Serbia’s central bank should surprise again

We look for a highly non-consensus 25 basis point cut from the National Bank of Serbia mainly due to the benign inflation outlook and pressures from the Serbian dinar's appreciation, which has triggered FX interventions

First of all, we acknowledge that there are serious risks to our call, stemming mainly from the international context to which the NBS pays great attention. Only two (us included) out of 25 analysts surveyed by Bloomberg are looking for a cut, with the rest expecting rates to stay on hold. Financial market developments, movements in global primary commodity prices, Fed and ECB diverging policies and EUR/USD movements all urge caution in the conduct of monetary policy. In a regional context, most of the central banks seem to have taken a long pause in the easing cycle or even embarked on hiking rates as is the case in Romania and the Czech Republic. Add to this previous rate cuts which have yet to be fully passed through and we have material reasons for the NBS to justify a wait-and-see stance at the 10 May meeting.

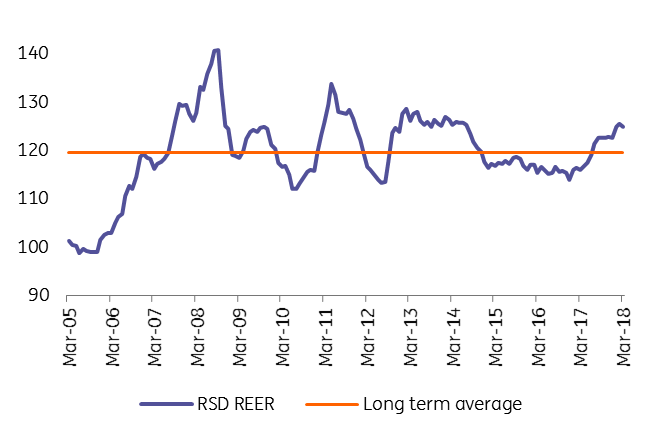

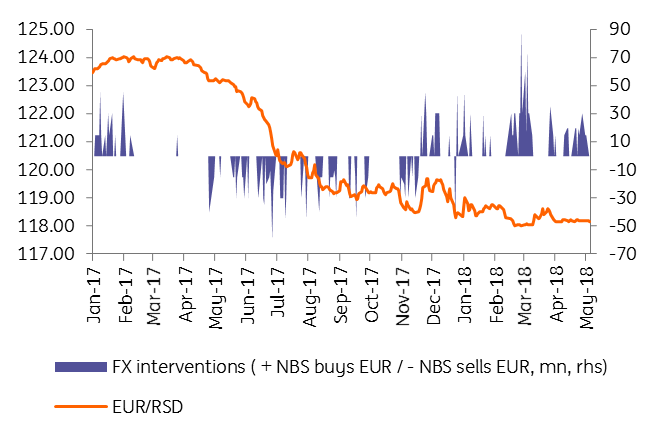

Nevertheless, we believe that the Executive Board of the NBS will once more tilt the risk balance towards giving more consideration to internal factors, such as inflation and dinar (RSD) strength. We base our view on the benign inflation outlook, which printed 1.4% year-on-year in March with core inflation decelerating to 0.8%, “its lowest level since inflation has been measured by the consumer price index,” according to the NBS press release, which added that “inflation will stay around the current level in the coming months”. As for the exchange rate, the FX interventions continued to be one-sided: to curb RSD strengthening pressure, as the real effective exchange rate (REER) shows some overshooting. Hence, we see that the NBS has another window of opportunity to cut the rates and give a boost to dinar lending.

RSD real effective exchange rate

NBS interventions

As mentioned, prudence is still warranted so an eventual rate cut could again be partially offset by a further narrowing of the standing facilities corridor to ±1ppt from ±1.25ppt, thus leaving market interest rates broadly unchanged.