Czech housing loans less affordable in 4Q18

Credit standards for housing and consumer loans significantly tightened in the last quarter of 2018 amid stricter macroprudential recommendations from the CNB, according to the bank lending survey published by the Czech National Bank (CNB)

Tightened credit standards expected due to new macroprudential measures

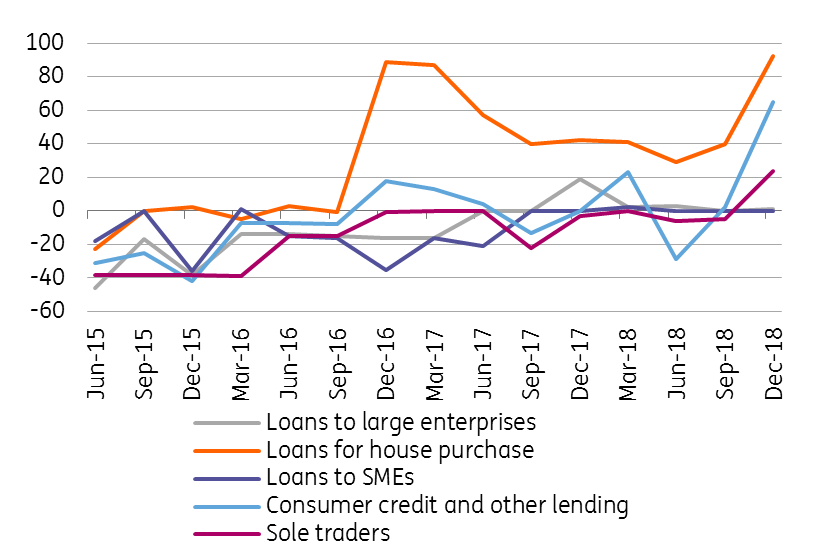

According to the latest Bank Lending Survey (BLS), the availability of housing loans decreased markedly in the last quarter 2018, mainly due to new macroprudential recommendations from the Czech National Bank (CNB), which limited debt-to-income (DTI) and debt-service-to-income (DSTI) to 9 and 45% respectively, since October last year. In addition to the above-mentioned CNB measures, weaker prospects for the property market and higher interest rates, driven by the increasing cost of funds, were behind a significant tightening of credit conditions for housing loans. Similar developments were also seen for consumer credit, as the new CNB income limits relate to the whole credit exposure of debtor/credit applicant, ie not just housing loans. For the next quarter, the banking sector expects the same availability of housing loans, leading to weaker demand.

Credit standards (% share of the banking sector)

Standards and conditions remain stable for corporate loans

By contrast, lending standards and conditions for loans to non-financial corporations just stagnated in 4Q18. As in previous quarters, part of the banking sector was pushed into lowering standards due to higher competition. Still, the downward pressure on margins largely ceased in 2018, and in the case of riskier loans, margins have even increased slightly. Demand for corporate loans in 4Q18 was driven mainly by the need to finance fixed investments. For 1Q19, some banks expect slightly tighter conditions for the SME segment, but stagnation for larger corporates. Also, demand for loans should remain broadly flat in the first quarter of 2019.

Mortgage rates should gradually increase

As such, the availability of housing loans decreased significantly at the end of 2018. This is related, in particular, to the stricter CNB recommendations, but also to a more cautious view of banks on the development of the property market and the rise of mortgage rates due to higher interest rates on the market. Although they have been declining recently- as the market significantly repriced CNB hike expectations for this year due to global economic uncertainty- we believe that the CNB hiking cycle is not over yet and both market and mortgage interest rate will continue to grow slightly this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap