Stalling imports widen Indonesia’s trade surplus

Indonesia’s trade surplus has widened, but at the expense of important consumer and raw materials imports

| -18.4% |

YoY change in imports |

| Worse than expected | |

Exports and imports fall sharply in June

Indonesia’s exports and imports contracted sharply in June, with imports suffering a much more pronounced drop of 18.4% year-on-year. Exports were expected to slip 17.8% but fell 21.2% YoY due to the slide in global commodity prices. Meanwhile, inbound shipments were forecast to edge lower by 4.2% YoY, only to plunge by 18.4% with both consumer and raw materials imports falling by 6.6% YoY and 23.8% YoY respectively.

One key factor for Indonesia’s export sector has been China’s recent performance, which appears to be impacting trade between the two economies. Non-oil exports to China fell 9.9% YoY, while imports from mainland China dropped 20.6% YoY for the same period.

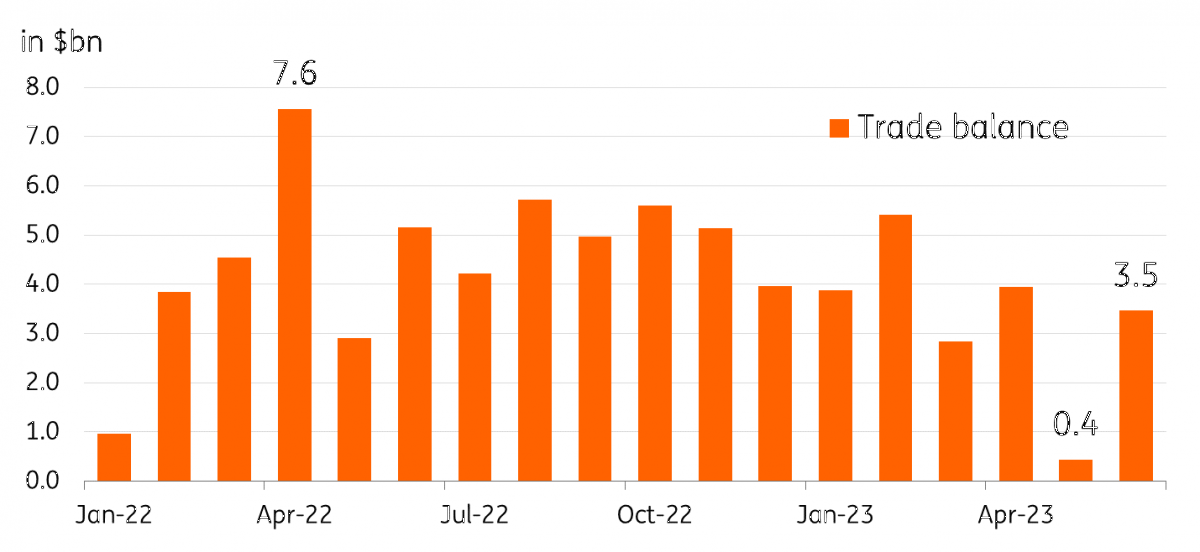

With the performance of exports and imports in June, the overall trade balance widened to $3.5bn, recovering from $0.44bn in the previous month. The trade surplus had been a key support for the IDR in 2022 after the balance hit a high of $7.6bn in April of last year. Since then, the trade surplus has narrowed to more normal levels and will likely be a key contributor to the stability of the IDR in the coming months

Trade surplus widens but remains much lower than 2022 peak

Import trends could point to slowing growth momentum

The widening of the trade surplus back to more comfortable levels may have been a welcome development, but the improvement could have come at the expense of growth momentum. The stark drop in imports was driven largely by slower inbound shipments of consumer goods and raw materials. The 6.6% YoY fall in consumer imports could signal waning household spending even after inflation slipped back within target. The substantial slowdown in raw materials imports may point to slower growth momentum in the coming months as well.

We are retaining our 4.7% YoY full-year growth for Indonesia for now, but we may need to revisit this outlook should consumer spending show more signs of moderating.