Romania: Sequential contraction for private consumption

The contraction of retail sales suggests macro data is catching up with the weaker sentiment

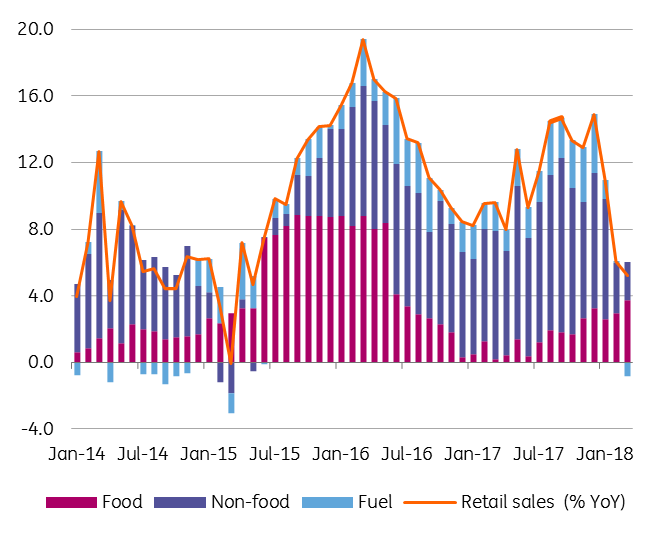

Retail sales growth slowed down in March to 5.2% year-on-year, the slowest pace of growth since May 2015. This is down from 6.1% in February 2018 and the 11.6% YoY increase last year.

Non-food sales slowed down to 4.6% YoY from 6.3% in February 2018 and the 17.7% average growth in 2017. Early April Easter helped food sales which accelerated from 8.8% to 10.8% YoY, while fuel sales were down 4.7% YoY, probably due to higher prices.

Retail sales sharply lower

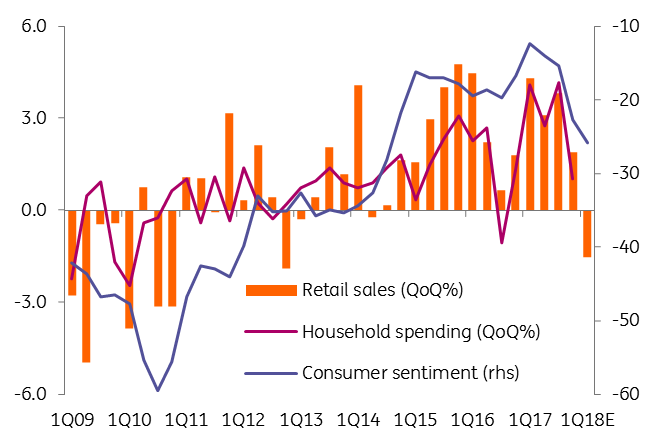

Retail sales decreased by 1.5% quarter on quarter in 1Q18 suggesting a sequential contraction in private consumption which increases the likelihood of a GDP growth contraction too.

In the first two months of the year, industry performance was rather weak on lower export orders, and sentiment indicators point to a disappointing March. It remains to be seen if the construction sector which was quite strong for the first two months of the year manages to keep QoQ GDP growth afloat. But regardless, we're looking for a weak 1Q18 GDP growth print.

Private consumption likely to contract in 1Q18

Soft retail sales data gives support to the National bank of Romania doves, but a rate hike on Monday seems like a matter of defending credibility and containing inflation expectations as inflation kept moving upwards and April should see another higher CPI increase.

This is also important to dissipate worries about central bank independence after the recent debates between the central bank and the main government coalition party. 1Q18 GDP release is due on 14 May, and it is likely to encourage the Bank to revise its output gap forecast lower.

Higher oil price outlook and the risk of a drought affecting the agriculture output and seasonal food prices are threatening the call for a mild downtrend in inflation during the summer. A sharp drop in CPI is expected in October and November due to base effects. Still, lower than expected imported inflation and stabilising core inflation should provide arguments for a longer data dependent pause by NBR post-May meeting until 4Q18 when core inflation is likely to print near the upper bound of the NBR target interval.

Download

Download snap