Russia: Corporate foreign debt redemption to be very light in 2019

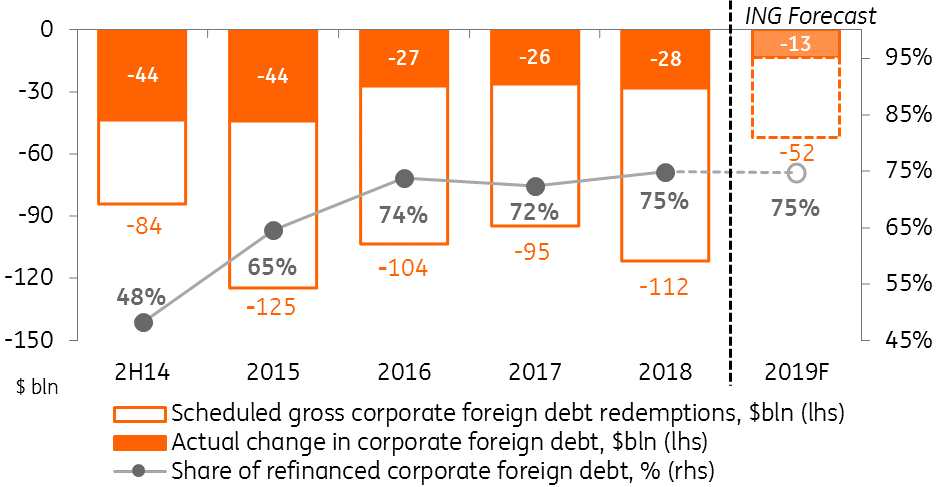

Despite a tightening in the sanction environment, Russian companies and banks managed to refinance 75% of the $112 billion of debt scheduled for redemption in 2018. With a gross redemption of just $52 billion scheduled for 2019, the net redemption could be as low as $10-15 billion vs $28 billion in 2018, reducing the pressure on Russia's capital account

| $28bn |

2018 Net redemption of Russian corporate foreign debtincluding $8bn in 4Q18 |

According to preliminary statistics of the Bank of Russia (CBR), foreign debt of the Russian corporate sector, including banks and companies, stood at $398 billion as of 1 January 2019, which in nominal terms represents a $15 billion decline in 4Q18 and $50 billion for the entire 2018. Having adjusted those figures for the FX revaluation of non-USD foreign debt (approximately 45%), we estimate the actual net foreign debt redemption at $8 billion in 4Q18 and $28 billion in 2018.

It should be noted that the foreign debt estimates, as well as the FX structure, are subject to subsequent revisions, but the preliminary numbers for 2018 suggest that Russian corporates' ability to refinance their foreign debt has increased. While the net redemption of $28 billion in 2018 is a bit higher than $26 billion seen in 2017, comparing it with the gross redemption schedule of $112 billion in 2018 vs. $95 billion in 2017 suggests that the Russian corporates managed to roll over 75% of the debt due in 2018 vs. 72% in 2017. This result appears surprising given the tightening in the sanctions regime against large publicly-traded entities last year.

The 2018 foreign debt data is positive news for the 2019 capital account, as this year's schedule envisions only $52 billion gross redemption, which is less than half of last year's figure. Assuming an unchanged ability to redeem and appetite for foreign debt, we expect actual corporate foreign debt to decline by only $10-15 billion, which is around half of the 2018 level. Given the historical seasonality, we expect around three-quarters of the annual net redemption to take place in 2H19 and virtually no change in foreign debt in 2Q19.

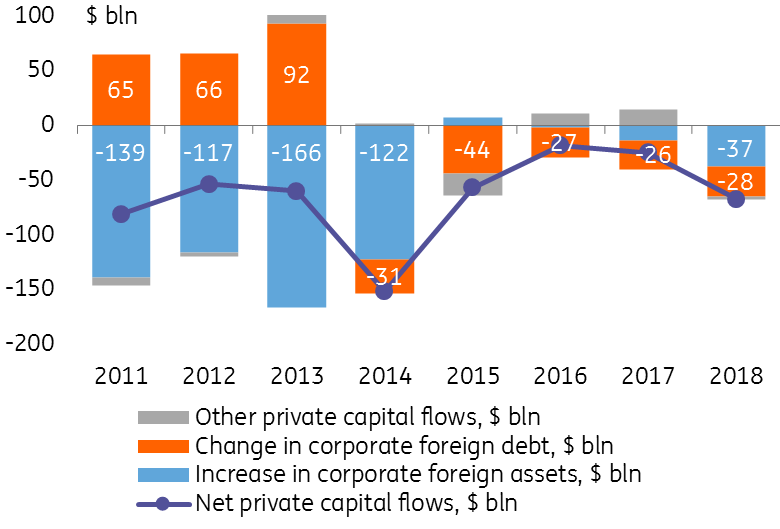

Corporate foreign debt redemption: net vs. gross

Given the likely easing of foreign debt redemption, the prospects for Russia's capital account will increasingly depend on another key component - accumulation of international assets by banks and companies. In 2015-17, virtually the entire net private capital outflow was explained by the net redemption of foreign debt. However, in 2018 the corporate sector restarted accumulation of foreign assets, as high oil prices led to an excessively large current account surplus that was not sterilized by the CBR in 4Q18. As a result, $37 billion out of the $68 billion net capital outflow in 2018 (including $21 billion of the $37 billion net outflow in 4Q18) was due to the accumulation of international assets.

For 2019, we expect a more modest increase of international assets of around $15-20 billion, reflecting a decline in the current account surplus vs. 2018 and its higher sterilization from the CBR. However, there are upside risks to all components of Russia's net capital outflow, and therefore ruble expectations, which are related primarily to foreign policy uncertainties.

Russia 2018 Balance of Payments: no need to panic about the capital outflow

Structure of Russian private capital flows

Download

Download snap