Russia: Near-term inflationary risks appear low

Russian CPI accelerated in June, mainly on the base effect. Meanwhile, stabilisation of global agriculture, commodity, and FX markets, along with extended limitations on foreign travel, lowers the risk of CPI hitting the 4.0% target this year

| 3.2% |

June CPI, YoYup from 3.0% YoY in May |

| As expected | |

June CPI accelerates, mostly on the base effect

Russian inflation accelerated from 3.0% year-on-year in May to 3.2% YoY in June, slightly below our expectations and in line with the consensus forecast. The key reason for this pick-up is due to the low base effect of June 2019 (caused by the freeze in gasoline prices and other temporary factors). In monthly terms, CPI actually decelerated from 0.3% month-on-month in May to 0.2% MoM in June, which is below the 0.4-0.6% MoM seen in June 2016-18.

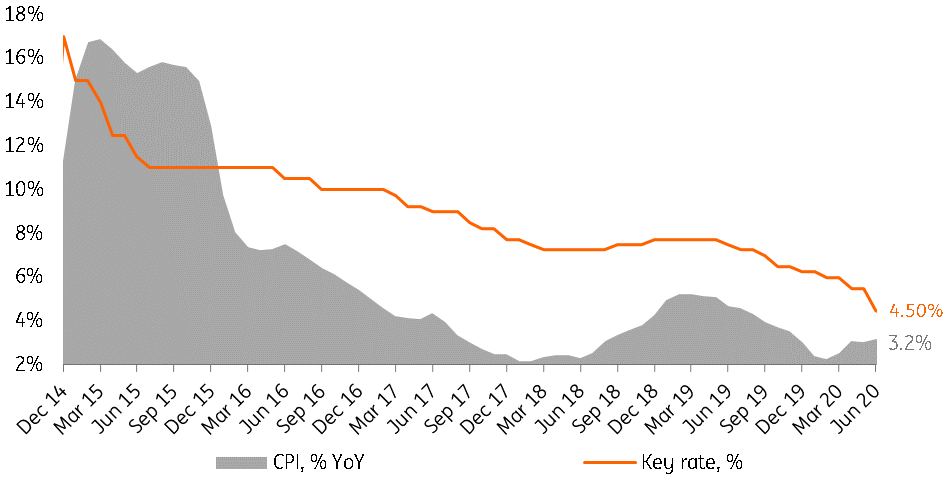

The disinflationary trend observed throughout 2H19 and early 2020 (annual CPI decelerated from 4.7% YoY in June 2019 to 2.3% YoY in February 2020) suggests that the statistical low base effect will remain until 1Q21 (Figure 1), optically pushing the annual CPI rates higher despite contained monthly rates. As an example, this June's 0.2% MoM is actually lower than the 0.4-0.6% MoM seen in June 2016-18. We see several factors limiting inflationary risks in the near term:

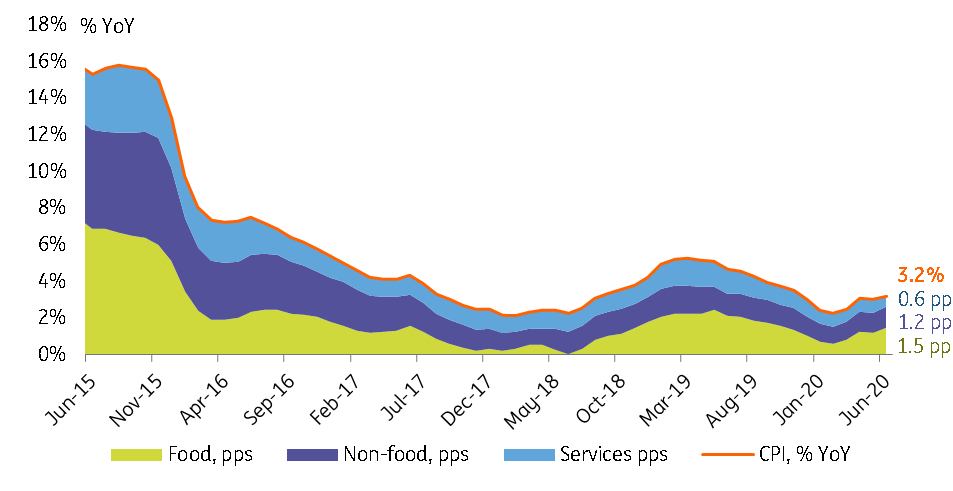

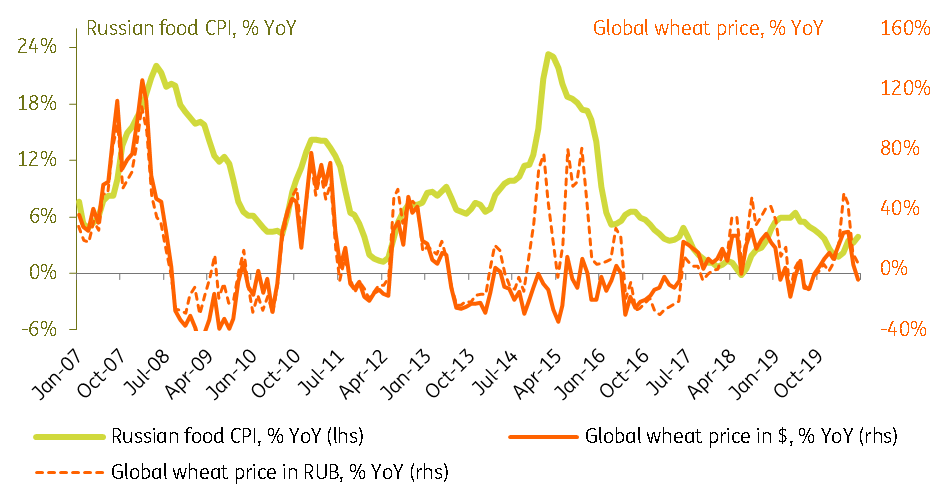

- Stabilisation of global agricultural prices suggests lower inflationary pressure on the food CPI in Russia. Based on higher stock expectations, global wheat prices in USD terms dropped 7% YoY in June after spiking 25% YoY in March-April, and in RUB terms wheat price growth moderated to 5% from 45-50% YoY, respectively (Figure 3).

- Recovery in FX rate lowers the CPI risks for the non-food segment. Thanks to the recovery on the global financial and commodity markets, RUB has now recovered almost half of the losses from March (12 percentage points out of the initial 25% drop), limiting the scope for inflation in consumer electronics and other household durables.

- Extended restrictions for international travel for the summer due to Covid-19 concerns are de-facto putting a freeze on travel and foreign tourism services, which has caused overall services prices to decelerate from 3.0% YoY in May to 2.5% YoY in June.

Figure 1: CPI picked up in June on base effect, downside to key rate remains

Figure 2: Food CPI is the key inflationary component, pressure in other segments modest

Figure 3: Inflationary pressure in the food segment lower on global stabilisation

Given that the current pick-up in CPI is caused largely by the base effect, and given new disinflatinary factors, we now do not exclude downside to our CPI forecast that we recently lowered to 3.7% YoY for year-end 2020. This reaffirms our view that the key rate has at least 50 bp downside from the current 4.5% level, to be realized throughout 2H20, and the likelihood of a 25 bp cut in July has increased.

Meanwhile, pro-inflationary risks attributable to the possible return of FX volatility in 2H20 and a pick-up in consumer demand may return to focus later in the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap