Briefing Romania

Hawkish NBR supports RON

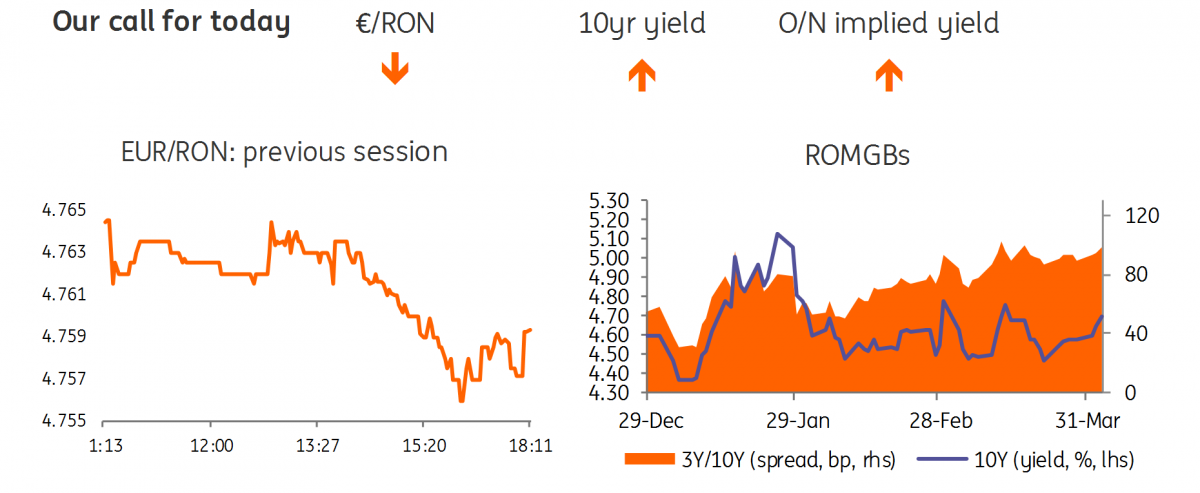

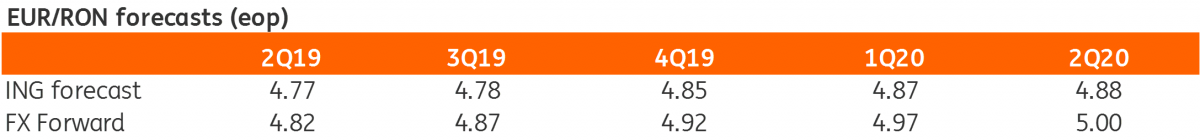

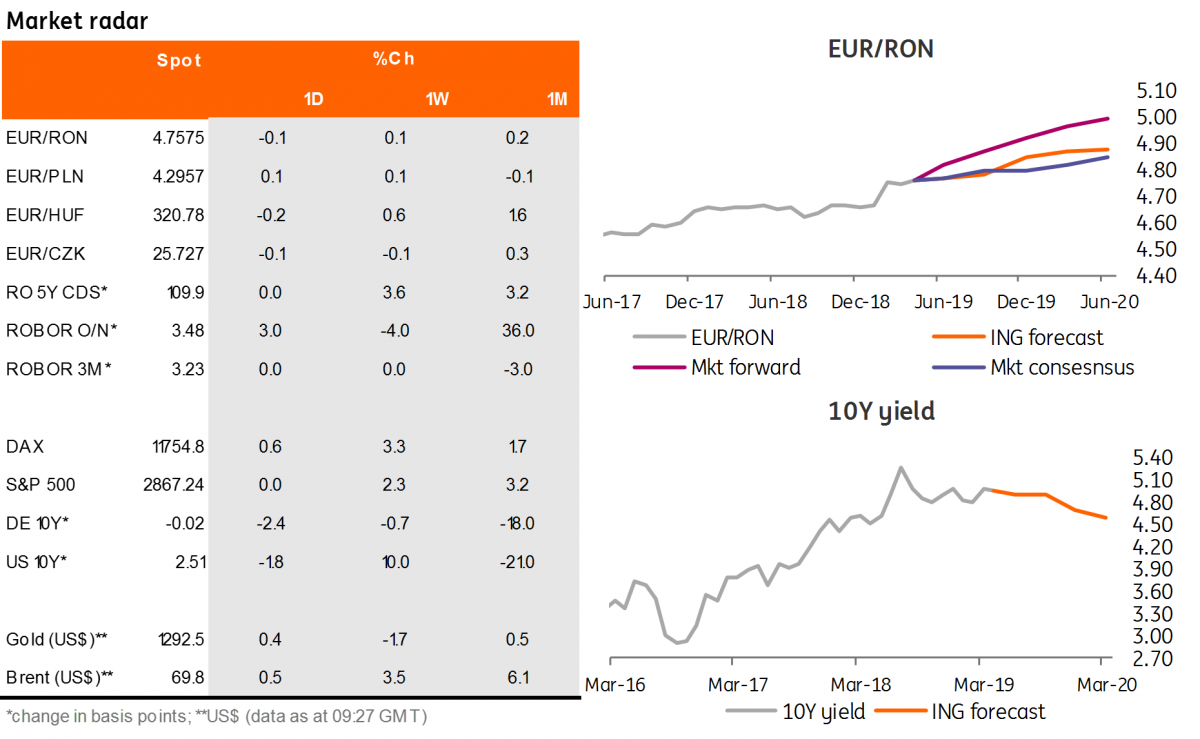

EUR/RON

The EUR/RON inched lower and closed below 4.7600 after hawkish comments from the NBR governor and a pledge “maintaining strict control over money market liquidity” aimed at “deterring amplifying FX pressures”. A 4.7500-4.7650 range is seen for today with risks to the downside if stops are triggered.

Government bonds

ROMGBs yield curve bear-flattened as the front yields spiked higher on the NBR's firm liquidity commitment. 10Y yields closed 8 basis points higher.

Money market

The forward curve shifted higher after the NBR governor's comments that the “era of surplus liquidity” has ended and short-term money market rates could stay around the credit facility level of 3.50%. 3M implied yields jumped c.65bp to 4.65%. The implied cash rate was also c.20bp up at 4.40% due to liquidity shortages after recent NBR FX interventions.

Download

Download snap