Russian ruble: resurgence of FX purchases is not the biggest threat

Russia announced surprisingly high FX purchases of $1.4bn for January after 10 consecutive months of sales. This is a reflection of higher oil revenues and should be neutral for the market at this point. The capital account, including foreign portfolio flows and local capital outflows, are a bigger concern than the current account and its sterilisation

Russia's central bank will buy $1.4bn of FX on the local market this month as a part of a budget rule, which is a material change from the $1.9bn of sales seen last month (Figure 1). This will be the first month of purchases since February 2020, and the volume is a surprise to the market, which expected $0.2bn of sales, according to the Reuters consensus, and to us (we expected zero intervention). Starting this month, the Finance Ministry's announcement, which in reality represents an off-market transaction with the Bank of Russia, will be fully channelled into the FX market by the CBR, as all the residual FX sales related to the one-off SBER transfer deal were completed last year.

We do not see this particular piece of news as necessarily negative for the ruble, as the purchases mirror rapidly improving oil exports and therefore higher oil revenue collection for the budget. Around $0.4bn of the purchases reflect the upward revision of December oil revenues and another $1.0bn is due to expectations of further improvement in January amid the oil price surge and higher volumes allowed to Russia by OPEC+. Those purchases are currently lagging behind the improvement in the current account, which under current oil prices could reach an $8bn surplus in January, and therefore should not trigger depreciation. Overall, assuming the oil price this year performs in line with ING's energy outlook, the extra fuel revenues of the Russian budget could reach RUB700-800bn this year, or around $10bn, meaning that CBR intervention will be sterilising only 20-25% of the expected current account surplus.

On a side-note, the return of FX purchases should be positive for RUB liquidity, which was routinely drained by the CBR intervention in the previous year, as net FX sales totalled $11bn last year, including $21bn in March-December 2020, or RUB 1.6tr, contributing to the overall RUB3.6tr drop in the banking sector's structural liquidity balance). January FX purchases should partially offset the negative effect of the January 2021 budget surplus (we expect it to be around RUB 150bn) on liquidity.

The news is neutral for the bond market, as it seems that in the first half of the year, the finance ministry will be sticking to the budget rule (even though it has the right to overlook it this year) in terms of the oil price neutrality for the gross/net OFZ placement programme of RUB3.7/2.7 tr for this year. As a reminder, according to the budget rule, excess oil revenues (revenues under Urals exceeding $43.3 in 2021) are to be saved in the sovereign fund. But we do not exclude the possibility that if favourable commodity market conditions persist in 1H21, and the market demand of OFZ remains weak (for political or inflationary reasons), the Ministry of Finance might redirect part of the excess oil revenues into spending in 2H21.

Figure 1: CBR to buy $1.4bn of FX in January 2021 after selling $20.9bn in February-December 2020

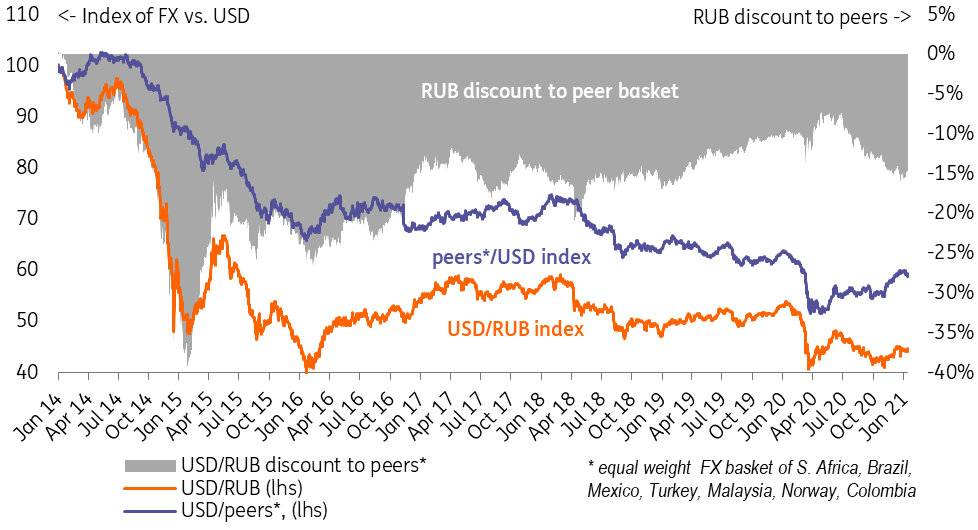

In the near-term, ruble underperformance relative to peers should be determined more by the capital account, as was the case since mid-2020 (Figure 2), rather than the current account and its sterilisation by MinFin/CBR. The risks to our generally constructive view on the ruble this year (supported by the global view on USD weakness and moderate emerging market risk appetite) are largely country-specific, including foreign policy uncertainty and spiking CPI, which limit foreign portfolio inflows into OFZ, as well as low local confidence leading to capital outflows by local corporates and high net worth households. The Bank of Russia's estimate for the 4Q20 balance of payments to be released on 19 January will be the next important data point to watch.

Figure 2: Ruble has been underperforming peers since mid-2020 on higher foreign policy uncertainty and CPI risks putting pressure on the capital account

Download

Download snap