Hungarian retail sales suffer from record inflation

After the fuel price cap was lifted in early December, fuel consumption dropped by 18.4% month-on-month. However, record-high inflation dragged down overall consumption similarly

| -3.9% |

Volume of retail sales (YoY, wda)ING forecast -4.4% / Consensus 0.2% / Previous 0.6% |

| Worse than expected | |

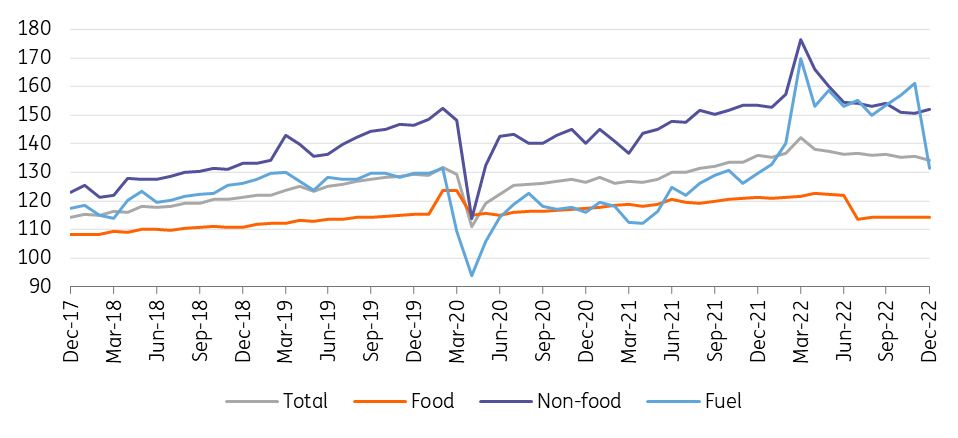

The extremely poor performance of December’s retail sales data caught most economists off-guard as the volume of retail sales contracted by 3.9% year-on-year. The last time we saw such a large YoY decline was in February 2021 when the entire country was under a full-scale lockdown. What’s more, this decline was the result of a 1.0% monthly fall in the volume of retail sales. In our opinion, such a weak fourth quarter performance in retail sales will take its toll on last year’s fourth quarter GDP data as well.

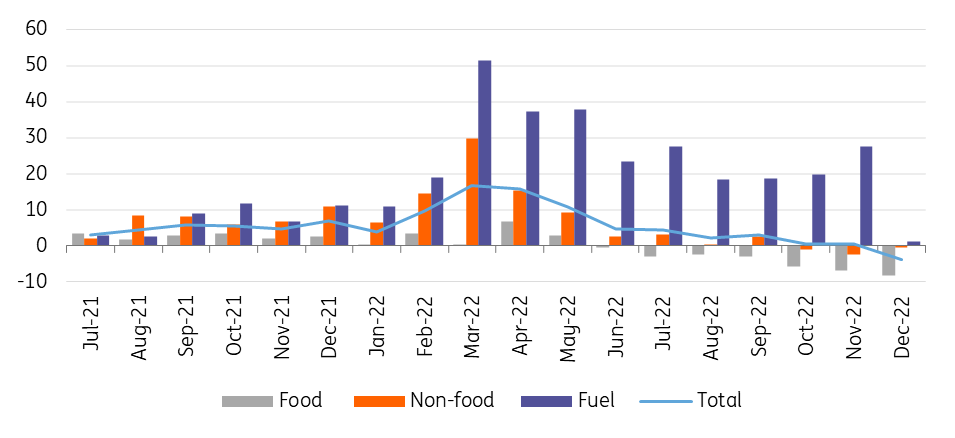

Diving deeper into the details we can see structural issues, even if we factor out the fuel retailing component, which was largely expected to decline. On a yearly basis, food retailing declined by 8.3%, but even on a monthly basis, it only grew by 0.1% during the holiday season, which means that the largest component in retail sales virtually stagnated. Overall, this reflects the new reality that consumers had to adapt to higher food prices as food inflation in December accelerated to 44.8% YoY.

Breakdown of retail sales (% YoY, wda)

Non-food retailing posted a 0.4% drop on a yearly basis, despite a 1% month-on-month increase, with sub-sectors displaying heterogenous monthly dynamics. In this regard, the biggest surprise came from the second-hand goods shops, where the monthly turnover increased by 31.1% in volume. In our view, this is another by-product of the extremely high inflationary pressure as consumers are shifting to buying second-hand goods with record haste. This realisation comes amid the Christmas shopping spree, which by previous standards should have boosted the volume of sales in clothing, manufactured and home furnishing goods but in fact, these items all showed declining demand.

With stagnating food retailing and declining non-food turnover, the last component further dragged down the headline number. Fuel retailing posted an 18.4% MoM decline. At first glance, the 1.3% growth on a yearly basis can be misleading concerning the current state of fuel retailing, thus we believe that the enormous monthly decline better reflects the current picture - which is very bleak. The Hungarian government lifted the fuel price cap in early December which resulted in a drastic drop in the volume of fuel retailing as drivers adapted to market fuel prices.

Retail sales volume in detail (2015 = 100%)

With December’s negative retail sales reading, we do not expect any positive surprise regarding last year’s fourth-quarter GDP data, which will be released next week. In our view, the quarter-on-quarter contraction in the last quarter will officially mean that the Hungarian economy has been in a technical recession since the second half of last year.

Going forward, we see further deterioration in retail sales data at least until March, as real wage growth continues to drop. With food prices remaining at highly elevated levels, we expect further stagnation in the food retailing sub-component, while consumers will continue to adjust to market fuel prices. In this regard, we expect further additional drops in fuel retailing on an annual-based comparison, while sub-components in non-food retailing should continue to deliver mixed signals as consumers are continuously optimising and shifting preferences to keep up with record inflation.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap