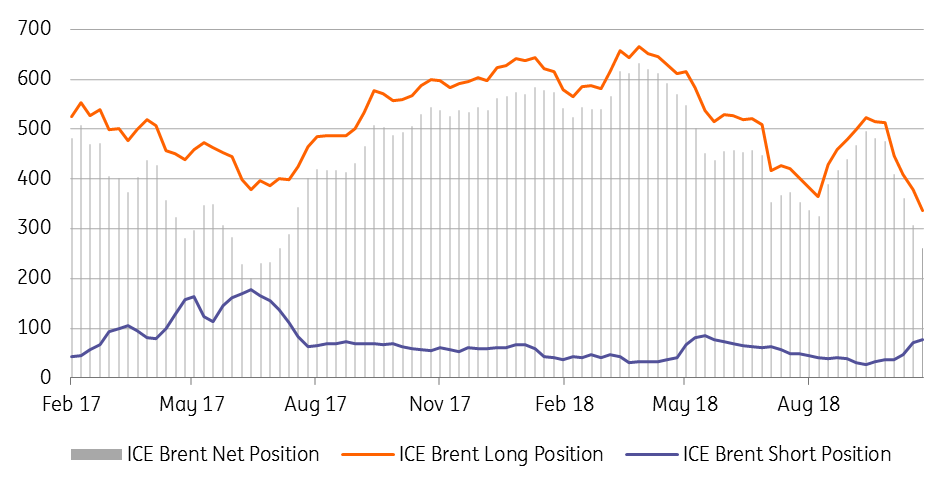

Speculators continue to reduce their net long in ICE Brent (000 lots)

Energy

OPEC JMMC meeting: OPEC members met in Abu Dhabi over the weekend, and heading into the meeting there was plenty of noise that the group could look at potential production cuts- a big change from their recent policy of pumping as much as they can. The group decided against announcing any official cuts, but do appear to be laying the groundwork for an announcement at their semi-annual meeting on the 6 December. They made it clear that the global market is set to be in surplus over 2019, suggesting that action will need to be taken. We believe that if OPEC+ decides on cuts once again, it would initially be for the first six months of 2019, given that this is where our balance sheet shows the bulk of the surplus. For now though, the Saudis have said that they will reduce exports by 500Mbbls/d in December from November levels.

Oil speculative positioning: The latest data shows that speculators continued to reduce their net long in ICE Brent over the last reporting week. Speculators sold 47,064 lots leaving them with a net long of 260,048 lots as of last Tuesday. The bulk of the selling came from longs liquidating, rather than fresh shorts. Meanwhile, there was also heavy speculative selling in NYMEX WTI, with speculators reducing their net long by 35,905 lots to leave them with a net long of 160,291 lots.

Metals

Speculators reduce copper shorts: CFTC data shows that speculators bought 12,213 lots in COMEX copper over the last reporting week to leave them with a net short of 2,200 lots. Speculators have largely held a net short in COMEX copper since early July, with concerns over what the impact from an escalating trade war between China and the US would be. However, copper fundamentals remain constructive. Whilst Chinese copper premiums have come off somewhat recently they still stand at US$100/t. Meanwhile, LME copper inventories still remain fairly tight, despite the spike higher in stock levels in early November. Finally, the LME cash/3M spread remains firmly in backwardation, suggesting tightness in the spot market.

Agriculture

Sugar speculative positioning: The latest CFTC data shows that speculators reduced their net long in No.11 sugar by 12,695 lots over the last reporting week, leaving them with a net long of 68,683 lots. Sugar in recent weeks saw a significant pick up in speculative interest, with speculators switching from a net short of over 100k lots in early October to a net long of almost 82k lots at the end of October. This buying was driven by concerns over a smaller EU crop, whilst Indian output appears as though it will be smaller than initially thought. However despite these revisions lower, the global market is still set to be in surplus over the 2018/19 season.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap