Russia keeps accumulating foreign assets

April balance of payments confirms the corporate preference to convert export proceeds into international assets, making foreign inflows into local state bonds the only support factor for the ruble exchange rate

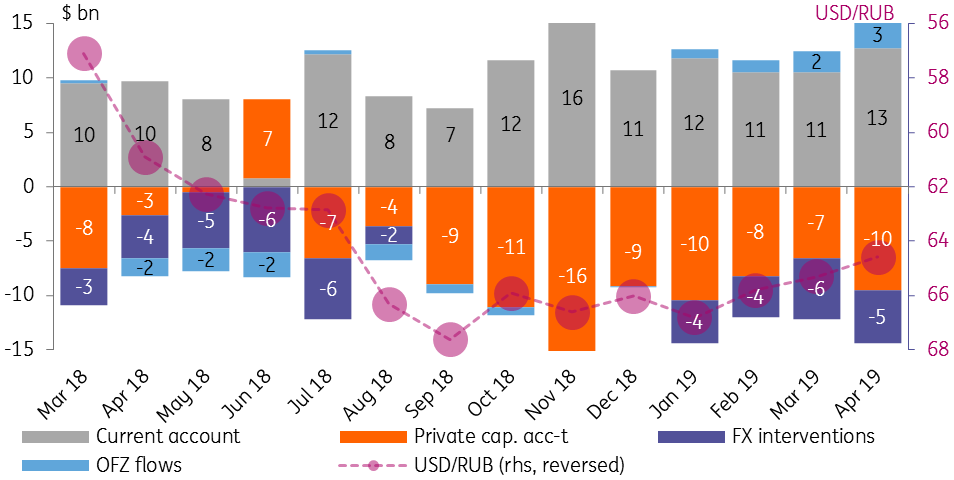

Preliminary balance of payments (BoP) data released by the Bank of Russia (CBR) indicates a 4M19 current account surplus of US$45.5 billion and net private capital outflow (reflecting the accumulation of foreign assets) of US$39.4bn. In addition, c.US$18bn of FX was purchased by the CBR over that period to fulfil the budget rule.

On a monthly basis, April brought an increase in both the current account surplus (to US$12.7bn from US$10.5bn a month earlier) and net private capital outflow (to US$9.5bn from US$6.6bn). Combined with a persisting US$5-6bn monthly FX purchase by the CBR, the current account is routinely channelled into an accumulation of foreign assets, which is more or less neutral for the ruble exchange rate.

The key reason for the appreciation in the local currency YTD has been the mounting inflow of foreign portfolio investment into local state bonds (OFZ). According to the latest data, this inflow accelerated from US$1-2bn per month in January-February to US$2bn in March and over US$2.5bn in April thanks to the improvement in the global EM risk appetite and no negative developments on the Russia-specific risk perception.

Monthly balance of payments and USDRUB

Going forward, we expect the monthly current account surplus to decline due to both seasonality and the outages in the Druzhba pipeline throughput. The latter, according to our estimates, could have a negative short-term impact on the export revenues within US$2bn. This should not cause an immediate negative impact on the RUB exchange rate, as the accumulation of foreign assets should be cut accordingly.

Given the planned US$5.4bn FX purchases by the CBR in May, the current account surplus will remain fully sterilized by the CBR and the private sector outflow, and the RUB exchange rate will remain dependent on the OFZ flow. The near-term trend appears favourable, with preliminary data on auctions hinting that another US$2bn foreign inflow is possible in May. However, in the longer term, we still consider the ruble to be vulnerable to global market volatility and adverse BoP seasonality related to the approaching dividend season in June.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap