Romanian consumers shrug off pessimism into year-end

Retail sales accelerated by 3.8% in December, taking the quarterly advance to 3.8% and full-year 2022 to 5.1%. The data supports our call for a robust fourth quarter GDP reading, but also for a visible slowdown in the first quarter

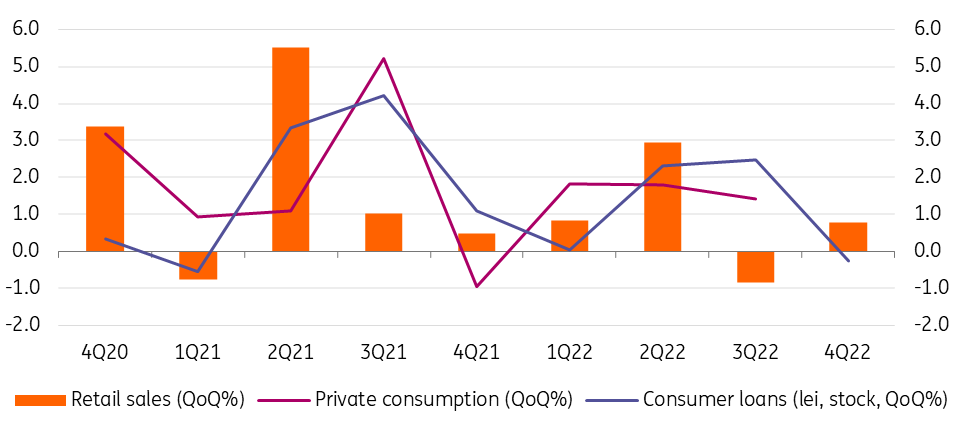

After a somewhat weak third quarter, retail sales accelerated in the fourth quarter of 2022, expanding by 0.8% versus the previous three months. In the third quarter, retail sales contracted by 0.8% from the second. In annual terms, December 2022 was only the third month of 2022 to witness an acceleration, as sales increased by 3.8% compared to December 2021.

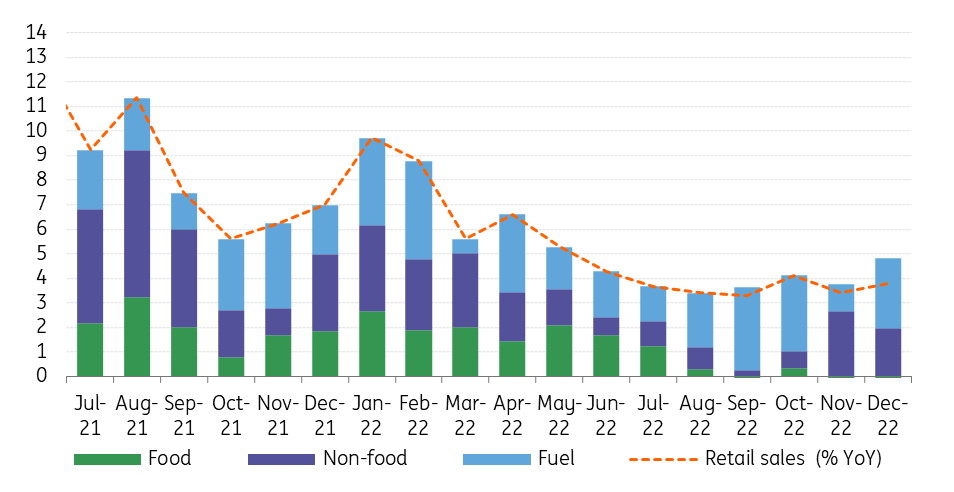

The robust headline number for December is supported by a relatively good structure as well, with non-food sales increasing by 6.6% and fuel by an impressive 13.6%, likely on the back of somewhat lower car fuel prices. Food sales remain less cycle-sensitive and dropped by 1.3% in December.

Retail sales (YoY%) and components (ppt)

With the picture for 2022 now complete, we can safely state the obvious, namely that consumer spending was remarkably resilient throughout the year. The very gradual slowdown compared to 2021 looks more like a return to a normal cruising speed than something that might raise an eyebrow.

As resilient as it might be, however, most signs point towards a slower start to the year for consumption. Facing sharply higher interest rates and deteriorating risk sentiment, the stock of consumer loans advanced by only 4.1% in 2022 with the actual new production of loans being mostly negative throughout the year. Moreover, while in 2022 retail sales might have still benefited from post-pandemic pent-up demand, it looks highly unlikely that there is any more of that into 2023.

Consumer lending turning less supportive

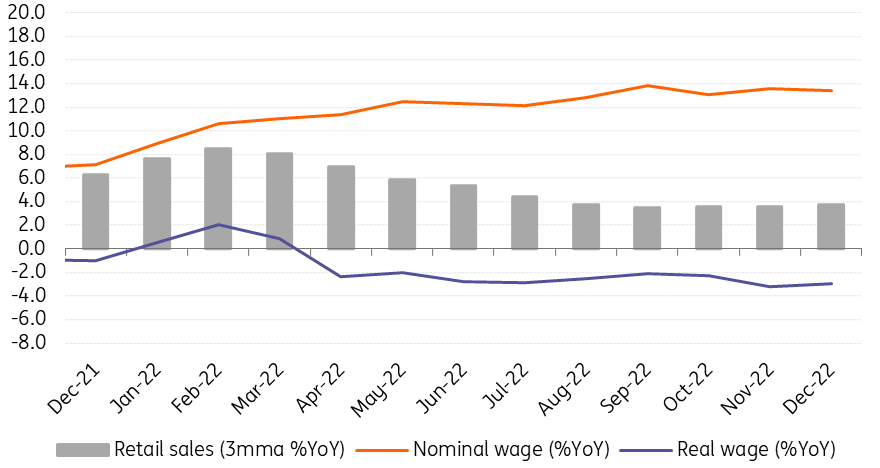

Somewhat balancing the consumption story, wage dynamics remained reasonably sound in 2022, with the average nominal net wage advancing by around 12.0% (December data is not out yet). This is below, but dare we say not that far from the 13.8% average inflation rate. Looking forward to 2023, there is a reasonable chance for the wage advances to recover the lost ground and exceed the average inflation rate. Overall, it is obvious that the destruction of purchasing power has not been of a great magnitude, and this should act as a backstop for private consumption in the short- to medium-term.

Retail sales following real wages

All considered, the consumption story will likely remain in positive territory in 2023, though a growth slowdown to very low single digits looks most probable.

With the fourth quarter sales picture complete, we remain of the opinion that the GDP advance has probably been quite robust in the fourth quarter. We maintain our estimate for a 1.0% quarterly expansion. This should take full 2022 GDP growth to around 5.0% and provide a strong carryover effect into 2023 which we maintain at 2.5%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap