Singapore exports maintain double-digit decline in 2Q

Data foreshadows a continued slowdown in manufacturing and GDP growth in the current quarter, making it increasingly difficult for the central bank to maintain its tighter policy stance

| -10% |

NODX decline in AprilYear-on-year |

| Worse than expected | |

Yet another disappointing export result

Singapore’s non-oil domestic exports (NODX) posted a steeper-than-consensus 10% year-on-year fall in April, though the outcome was pretty close to our more bearish view. The consensus estimate was a 4.6% fall and we were at 12%, on top of an 11.8% fall in March.

Electronics exports remained a weak spot with a 16% fall led by semiconductors (-21%). However, non-electronics shipments also contracted for the second straight month by over 7%, making it a broad-based export weakness.

Data foreshadows a continued slowdown in manufacturing and GDP growth in the current quarter. Look out for industrial production data next week.

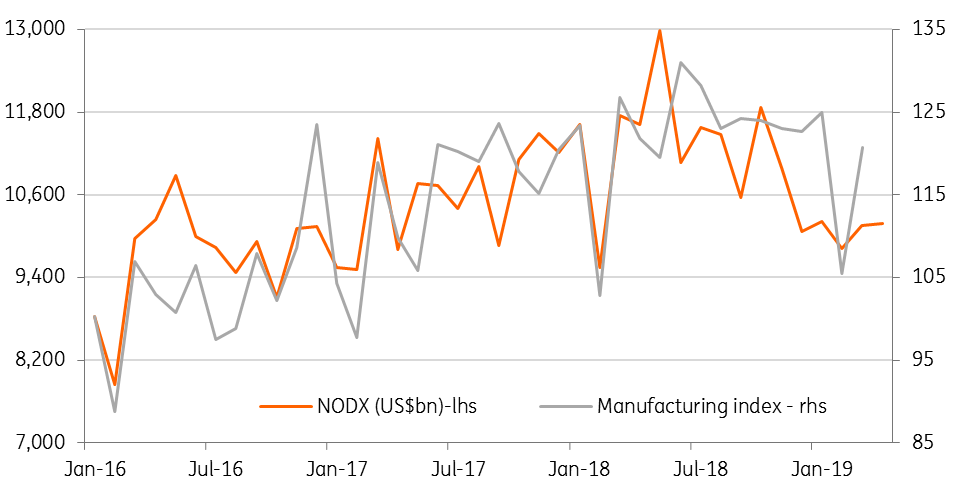

Exports drive manufacturing - the trend remains on downward

Weak activity calls for easier monetary policy

Singapore is among the front-line Asian economies to face the brunt of the recent escalation of trade tensions between the US and China. A steeper manufacturing contraction driving a GDP slowdown in the first quarter of 2019 bore out the adverse impact of the deteriorating external environment. With trade tensions moving to the next level of more and higher tariff barriers things could get even worse from here on.

Such a state of affairs will make it increasingly difficult for the Monetary Authority of Singapore, the central bank, to sustain its tightening monetary policy bias going forward. Indeed, the MAS paused tightening in the last policy review in April. We think the odds of MAS scaling back part of the tightening moves in 2018 are on the rise.

Download

Download snap20 May 2019

What’s happening in Australia and around the world? This bundle contains {bundle_entries}{/bundle_entries} articles