Philippines: Inflation blows past expectations to hit 8.7%

Inflation has yet to peak in the Philippines with inflation jumping to 8.7%YoY, up from 8.1% in the previous month

| 8.7% |

January YoY inflation14 year high |

| Higher than expected | |

January inflation sizzles at 8.7%

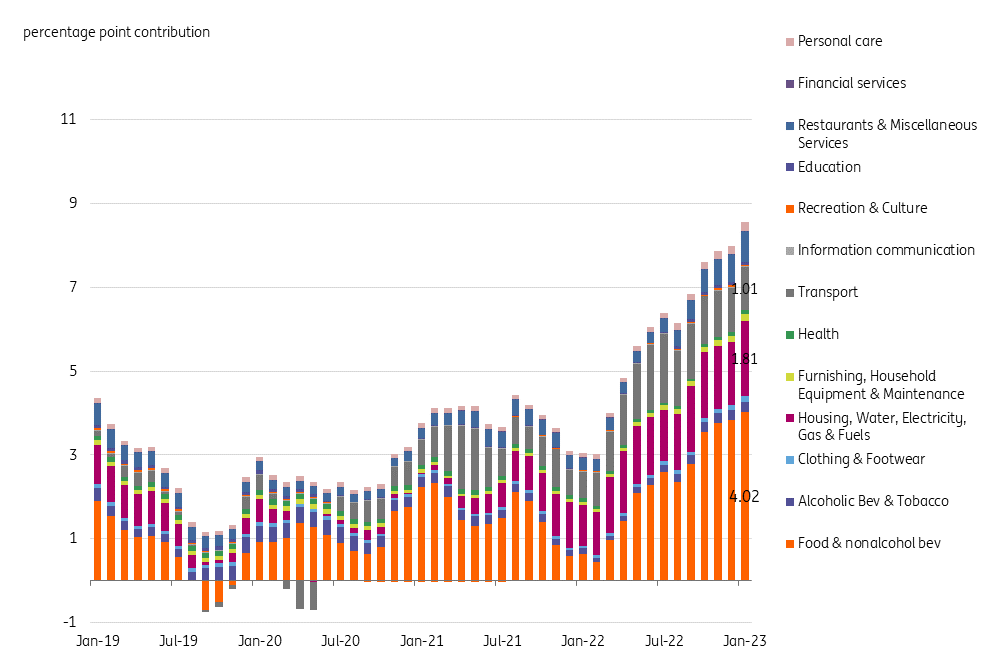

Price pressures were on full display with headline inflation blowing past expectations to hit 8.7%YoY. The market consensus pointed to inflation slowing to 7.6%YoY from the 8.1% rise last month, but price pressures remain persistent. Nine out of the thirteen categories reported inflation past the central bank’s upper bound target of 4% indicating that this price surge is clearly broad-based and not limited to select commodities. Food inflation accelerated to 10.7% YoY (10.2% previously), transport costs increased 11.2% and utilities rose by 8.5%.

Poor agriculture output and elevated energy prices drove much of the supply-side price pressure but inflation was also driven by surging domestic demand. Robust economic growth resulted in accelerating inflation for items related to recreation (4.2%), restaurants & accommodation (7.6%) and personal care (5.0%). The confluence of supply and demand side pressures is likely to keep inflation elevated in the coming months with inflation only grinding lower throughout 2023.

Inflation is everywhere: Price pressures have spread across the CPI basket

BSP to continue tightening policy next week

The Bangko Sentral ng Pilipinas (BSP) meets to discuss policy next week and we believe Governor Medalla will whip out a 50bp rate increase in an attempt to get ahead of surging inflation. Medalla previously sounded off on the possibility of pausing “as early as the first quarter” but today’s inflation report likely means BSP will need to stay hawkish in the near term.

BSP increased rates on consumer credit last January which could act as an additional tightening measure to combat soaring inflation. Nevertheless, price pressures are broad-based and BSP will likely need to sustain rate hikes until we see inflation head back towards the target in a convincing manner.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap