The Commodities Feed

Your daily roundup of commodities news and ING views

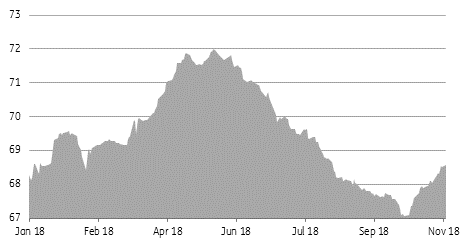

Total known gold ETF holdings (Moz)

Energy

Waivers on Iranian oil: Yesterday, the US announced that the eight countries which have received waivers on Iranian oil imports include, China, India, Italy, Greece, Japan, South Korea, Taiwan and Turkey. According to Bloomberg ship tracking data, these destinations took a total of 1.32MMbbls/d over the month of October, representing 75% of total Iranian exports. This data, however, does not pick up tankers which have turned off transponders. The waivers given by the US are set to last for 180 days.

US oil data: The API is scheduled to release weekly inventory data later today, with market expectations that US crude oil inventories increased by 2MMbbls, according to a Bloomberg survey. An increase this week, which is confirmed by the EIA tomorrow would be the seventh consecutive US crude oil build. Meanwhile, the EIA is scheduled to release its latest Short-Term Energy Outlook today, and following the stronger than expected production levels over August, there is the potential for upward revisions to their 2018 production forecast. Last month, the EIA forecast US oil output would average 10.7MMbbls/d in 2018, and 11.8MMbbls/d in 2019.

Metals

BHP’s rail operations suspended: A derailment of one of BHP’s iron ore trains in Western Australia has led to the suspension of rail operations between mines and Port Hedland. The company expects that it will take around a week for rail operations to return to normal, and that inventories at Port Hedland will be drawn down over the period, which should limit the impact. However, a longer-than-expected suspension is certainly an upside risk for iron ore prices.

Gold ETF purchases: Investors have continued to flock towards precious metals, with total known gold ETF holdings rising by 63kOz yesterday. In fact over the past month, investors have increased their holdings in gold ETFs by more than 1.5mOz. Meanwhile over the last reporting week, speculators increased their net short by 18,723 lots, leaving them with a net short of 45,622 lots. Given the recent run-up in gold prices, this selling likely reflects profit-taking.

Agriculture

US export inspections: The latest data from the USDA shows that 1.25mt of corn was inspected over the last week, up from 699kt in the previous week, and significantly higher than the 457kt inspected over the same period last year. This takes total corn export inspections to 9.9mt so far this season, up from 5.6mt over the same period last season. Meanwhile, soybean export inspections totalled 1.23mt over the week (including 68kt for China), down from 1.33mt in the previous, and considerably lower than the 2.49mt seen in the same week last year. Cumulative soybean inspections so far this season total 8.58mt, down from 14.87mt at the same stage last season. Meanwhile, the USDA also released its latest crop progress report, which showed that 76% of the US corn crop has been harvested, whilst 83% of the soybean crop has been harvested- both broadly in line with expectations.

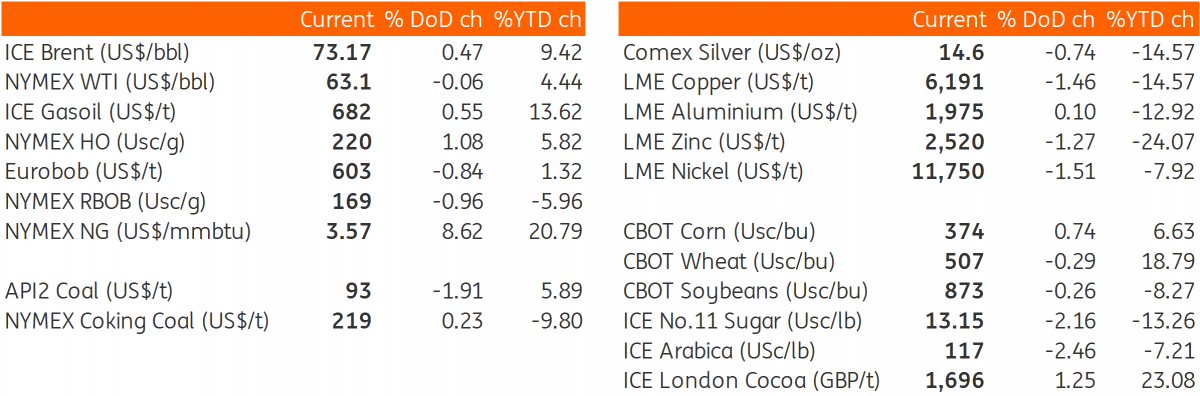

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap