The Commodities Feed

Your daily roundup of commodities news and ING views

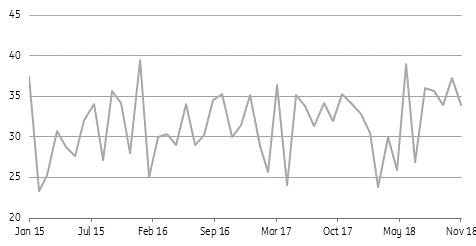

Brazil iron ore exports (m tonnes)

Energy

OPEC+ cuts: This week the market is going to be fully focused on developments at OPEC+ meetings in Vienna. Expectations for a cut are building, particularly after comments from Russian President Vladimir Putin at the G-20 summit over the weekend. The issue now is how much will the group cut. There were media reports yesterday that Russia was willing to cut output by a maximum of 150Mbbls/d, which if the case, will make it more difficult for group cuts to exceed 1MMbbls/d, and so likely that Saudi Arabia will have to make the bulk of the cuts. What does help OPEC+ is the fact that they are going into meetings knowing that Canadian output will be cut by 325Mbbls/d, and so this is something that they will certainly factor into their cuts, and what it means for the global balance.

US crude oil inventories: The API is scheduled to release its weekly inventory numbers later today, and the market is expecting that US crude oil inventories fell by 2.25MMbbls over the last week. If this is the case, and confirmed by the EIA later in the week, it will be the first crude oil draw since mid-September. Meanwhile, market expectations at the moment are for builds of around 2MMbbls in both gasoline and distillate fuel oil inventories. Finally, the EIA has delayed the release of its weekly petroleum report until Thursday, with Wednesday a national day of mourning following the death of George H.W. Bush.

Metals

Brazil iron ore exports: Iron ore exports from Brazil fell 8.7% month-on-month (-0.5% YoY) to 34mt in November, while year-to-date exports are up 0.5% year-on-year to total 352.6mt. Recent pressure on Chinese steel margins and ongoing winter cuts are likely to weigh on Chinese iron ore demand in the coming months. As Chinese margins fall, this should also weigh on the premium for higher quality ores. On the other hand, Vale reported that its iron ore production increased 10.3% YoY (+8.5% QoQ) to 104.9mt in 3Q18, and the company is on track to produce 390mt in 2018 as the ramp up at S11D continues.

Codelco mine protests: Mine workers at the Radomiro Tomic copper mine protested yesterday morning against gender discrimination and job cuts. The protests ended soon after without any loss of production. Last week, BHP’s Spence mine also saw similar protests for a few hours, though no production loss was reported.

Agriculture

Chinese soybean imports: China’s National Grain and Oils Information Center expects that Chinese imports of soybeans will total just 84mt in the 2018/19 season, down 10.1mt from the previous season. The Center is expecting a reduction in imports as a result of an outbreak of African swine fever in the country, which has led to the culling of domestic hogs. Last data suggests that 600,000 hogs were culled, however this is only 0.2% of total hogs in the country.

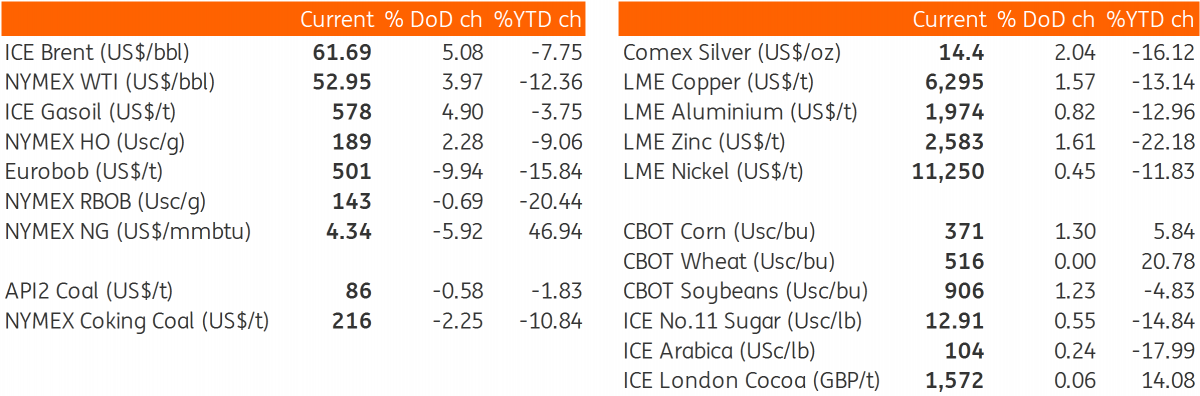

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap