Hungary: Industry disappoints once again

Industrial production posted another weak performance at the end of the first quarter. The significant working-day effect suggests capacity constraints

| 1.9% |

Industrial production (YoY wda)Consensus (3.0%) / Previous (4.1%) |

| Worse than expected | |

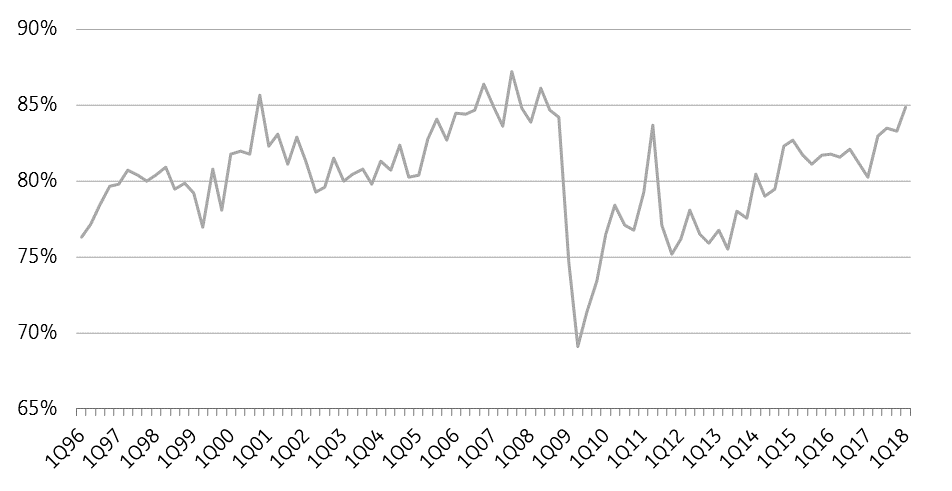

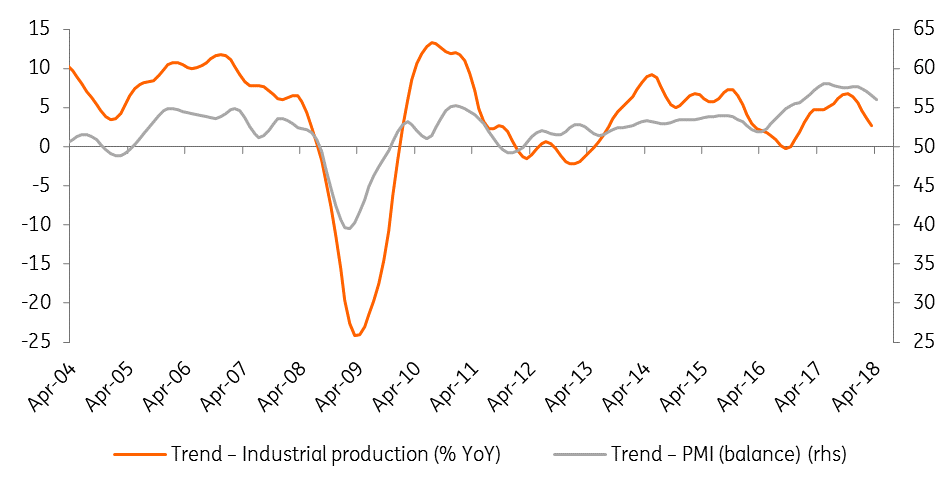

Industrial production – based on working-day adjusted data – rose by 1.9% YoY in March, posting a negative surprise to the market and even to the pessimistic expectations. When we consider the raw data, industrial output declined by 2.4% YoY due to last year’s high base. The significant difference between the raw and the adjusted data is due to the fact that there were two fewer working days in March 2018 than in March 2017. It also suggests that companies are facing capacity constraints, producing with a high capacity utilisation (84.9% in 1Q18, the highest level since 2008).

Capacity utilisation reaches a 10-year high level

In the details, the Hungarian Central Statistical Office (HCSO) commented on the data, which can give us a clue as to what caused the higher-than-expected slowdown in March. First of all, machinery output showed a significant contraction after outperforming a year ago, but other industries also posted weak performances. The only silver lining was the energy sector due to the colder weather.

Both PMI and industrial output shows a trend-like drop

The big picture

Despite the rather weak industrial performance in the first quarter, which was more-or-less expected, the retail sector surprised on the upside, and thus the risks are rather skewed on the upside when it comes to our 3.8% YoY GDP forecast for 1Q18.

Download

Download snap