Czech retail sales disappoint in September

September retail sales slowed down to 1.4% - the weakest print in a year and a half. Still, some one-offs could be in place, making the weak figure less worrying

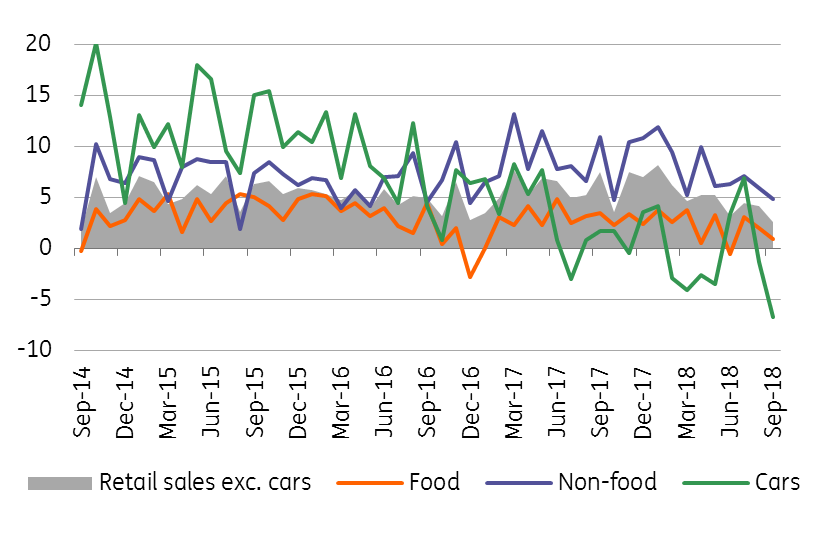

Retail sales slowed down both for food and non-food items

Retail sales (excluding cars) increased by just 1.4% year on year in September, which is quite a disappointment given the market expectations of 3.0% YoY growth. If we take into account the negative calendar bias, sales increased by 2.5% YoY, but still below the year-to-date average growth of 5%.

Closer analysis suggests that growth in both food and non-food goods slowed down. Food prices even slightly decreased year on year, by 0.9% and sales of non-food products grew by just 3.1% after more than 7% this year (taking into account working day bias, the numbers are slightly better, still below average growth, +0.9 %, and 5.1%).

Sales of clothing and footwear recorded a solid decrease in September (-2.8% YoY vs 6% one-year average annual growth), quite surprisingly.

Weaker car sales were a result of new emission rules

Sales of cars are facing problems with new emission standards since September that have curbed sales of a number of models in recent months. New car registrations fell by 20-30% across the EU in September. As a result, total car sales in September in the Czech economy fell by 10% YoY, but this was the expected development. For the time being, however, it is not entirely clear how long the problem with car emissions might last.

Retail sales in the main segments (% YoY, adjusted for working days)

But there are a few one-offs at play

Retail sales without cars disappointed in September.

However, we still believe, that some one-offs could be behind this particular weak number. For example sales of clothing and footwear fell due to the very strong base from the last year. Also, the September month was particularly cold, which accelerated the sales of autumn assortments as cloth sales increased by 25% YoY last September but also because it accelerated seasonal discounts for the summer clothes too. Food sales could be impacted by the different distribution of holidays in September.

Retail sales should remain solid, but expect a slowdown in annual terms

Despite the weaker figure today, we still believe that total retail sales might be gradually slowing down due to a high base. However, this is natural, as mainly more durable goods demand should be saturated after some time of favourable economic growth.

This means that after the 8% growth in retail sales last year, the year-on-year dynamics should slow-down closer to 5-6% annual growth, being more consistent with expected real wage developments in the Czech economy in forthcoming two years. Still, given the strong wage growth and overheated labour market, households' consumption will remain a major growth factor of the Czech economy this and next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap