BriefING Romania

NBR rate decision, no change expected

EUR/RON

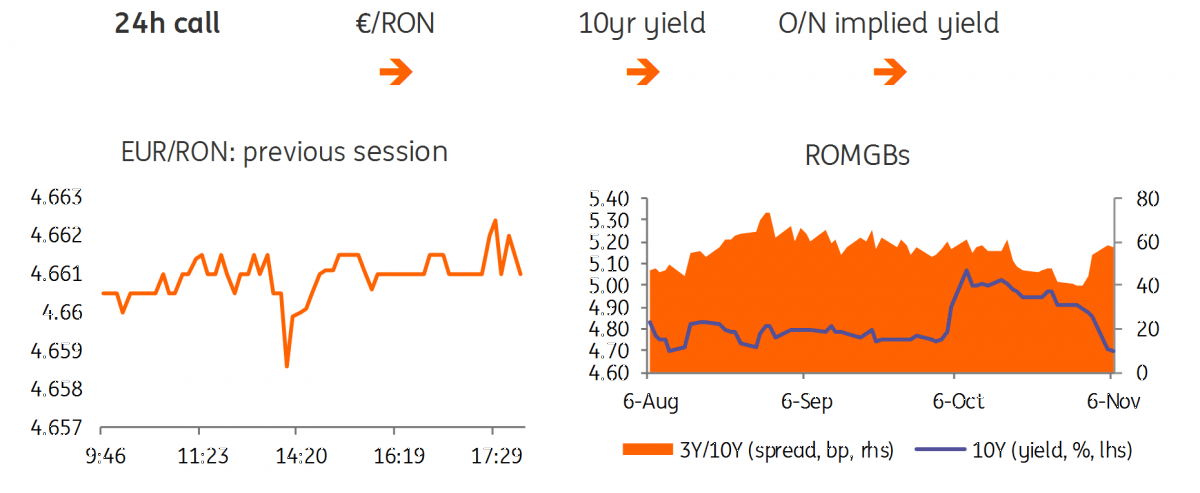

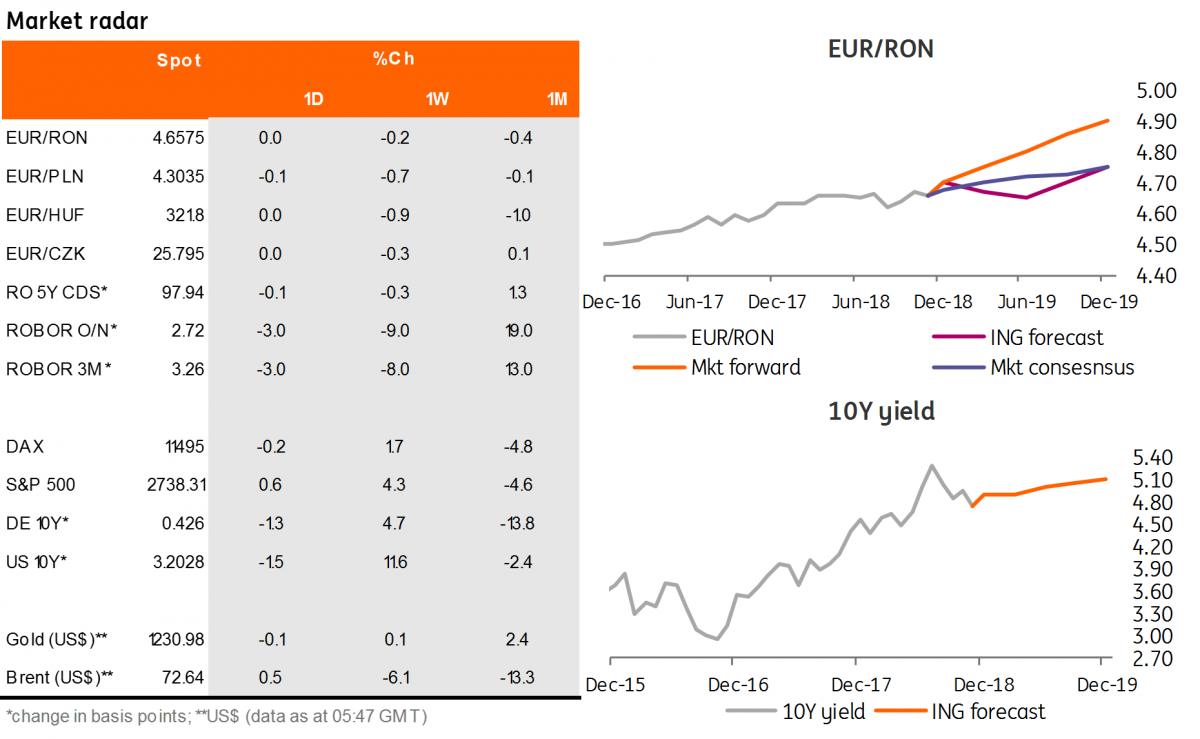

The EUR/RON traded quietly just above 4,6600 yesterday, with a brief test below just after the fixing time. For today, we will probably see some range trading ahead of the National Bank of Romania's (NBR) key rate decision.

Government bonds

ROMGBs continued to rally yesterday in an aggressive bull flattening move. The yield curve shifted lower by 5 to 15 basis points, with the back end posting biggest drops. The very strong April 2024 bond auction gave a fillip to the rally. The Ministry of Finance upsized the amount from RON300 million to RON365 million on strong demand (bid-to-cover ratio at 4.4x) which pushed yields below our expectations, printing an average/cut-off of 4.66%/4.67%. The market will likely be in wait-and-see mode ahead of the NBR meeting today. Though largely expected, no change in interest rates could still be mildly positive for ROMGBs. MinFin auctions today EUR150 million in 5Y EUR-denominated domestic market bonds, an instrument used by banks to park their surplus hard currency and by MinFin to diversify its financing sources.

Money Market

The NBR rolled over its one week repo yesterday, with 11 banks taking RON12.3 billion. This is below the RON16.7 billion injected last week, but still above our expectations. The cash rates inched lower towards 2.70% and should trade around the key rate in the coming days. The central bank's Monthly Bulletin showed that the October daily average liquidity deficit for the banking system decreased by c.RON0.7 billion to RON3.25 billion.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap