BriefING Romania

New 7-year benchmark auctioned today

EUR/RON

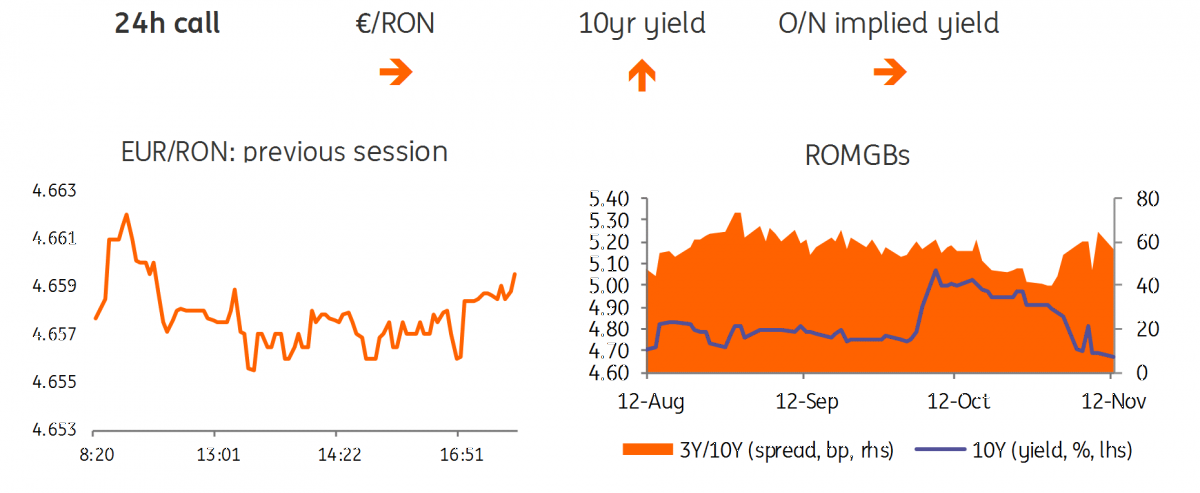

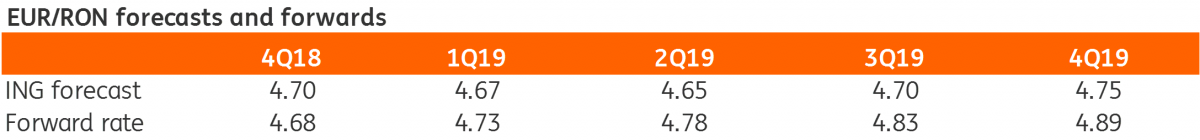

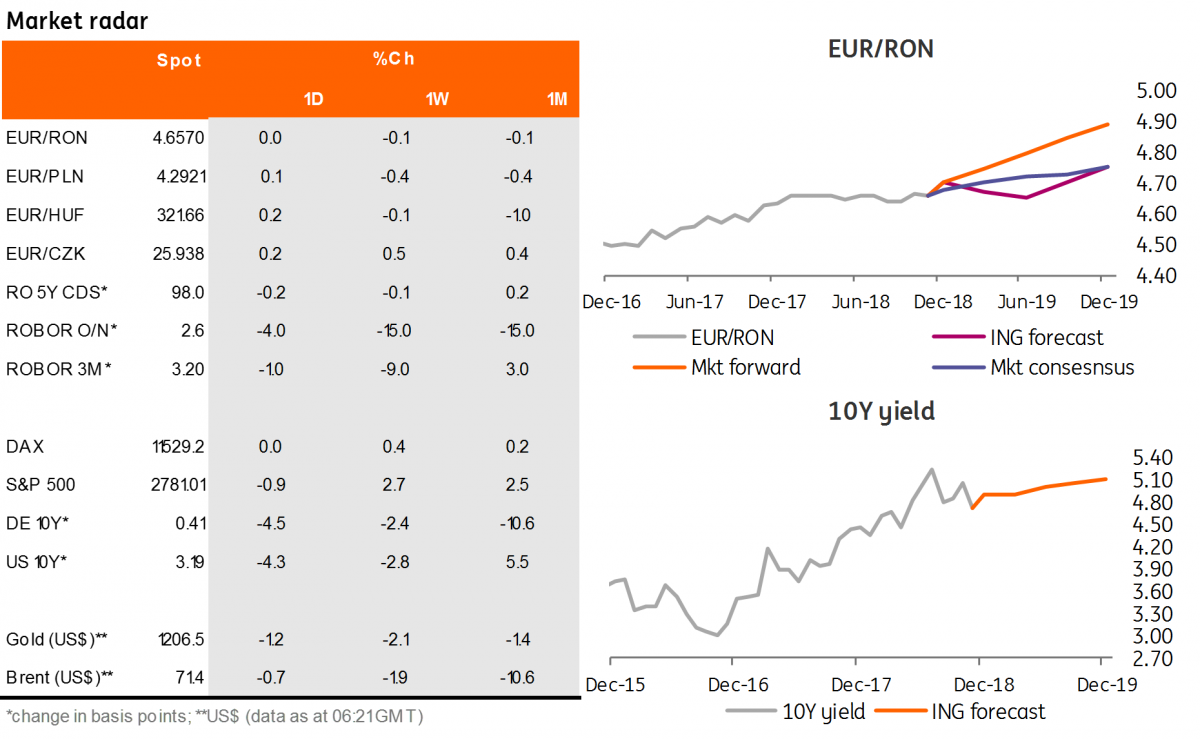

The EUR/RON swung around 4.6570 on Friday on somewhat better volumes and closed the day marginally higher but still below the 4.6600 level. We see the pair remaining below 4.6600 today on slightly improved global risk sentiment.

Government bonds

The buying interest for ROMGBs extended into Friday's session and pushed the yield curve some 3-4 basis points lower. Today, the Ministry of Finance auctions a new ISIN, targeting RON400 million with a maturity of April 2026. We should see decent demand given the latest pattern in primary market auctions, though today’s inflation data could deter some players or at least push the required yield a touch higher, in the 4.68-4.70% area.

Money Market

The money market curve closed virtually flat on Friday with most players focused on filling their day-too-day balances. While a repo auction today would probably calm rates for the next two weeks, it might not be really necessary as monthly government spending is finding its way into banks' liquidity positions.

The week ahead

For the week ahead, US core inflation should remain above the Federal Reserve's 2% target, and we expect it to stay like that as firms look to pass on higher wage costs. These positive fundamentals, combined to some extent with the additional tailwind of earlier tax cuts, should make for another decent set of retail sales figures next week.

The second estimate of eurozone GDP, including most of the country estimates, will be released on Wednesday. With September industrial production data out as well, we should have a rather complete picture of how poor the performance has actually been.

In Romania, the 3Q18 GDP print should be less positive for the government, as it's likely to confirm that even the updated official growth forecast is over-optimistic. We expect GDP growth to slow down to 3.0% year-on-year - mainly on base effects. On the monetary policy front, it will be interesting to see if there are any signs of cracks in the unanimity of the central bank given that Governor Mugur Isarescu's dovish tone was in stark contrast to Deputy Governor Liviu Voinea's hawkish message less than a month ago. The EUR/RON is unlikely to break away this week from the 4.6500-4.6700 seen since early October.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap