Czech Republic: December inflation lower

Czech inflation slowed down more than expected in December to 2.3% year-on-year amid lower prices of food. November sales in retail and services were impacted by the lockdown, though less than in April

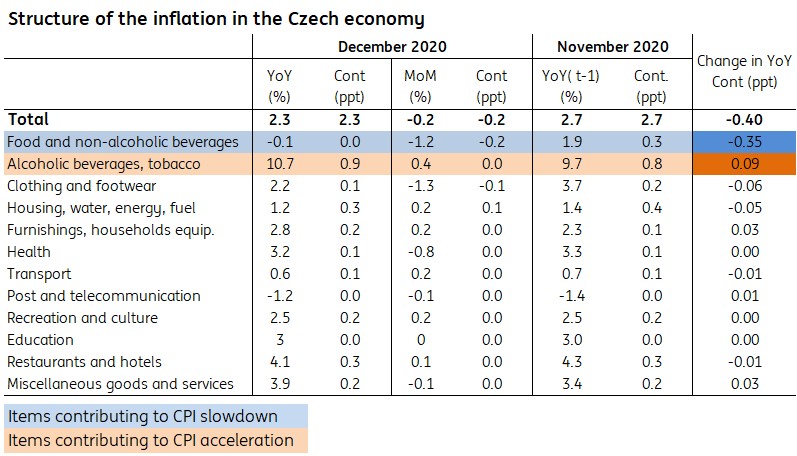

Food prices behind CPI slowdown in December

December inflation decelerated more than expected to 2.3% after 2.7% in November. The deceleration was driven mainly by food prices, which fell by 1.2% month-on-month (MoM) and their year-on-year dynamics switched to -0.1% YoY after 2% in November. As such, the contribution of food prices to YoY CPI fell by 0.35 percentage points and explains most of the CPI deceleration in December. Prices of services remained stable at 2.8% YoY, as in November. Core inflation in the Czech National Bank definition slowed down just slightly from 3.7% to 3.6% YoY.

2020 inflation highest in last 8 years

For the whole 2020, CPI reached 3.2%, the highest print since 2012, but it should decelerate to slightly above 2% for this year. There is a lot of uncertainty stemming not only from the coronacrisis, but also the new fiscal package, which will most likely be pro-inflationary. Given the fact that lower December CPI was driven by volatile food prices only, it does not change our outlook for 2021 inflation of 2.3% and CNB tightening in 2H21.

November sales impacted by lockdown, but less than in April

November retail was impacted by the second lockdown, as sales fell by 5.6% MoM and 7% YoY. However, November had a different number of working days compared to November 2019, and adjusting for that, retail sales (without cars) would have fallen by -5.3% YoY working day adjusted. Though the number ended below market consensus (-5% vs -7%), it still remained better than during the first lockdown in April, when sales fell by -10.4% YoY WDA. Sales in selected services remained -10.9% YoY lower in November (vs. -21% YoY in April and May), as a further fall in sales in the lockdown impacted sectors (restaurants: -65% YoY; accommodation: -82% YoY) were compensated by IT (+16% YoY) and delivery services (+28% YoY).

Sales in retail and selected servies (2019 avg = 100)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap