Good news on UK inflation bolsters chances of a 25bp August hike

UK inflation fell more than expected in June, owing in part to an encouraging decline in service-sector CPI. The August Bank of England meeting is going to be a close call, but we think this latest data makes a 25bp hike more likely than a repeat 50bp increase

Finally, we have some good news on UK inflation. Headline CPI has dropped back to 7.9%, below consensus and almost a full percentage point lower than in May. Much of that can be put down to petrol and diesel prices, which fell by 2.6% across the month – a stark difference to the same period last year, where we saw a near-10% spike amid the ongoing fallout of the Ukraine war. But encouragingly, we also saw a marked slowdown in food inflation.

These prices increased by 0.4% on the month, which looks like the slowest month-on-month increase since early 2022. This is a trend that should continue, given that producer prices for food products are now falling on a three-month annualised (and seasonally-adjusted) basis, as the chart below shows.

Producer prices point to further improvements in food inflation

The good news continues for services

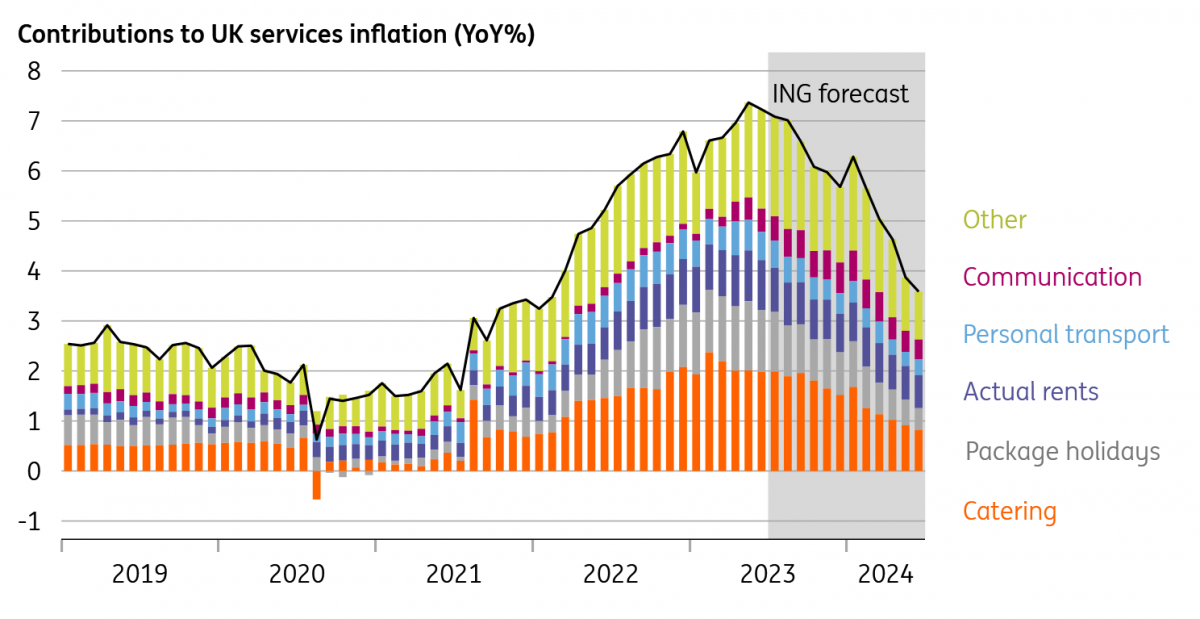

What matters most to the Bank of England is services inflation, and the good news continues here too. Service-sector CPI slipped back from 7.4% to 7.2%, contrary to both the Bank of England’s and our own forecasts for this to remain unchanged in the near term. As always, we caution that one month doesn’t make a trend, but our expectation is that services inflation should gradually nudge lower through the remainder of this year.

While stubbornly high wage growth will ensure that the journey back towards target is a long one, surveys have shown that price rises among service-sector firms (most notably hospitality) can be traced in large part back to higher energy prices. Now that gas prices are dramatically lower, the impetus for firms to continue to raise prices quite as aggressively should fade. Indeed, the proportion of hospitality firms expecting to raise prices over the next few months has tumbled from 46% in April to 26% now, according to ONS survey data.

Has UK services inflation finally peaked?

All in all, we now expect headline inflation to dip back to 6.6% in July, owing to the near-20% fall in household energy prices. Core inflation should slip back to roughly the same level too.

Is this enough to convince the Bank of England to opt for a 25bp rate hike in August? We think it probably will – but it's going to be a close call. The Bank will also be looking at the recent wage data, which was stronger than expected but came alongside figures showing a renewed cooling in the jobs market and improvements in worker supply. The risk is that the BoE applies a similar logic to that seen in June. This could mean that if it expects to hike again in September, then it might as well opt for a larger 50bp hike in August. We certainly wouldn’t rule this out.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap