Hungary: Retail sales boost GDP outlook

Retail sales in food shops posted a growth rate not seen since 2014, translating into another strong overall performance by the retail sector

| 7.1% |

Retail sales (YoY)Consensus (6.2%) / Previous 6.6% |

| Better than expected | |

Retail sales turnover (adjusted by working days) increased by 7.1% year-on-year in March, beating even ING’s estimate, which was the most optimistic. It shows a significant acceleration after a rather disappointing February reading, thus the sector closed 1Q18 on a positive note.

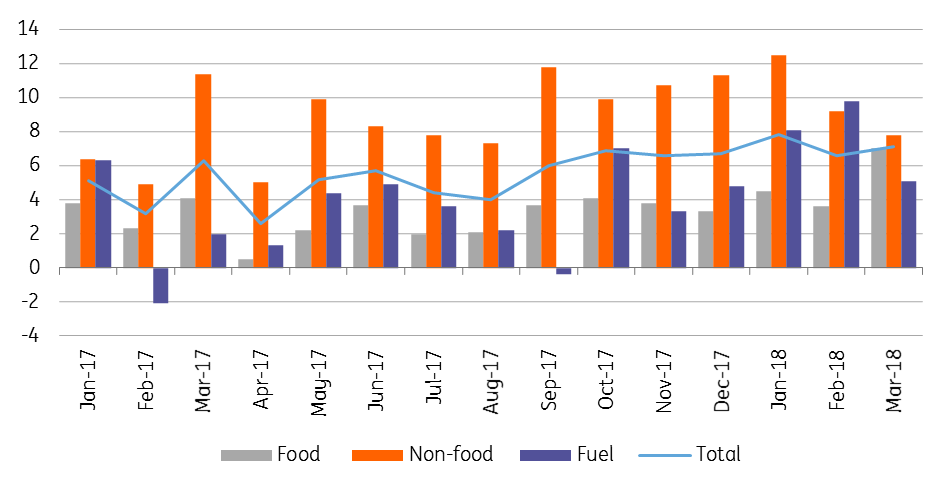

Breakdown of retail sales (% YoY, wda)

The surprisingly strong turnover growth was mainly due to one-offs. First of all, the earlier than usual Easter affected consumer spending in food stores. Secondly, Hungary’s 2.9 million pensioners got the government’s gift voucher worth of HUF10,000 (EUR32) around the end of March. Against this backdrop, turnover in food shops increased by 7% YoY, a growth rate not seen since 2014. Retail sales in non-food shops has remained strong, posting a 7.8% YoY increase in March, mainly on the back of the improving financial situation of households. Turnover in automotive fuel retailing rose by 5.1% YoY.

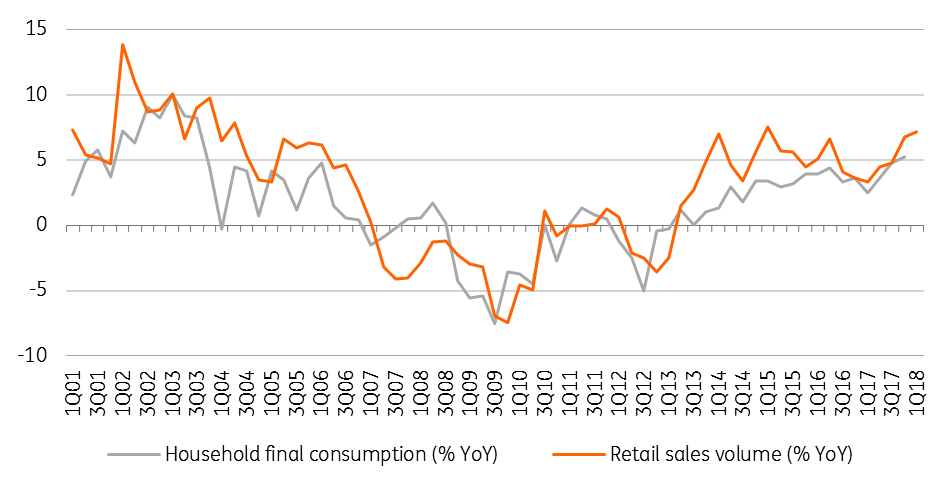

Retail turnover increases, will consumption follow?

Based on the overall performance in the retail sector in 1Q18 we can be optimistic about the GDP data. In year-on-year terms, retail sales rose at a slightly higher pace in 1Q18 than in the previous period. It means we can expect at least the same, if not a better contribution from consumption to GDP growth. Economic activity certainly won’t be hindered by household spending. We see now upside risk to our 3.8% YoY 1Q18 GDP forecast.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap